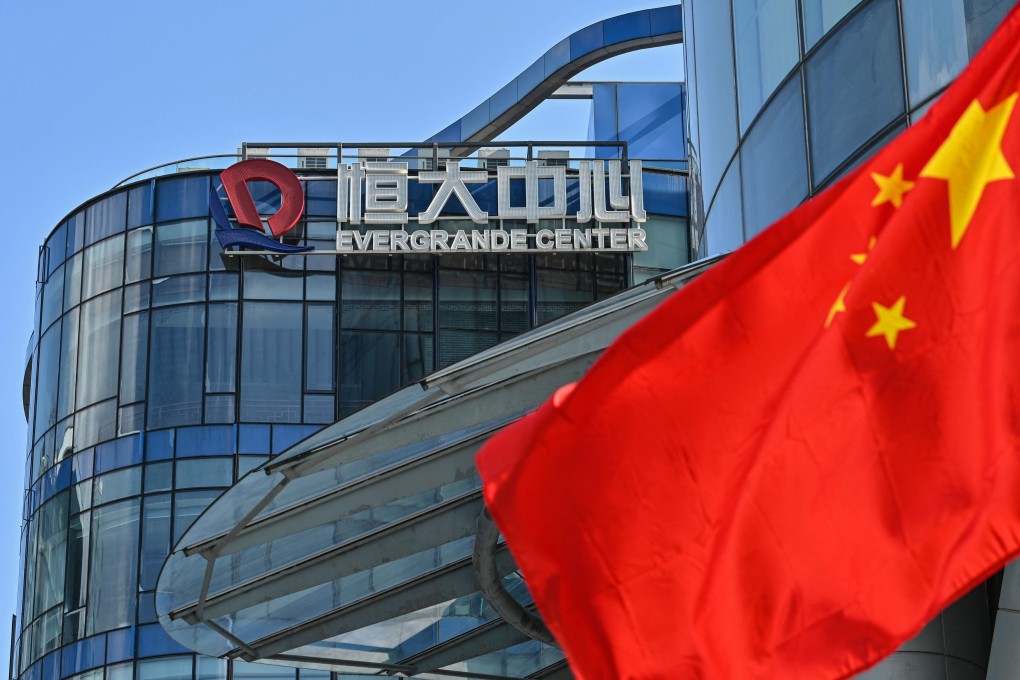

Evergrande crisis: Hong Kong banks can handle stress as they have little exposure to troubled Chinese developer, source says

- HKMA says banks in Hong Kong have hardly extended loans to China Evergrande Group, which is struggling with debts of over US$300 billion

- HSBC and Standard Chartered executives told a banking conference last week that they have negligible exposure to Evergrande

The city’s de facto central bank has also been closely monitoring credit-related developments at the Shenzhen-based developer, which is on the verge of defaulting on bond interest payments amounting to over US$83.5 million, the source said. Banks have heeded the HKMA’s warnings, resulting in local lenders having little lending exposure to Evergrande, the source added.

“The HKMA has been closely monitoring the credit risks facing the banking sector,” Arthur Yuen Kwok-hang, deputy chief of the HKMA, said at a seminar on Tuesday, without naming any company. “Our assessment is that the overall risk to banking stability remains manageable.”

An HKMA spokeswoman declined to comment on individual companies.

Evergrande, the world’s most indebted developer, currently has over US$300 billion in liabilities, compared with 2.38 trillion yuan (US$369 billion) in assets.