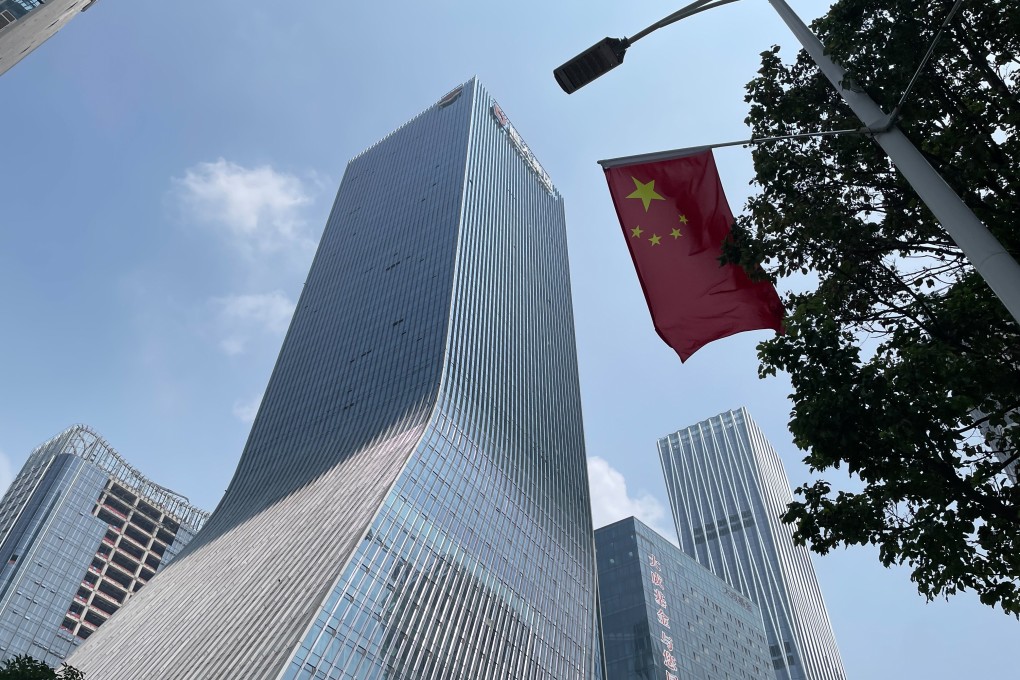

Evergrande: concerns linger even as embattled developer’s Hengda unit makes interest payment on US$327 million onshore bond

- Evergrande’s onshore real estate unit made an interest payment on onshore debt on Tuesday

- Construction, real estate account for nearly half of China’s US$27 trillion in corporate debt, S&P says

However, a payment on its yuan-denominated debt has done little to reassure offshore bond holders – or major credit rating agencies about the Chinese property sector – after the company missed two interest instalments in September and another three coupon payments last week.

“The recent troubles of property group China Evergrande Group have rattled investors. Should Evergrande default, there may be contagion effects for other developers, home prices, and the economy,” S&P Global Ratings analysts Terence Chan and Eunice Tan, said in a research note on Tuesday. “Evergrande’s cash flow troubles foreshadow what could go wrong for liquidity-challenged Chinese corporates.”

02:25

Unpaid by Evergrande, supplier sells car and home to rescue his business

China’s corporate debt topped US$27 trillion, equivalent to 31 per cent of the global total and its debt-to-gross domestic product ratio is markedly higher than the global rate, implying “substantial financial and economic contagion risk”, according to S&P.