Explainer | What is driving an almost 200 per cent growth in sustainability-linked debt financing

- Globally, green and sustainability bond and loan issuances totalled US$809.5 billion in this year’s first half, nearly tripling year on year

- In China, Hong Kong and Taiwan, about 41 sustainable bond transactions worth US$19 billion were recorded in first six months of 2021, compared to 23 deals worth US$7.6 billion in all of last year

Sustainable debt financing has flourished globally in the past year. Growth in green bonds, which finance projects with environmental benefits, and sustainable loans that also support social projects, has been particularly strong.

Such flows of funds from lenders and bond investors to borrowers, which are guided not only by conventional financial performance metrics such as profitability and capacity to repay, but also non-financial considerations, have been gathering momentum.

Globally, green and sustainability bond and loan issuances totalled US$809.5 billion in this year’s first half, nearly tripling from the US$286.7 billion in issuances in the same period last year, according to Refinitiv. This number also exceeded the total of US$743 billion recorded in the whole of 2020.

Here’s what debt creditors and bond investors need to know about sustainable financing.

How fast has green and sustainability debt been growing?

03:26

Two sessions: How China's environmental policies are giving a boost to green industries

What is driving deals?

Government policy is one factor. In Hong Kong, the monetary authority which also acts as the city’s de facto central bank, has rolled out a three-year grant scheme that subsidises bond issuance expenses for first-time green and sustainable bond issuers. Commencing in May, the up to HK$800,000 (US$102,928) grant per transaction also covers external review and reporting fees for bond issuers and loan borrowers.

39:35

Sustainability: Green bonds to help drive China's push towards carbon neutrality

The publication of updated standards and guidelines for the issuance of green and sustainability-linked bonds mid last year by the International Capital Markets Association (ICMA) that helps avoid “greenwashing” has also helped spur deals, said a Fitch Ratings report this month. Greenwashing refers to marketing spin aimed at giving the impression that greater environmental benefits can be achieved by companies’ products or projects than in reality.

More and better quality disclosures on non-financial performance metrics, such as ESG performance data, has also been key to the growth of sustainability-linked debt issuance.

The European Union has taken a leading role on ESG disclosure requirements and standards, issuing a directive in 2014 to its member nations to make the disclosure mandatory by 2016. A plan announced in April would more than triple the number of companies subject to ESG disclosure requirements over three years, including large privately owned firms. Such disclosure will also need to be audited.

02:38

China launches world’s largest carbon-trading scheme as part of 2060 carbon neutrality goal

In the United States, a bill passed in June by the House of Representatives to make the disclosure of specific ESG data mandatory for listed firms, if replicated in the Senate, will support the growth of sustainability-linked bonds and loans in the world’s largest economy, Fitch said.

What’s the difference between sustainability-linked bonds and loans and conventional ones?

While both are fixed-income instruments from which investors can earn interest, borrowers of sustainability-linked instruments need to set predetermined sustainability performance targets that are both relevant and important. If they are not met, the debtors will have to bear a penalty in the form of a higher coupon or interest rate.

01:24

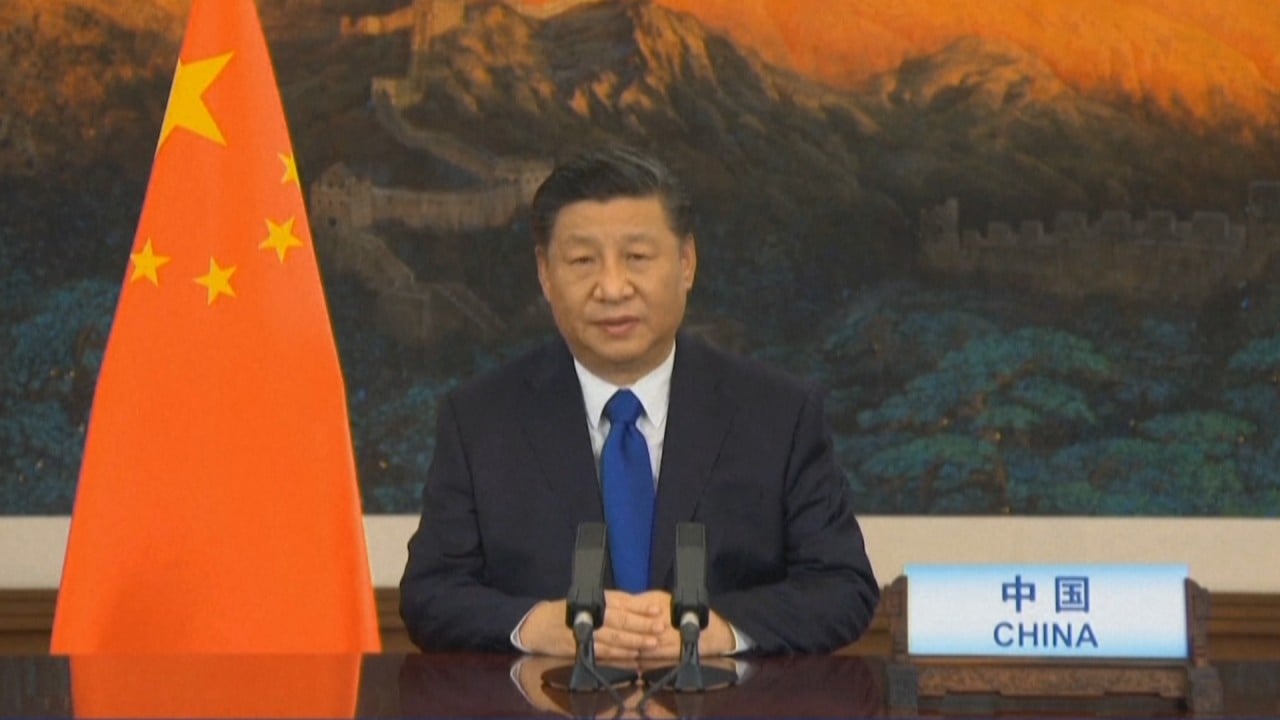

China to reduce carbon emissions by over 65 per cent, Xi Jinping says

“Here, unlike conventional instruments, a borrower is not restricted in the use of proceeds to finance a green or social project,” said Alvin Yeo, UBS’ head of sustainable finance, leveraged debt capital markets in Asia. “The focus is on the ambitiousness of the sustainability performance targets and credibility of the strategies to achieve them.”

How can bond issuers and investors avoid greenwashing?

Issuers should explain in writing how their bond programmes directly align with principles and guidelines issued by the ICMA, Fitch said. They should also engage an external reviewer or auditor both before and after their bonds are sold, to ensure adherence to the principles and track that the proceeds are spent where they should be, it added.