Advertisement

Dalio’s Bridgewater suffered setbacks in Chinese tech, education stocks last quarter while EV makers surged before July sell-off

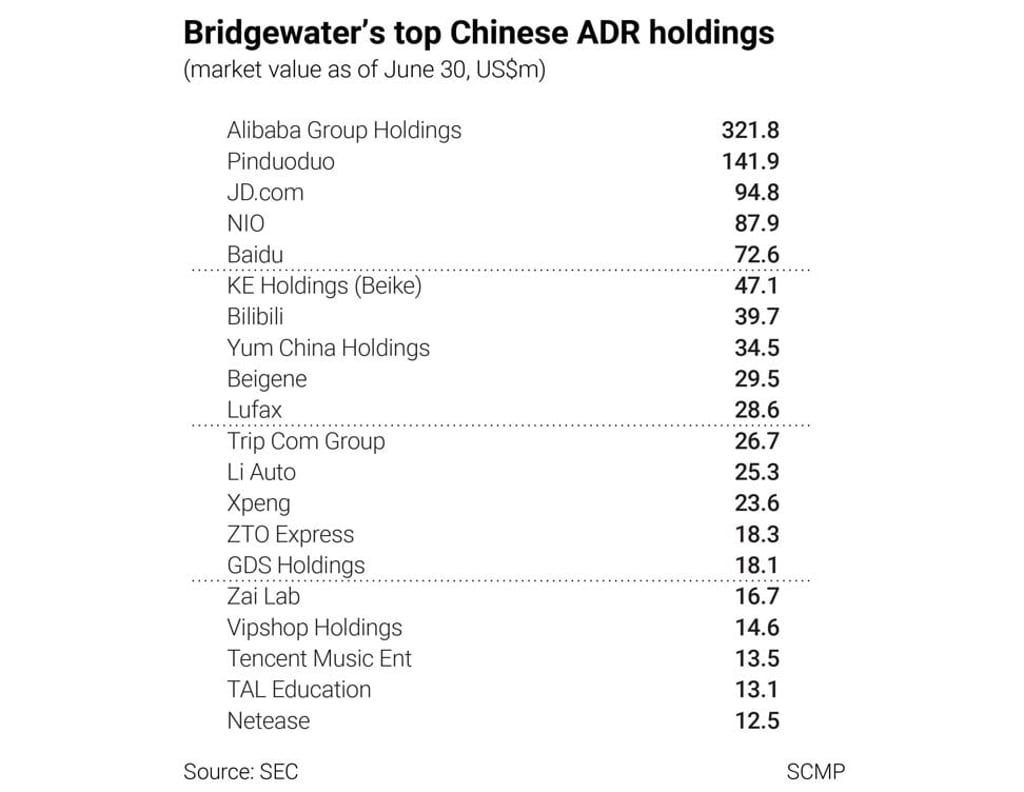

- Bridgewater held depositary shares in some 37 Chinese firms with a market value of almost US$1.2 billion

- Alibaba, Pinduoduo, JD.com, NIO and Baidu, its five biggest by market value, produced a mixed bag of performances before the July tech sell-off

Reading Time:2 minutes

Why you can trust SCMP

Bridgewater Associates, the world’s biggest hedge fund, took some knocks on its investments in Chinese education and technology stocks last quarter, before the market sold off in July. Its bets on three Chinese Tesla challengers paid off handsomely.

Its holdings in New Oriental Education and Technology, TAL Education, Gaotu TechEdu, JD.com and Pinduoduo recorded some of the biggest declines in value, according to its latest 13F quarterly filing with the Securities and Exchange Commission.

It bought more shares in Li Auto and Xpeng while trimming its stake in NIO, three of the biggest challengers to Tesla’s dominance in the mainland’s electric vehicle market. The surge in their stock prices helped keep the firm’s overall China play in net gain.

Advertisement

The fund, founded in 1975 by China optimist Ray Dalio, had about US$1.2 billion worth of stakes in at least 37 companies within its China holdings, according to the second-quarter filing. Alibaba Group Holding, the owner of this newspaper, Pinduoduo, JD.com, NIO and Baidu were its top five with a combined market value of US$719 million on June 30.

Advertisement

The mixed bag of performance underlined the volatility infecting Chinese companies as investors struggled with regulatory policy risks since authorities began cracking down on internet-platform operators by foiling Ant Group’s jumbo stock offering for antitrust violations.

An attack on Didi Global, barely a week after its New York listing debut in late June, fuelled a US$1.2 trillion sector sell-off in the mainland, Hong Kong and US markets and left investors guessing on how far China will go in its pursuit to fix income inequality and stamp out malpractices.

Advertisement

Select Voice

Select Speed

1.00x