Evergrande crisis: developer Modern Land (China) seeks debt extension, to repay US$87.5 million early

- Beijing-based developer seeks an extension on US$250 million bond to avoid ‘any potential payment default’

- Debt extension request comes as concerns continue to swirl about a potential Evergrande default and the Chinese property sector

The Beijing-based builder said it was seeking bondholder approval to extend the maturity of its 12.85 per cent senior notes from October 25 to January 25 and to repay US$87.5 million of the principal amount.

The Hong Kong-listed company separately said that its chairman, Zhang Lei, and its president, Zhang Peng, had agreed to provide about 800 million yuan (US$124 million) in shareholder loans, with the expectation that they would be completed in two to three months.

02:28

Angry protest at headquarters of China Evergrande as property giant faces liquidity crunch

Modern Land did not immediately respond to a request for further comment. The company’s shares declined by as much as 1.1 per cent in Monday’s afternoon session in Hong Kong.

The request to extend Modern Land’s debt repayment comes against the backdrop of an expected default by Evergrande, China’s biggest home builder by sales last year.

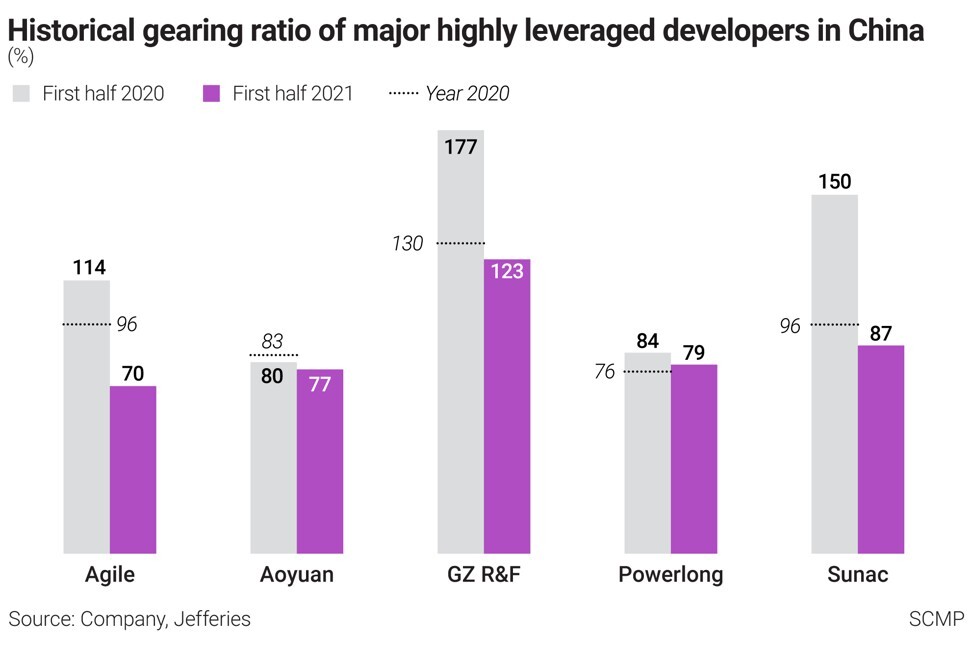

Property developers such as Evergrande have been squeezed by Beijing’s efforts in the past year to tamp down speculative property price bubbles. In August last year, the People’s Bank of China adopted new “three red lines” requirements to measure the debt levels of developers and to limit their ability to borrow if they were overleveraged.

Cracks are starting to show with other developers, as well.

For its part, Modern Land previously said it would seek to “continuously reduce debts” in the second half of this year.