HKMA and banks to equip staff with new skills, as 9,000 jobs are in peril due to digitalisation

- About 9 per cent of the nearly 100,000 bank employees in Hong Kong are likely to lose their jobs over the next three to five years because of branch closures

- People with skills in wealth management, green finance and digital banking are likely to be in demand, HKMA deputy CEO Arthur Yuen says

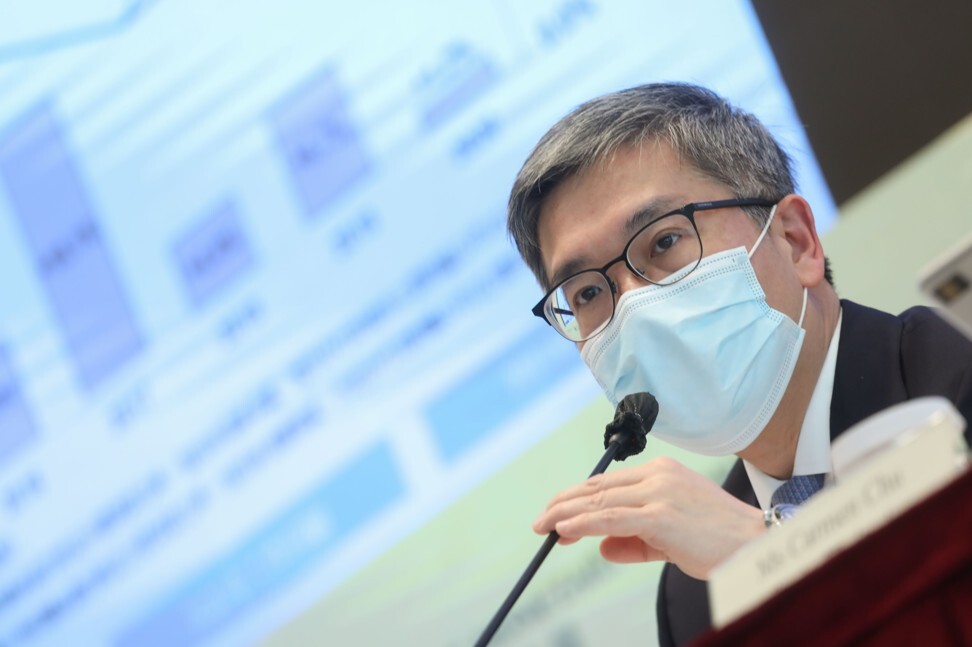

A recent study conducted by the HKMA and banks showed that about 9 per cent of the about 100,000 front line and back office staff at bank branches in the city will lose their jobs in the next three to five years, said Arthur Yuen Kwok-hang deputy chief executive of the HKMA.

“Banks have been cutting down their branch network due to the changes in customer behaviour in recent years,” Yuen told a media briefing last week. “The Covid-19 pandemic has accelerated the trend as the outbreak has encouraged more customers to shift to using digital banking services instead of going to physical bank branches.”

This has led banks to shut down some branches or change the design of their branches to offer more than just counter services for deposits and withdrawals, such as wealth management and other more sophisticated banking services.

“Such a trend will mean thousands of bank staff in the next three to five years may lose their jobs as their skill set will be outdated. Meanwhile, there are some jobs in the banking sector, such as in wealth management, green finance and digital banking that is struggling to get the right talent,” Yuen said.

To plug the gap, he said HKMA will work with the banking sector and training institutes to help train staff with new skills.

“Some bank staff who are close to retirement may not like to take a new course, but for those who want to learn a new skill set to avoid being made redundant, the banks should offer training to help them meet future needs,” Yuen said.

Hong Kong banks can handle stress related to Evergrande debt crisis

“Green finance will also need a lot of people. Hong Kong banks will need people who know how to price and certify green investment products as China will need to raise a lot of money to achieve its goal of carbon neutrality by 2060,” Yuen said.

Yuen said the HKMA will also provide training programmes to help attract more university students to join the banking industry after graduation.

HSBC and Bank of China (Hong Kong) expressed support for the HKMA’s training initiatives.

“We give colleagues the opportunity to upskill in a way that’s right for them – whether that is through face-to-face training, online courses, mentoring, job shadowing or volunteering,” an HSBC spokeswoman said. HSBC employees completed 5.2 million hours of training globally last year, she added.

Bank of China (Hong Kong), which has 190 branches – the most in the city, will also provide new skills training for its staff to meet future needs of the banking industry, a spokeswoman said.