Advertisement

BYD suspends US$414 million IPO plan of semiconductor unit amid investigation into law firm advising on the deal

- Shenzhen Stock Exchange suspended reviewing BYD Semiconductor’s IPO application on August 18

- BYD’s chip-making unit may need to replace the law firm which in turn has three months to complete the due diligence

2-MIN READ2-MIN

BYD, the Warren Buffett-backed Chinese battery and carmaker, has put on hold the proposed spin off of its semiconductor unit, after the mainland regulator launched an investigation into the law firm advising on the deal.

The Shenzhen Stock Exchange said in an announcement on Saturday that Beijing Tian Yuan Law Firm was being investigated by the China Securities and Regulatory Commission, without giving further details.

The applications of 14 other firms seeking to list on the exchange’s ChiNext board were also suspended because the law firm was advising them too. The exchange said that it had suspended handling IPO applications since August 18.

Advertisement

BYD in May announced that it would list its 72.3 per cent owned chip-making unit BYD Semiconductor on ChiNext, a Nasdaq-like tech board, with the aim of raising 2.69 billion yuan (US$413.83 million).

01:47

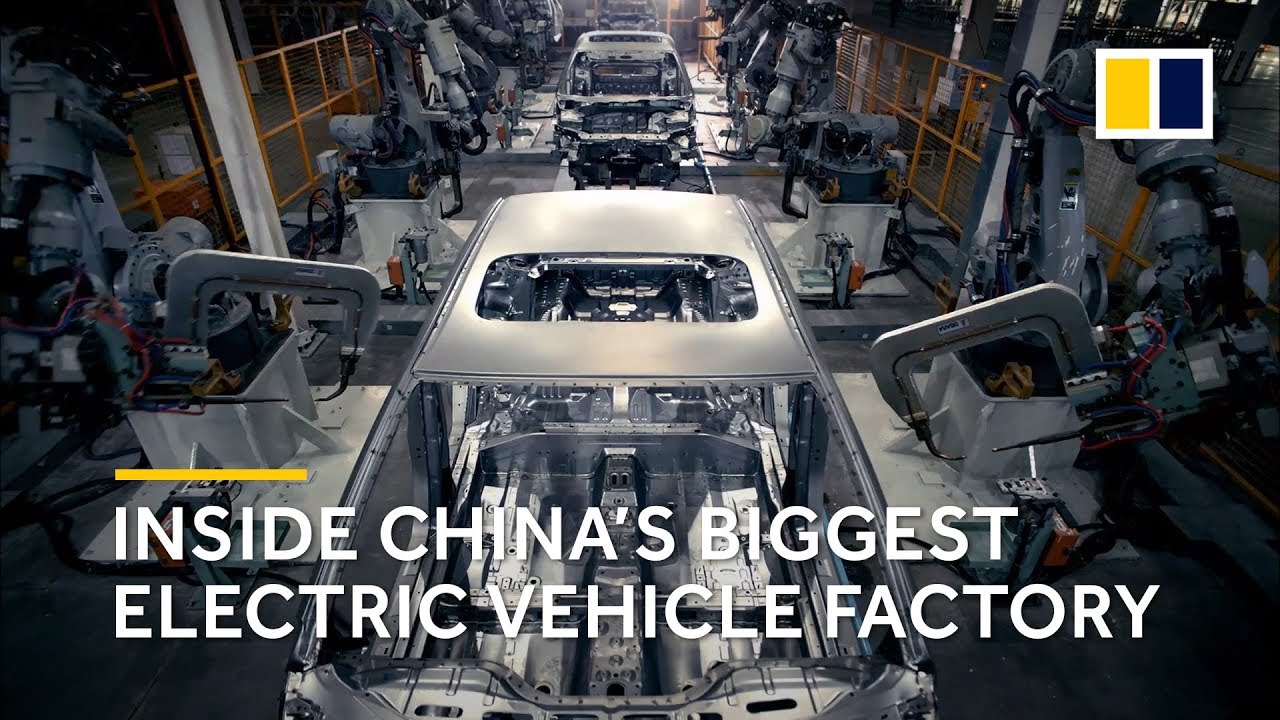

Behind the scenes at BYD Auto: China’s biggest electric vehicle factory

Behind the scenes at BYD Auto: China’s biggest electric vehicle factory

BYD Semiconductor will proceed with the due diligence as soon as possible, while the company was not yet sure if it would need to change the law firm as yet, a spokeswoman said.

Advertisement

Beijing Tian Yuan Law Firm did not respond to a request for comment.

Advertisement

Select Voice

Select Speed

1.00x