Evergrande: default alarms put thousands of suppliers, jobs and economy at risk as developer’s IOUs balloon

- World’s most indebted developer owed suppliers more than US$103 billion in construction, furnishings and materials sectors on June 30

- Evergrande’s founder and chairman Hui Ka-yan, also known as Xu Jiayin in mainland China, turns 63 today

The third of a three-part series on China Evergrande Group takes a deep dive into how the property developer’s debt crisis is affecting thousands of suppliers across the construction, furnishings and real estate services sectors and how the fallout of an Evergrande collapse could affect China’s economy.

The Emerald Bay development in Tuen Mun and its sister project The Vertex in Cheung Sha Wan were supposed to showcase properties for China’s biggest developer by sales, with high-end German appliances, in-flat wine refrigerators and opulent common areas featuring modern design elements.

02:25

Unpaid by Evergrande, supplier sells car and home to rescue his business

That could have profound effects on China’s economy, where the property development, construction and real estate services industry account for more than a quarter of China’s US$14 trillion gross domestic product.

“If Evergrande collapses, my company, my six employees and all of those construction workers I hire will lose their jobs, and we will all be ruined,” said Lin, a supplier who only gave his family name, and who runs a painting and heat-insulation business in eastern Jiangsu province.

Six Evergrande projects in the Yangtze River Delta region, now halted, accounted for half of his business turnover, said Lin. He is still holding 5 million yuan of commercial acceptance bills (CABs) or IOUs from the company, some of them six months past due.

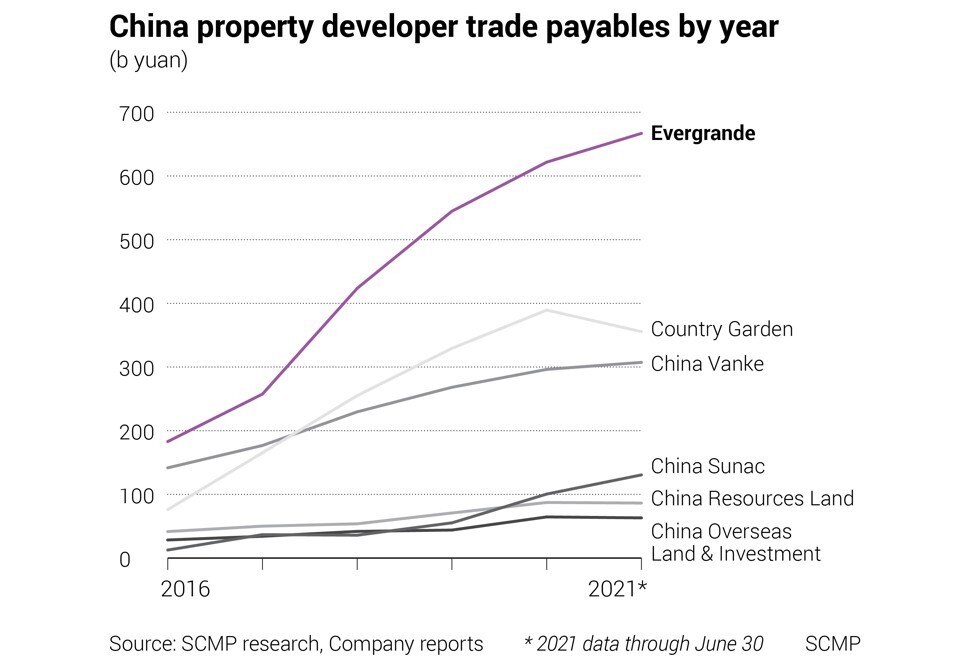

Evergrande had about 667 billion yuan of trade payables on June 30, according to its accounts, of which almost 90 per cent are due within 12 months. They can range from commissions on pre-sold properties to materials to outfit its flats, such as Miele ovens, Warendorf kitchen cabinets and Siemens fridge-freezers.

At the same time, Evergrande has an outsize amount of CABs – where it issued a paper slip to vendors with the promise to pay later – when compared with its peers.

Evergrande had 205.7 billion yuan in those outstanding IOUs at the end of 2020, according to a July report by the securities firm Central Wealth, eclipsing the combined amount owed by 34 of its rivals including Greenland Holdings, Sunac China and Country Garden.

