Beijing’s sovereign digital currency push to boost Hong Kong’s fintech start-ups

- A bridge project between PBOC and HKMA could lead to opportunities for the more than 3,300 start-ups in Hong Kong

- Fintech needs to be where the financial hubs are, and if you are not in Hong Kong then there are only a few remaining options, says InvestHK’s fintech head

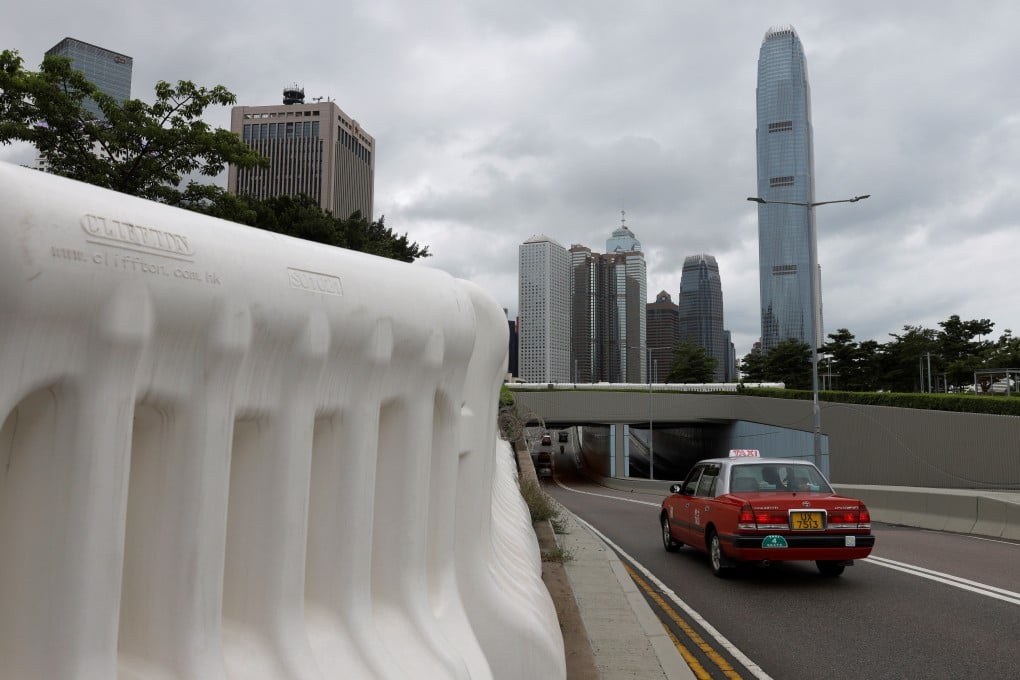

As Beijing pushes ahead with a sovereign digital currency and a national blockchain network, Hong Kong’s fintech community is using the city’s role as a bridge between mainland China and the rest of the world to seize opportunities for innovation.

The project could lead to opportunities for the more than 3,300 start-ups in Hong Kong, allowing them to service importers and exporters using fintech. It could provide incentives for innovation in fintech and trade finance solutions, said King Leung, head of fintech at InvestHK, the government body promoting foreign direct investment.

“For fintech start-ups focusing on business-to-business solutions, there are only a handful of major cities that have a strong base of financial institutions,” said Leung. “Fintech needs to be where the financial hubs are, and if you are not in Hong Kong then there are only a few [remaining] options.”

Through a partnership with Tradelink, a trade and custom documents filing service provider, Ping An OneConnect has introduced an SME loan service that approves loans within five days. The new service leverages Tradelink’s decades of custom clearance data to determine a borrower’s credit health.