Hong Kong government keen on public to take part in US$22.5 billion green bond issuance programme

- Hong Kong government plans to issue HK$175.5 billion (US$22.5 billion) worth of green bonds in a bid to make city a hub for sustainable finance, says Paul Chan

- Some of the bond issuances will be open to the general public to allow them ‘to reap the benefits’ of sustainable development

Hong Kong’s finance chief said the government plans to issue HK$175.5 billion (US$22.5 billion) worth of green bonds over the next five years, with some bond issuances open to the general public “to reap the benefits” of sustainable development.

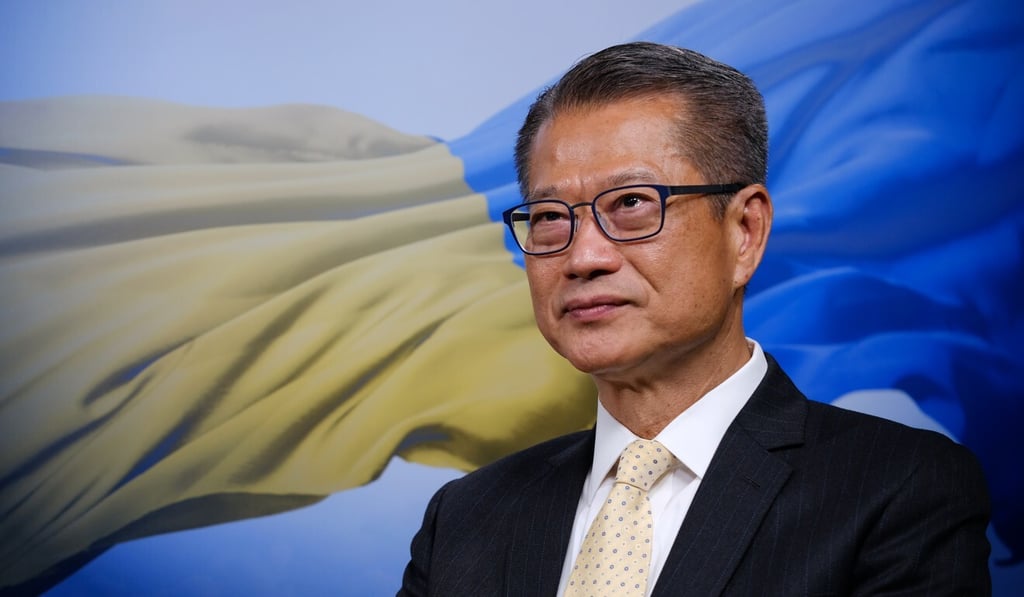

The green bonds will be offered on a regular basis in different currencies and tenors to set a yield curve for the market in a bid to develop the city as an international hub for sustainable finance, Financial Secretary Paul Chan Mo-po said on Wednesday.

“As an international finance centre, offshore yuan trading hub and international asset management centre, Hong Kong has the conditions and advantages to develop to become a leading green and sustainable financing hub in the region,” Chan said at the ESG and Green Finance Opportunities Forum organised by the Chamber of Hong Kong Listed Companies on Wednesday.

As green and sustainable development is also the concern of the public at large, “we will issue some of these green bonds for retail [investors], so that citizens can also participate and reap the benefits”, he added.

Green bonds are fixed-income products designed to fund projects that are environmentally friendly and could top US$29 trillion globally over the next decade.