Some vendors are so desperate to be paid that they are posting photographs of their IOUs on the social media platform Weibo as they struggled to get an answer from the developer.

“No one answers the phone calls and no one in the group is responsible for the redemption of the bills,” said one Weibo user who claims to be a vendor. “They shirk responsibility and everyone in the company is trying to save themselves. Deadbeat.”

As a result, a collapse by Evergrande could cascade down to multiple layers of subcontractors and smaller suppliers who do not have a direct relationship with the developer, but still find themselves out of pocket when the music stops.

In recent weeks, Evergrande also appears to have missed interest payments on at least two offshore bonds. Delayed repayments, if not resolved within 30 days, would be tantamount to a default that may prompt all lenders to demand immediate repayment.

This summer, the company has been shedding assets and turning over properties to its suppliers in the hope of generating enough cash to allow it to complete thousands of unfinished flats and homes, giving it some breathing space to stay ahead of its debt obligations.

Between the end of June and August 27, the company sold 25.17 billion yuan in property units to suppliers and contractors to settle some of its outstanding payments.

Suzhou Gold Mantis Construction Decoration, which counts Evergrande among its largest clients, said it was repaid 1.7 billion yuan in property to set off against overdue CABs. It was still owed 4.1 billion yuan at the end of June, including 60 million yuan past due.

In July, Suofeiya Home Collection, a custom furniture maker, acquired a 40 per cent stake in a joint venture with Evergrande, to offset about 160 million yuan in receivables owed by the developer.

Lin, the painting and heat-insulation contractor in Jiangsu province, received two completed flats worth 1 million yuan in a project in southern Guangdong province as partial repayment.

“I have no choice but to accept this,” he said. “I am hoping to sell it as soon as I can get the home ownership certificate by the end of this year. I need the cash, whatever I can get, to sustain my business.”

Centaline Group founder Shih Wing-ching said Evergrande offered properties to repay part of the HK$200 million (US$25.7 million) of overdue commissions from projects in Hong Kong and the mainland. Still, he is concerned property owners might not receive top priority if the company goes into liquidation.

“We want cash,” said Shih, whose company is the biggest Hong Kong-based agency operating in mainland China. “If we accept their properties, we have to pay stamp duties and other related taxes to recover our commissions.”

Centaline filed a lawsuit in High Court in Hong Kong on Thursday to recover HK$90.3 million in commissions from the sale of 401 units at the Emerald Bay project and HK$16.4 million from the sale of 42 units at The Vertex development.

Keeping its building contractors and other suppliers happy is vital to Evergrande’s ability to stave off collapse, particularly as unfinished units became harder to sell as prospective buyers are spooked by its financial fragility.

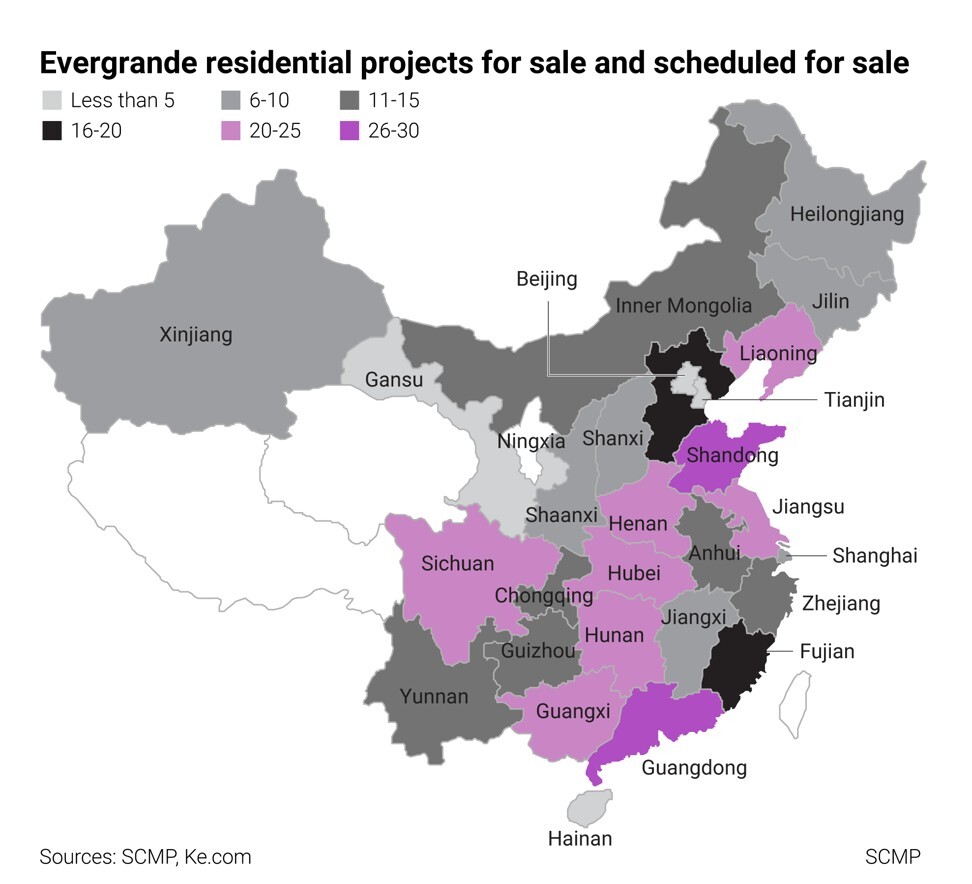

Evergrande had a stable of properties under development worth 1.3 trillion yuan as of June 30, according to its interim report. That is in addition to 144 billion yuan in completed properties ready for sale as of the end of June.

At the Emerald Bay development in Tuen Mun, no new flats have been sold since July after banks in the city backed away from offering mortgages for unfinished properties. This has compounded its cash crisis, as presales of homes is a major source of liquidity for developers.

Evergrande, founded by the property magnate Hui Ka-yan in 1996, has since halted construction at hundreds of projects and several local governments have ordered the company to place its revenue from presales into custodial accounts to protect homebuyers.

Beijing is scrambling to ensure that a potential collapse of Evergrande, the country’s biggest property developer by sales, does not start a cascade that undermines the nation’s housing market – where 90 per cent of households own the home they live in and 20 per cent own multiple properties.

The effects of a potential Evergrande collapse could spread well beyond the 163,000 people who work for the developer directly.

Real estate and related activity, such as construction, accounts for about 29 per cent of China’s GDP – comparable to pre-global financial crisis Spain and Ireland, according to Kenneth Rogoff, a Harvard University professor and American economist.

At the end of 2019, real estate and construction jobs accounted for about 25 per cent of urban employment at non-private companies, such as state-owned enterprises and publicly listed companies, according to the National Bureau of Statistics.

“If Evergrande collapsed, it would push some small businesses and people to the edge,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management. “The worst part is Evergrande‘s contagion risk spreading to other Chinese developers. A wave of chain of events will cost more jobs. That is why the government is trying to prevent a domino effect.”

Of Evergrande’s suppliers who have publicly disclosed their exposure, Jiangsu Nantong Sanjian Construction Group had the largest exposure, with 4.7 billion yuan in receivables attributable to Evergrande at the end of June. That included 3.1 billion yuan of Evergrande IOUs, the engineering contractor said.

Home decoration maker Grandland Group said it had receivables of 2.7 billion yuan owed at the end of June, 335 million yuan of which were already overdue. Evergrande is its biggest customer, accounting for 45 per cent of revenue.

Other affected suppliers include household textile maker Dohia Group, home decoration maker Jianyi Group and advertising agency Leo.

The fallout from an Evergrande collapse could be particularly hard on smaller, privately owned construction outfits, according to Matthew Chow, an S&P Global Ratings analyst. These firms, he said, “tend to be more focused on housing construction and rely heavily on a few large customers”.

For family-run suppliers, the developer’s distress is already being felt in their wallets. A supplier by the family name Rao, who runs a wood business, said she has received some 600,000 yuan in IOUs issued by Evergrande. In the past, these IOUs could be redeemed on time. Since March, however, she has been unable to get paid.

“I cannot understand that Evergrande, a company worth billions of yuan, cannot just pay my 600,000 yuan,” said Rao. “It is just a small case to Evergrande, but may ruin my business, the income source of my entire family.”