Evergrande staves off default, paying US$83.5 million of overdue offshore bond coupon before 30-day grace period runs out

- Evergrande wired the payment due on its 8.25 per cent, US$2.03 billion bond maturing in March 2022 to Citibank on Thursday, according to separate reports

- Evergrande missed the payment on its offshore debt on September 23 and was given 30 days grace until this weekend before being declared in default

The Shenzhen-based developer wired the payment due on its 8.25 per cent, US$2.03 billion bond maturing in March 2022 to Citibank on Thursday, according to separate reports by the state-run China Securities Times newspaper and Reuters, both citing unidentified sources. Evergrande did not respond to a request for confirmation while Citibank, the bond’s trustee, declined to comment.

Evergrande, with more than US$300 billion in liabilities, is hardly out of the woods, as it missed five interest payments on its offshore debt in September and October, including Thursday’s coupon payment. It has two coupon payments totalling US$235 million due on Sunday.

Evergrande, with numerous entities and publicly traded subsidiaries involved in everything from its core real estate development to electric cars, health, bottled water and even a football club, had doubled down on its negotiations to stave off a financial collapse.

Its venture Jumbo Fortune Enterprise got creditors to agree this week to an extension on the repayment of a US$260 million bond that Evergrande had guaranteed, according to REDD Intelligence, a bond information portal.

Investors cheered the coupon payment, pushing Evergrande’s shares up by as much as 7.8 per cent to an intraday high of HK$2.78 in Hong Kong, reversing yesterday’s 12.5 per cent slump when the developer’s plan to sell a unit for US$2.6 billion failed to materialise. Evergrande Property Services Group, the management unit that Evergrande withdrew from sale, rose by as much as 5.3 per cent, in contrast to the 10.2 per cent tumble when the withdrawal was announced.

Evergrande’s offshore coupon payment is a “huge boost,” as a default and a forced restructuring was widely expected by the financial markets, said Lucror Analytics’ credit analyst Zhou Chuanyi in Singapore.

“Investors’ confidence over Chinese companies, particular developers, have been gravely hit by what Fantasia and Modern Land did, and now we understand that at least some Chinese companies, like Evergrande, are still trying very hard and willing to pay, shrugging [aside] its liquidity issues,” Zhou said. “The effort means something.”

However, it ran into issues recently as it tried to amass enough capital to keep the lights on and complete its backlog of 1.3 trillion yuan in unfinished properties.

The Evergrande crisis has left Chinese officials in a difficult spot as they try to balance policy efforts to control speculative pricing bubbles in the mainland property sector with the need to maintain social stability, particularly given the importance housing plays in its economy.

“We believe the mounting pressure will lead the authorities to take further measures to accelerate credit growth before the year-end, including reserve requirement ratio cuts,” Fitch Ratings analysts Andrew Fennell and Grace Wu said in a research note on Thursday. “They may also scale back the implementation of some property-related regulations.”

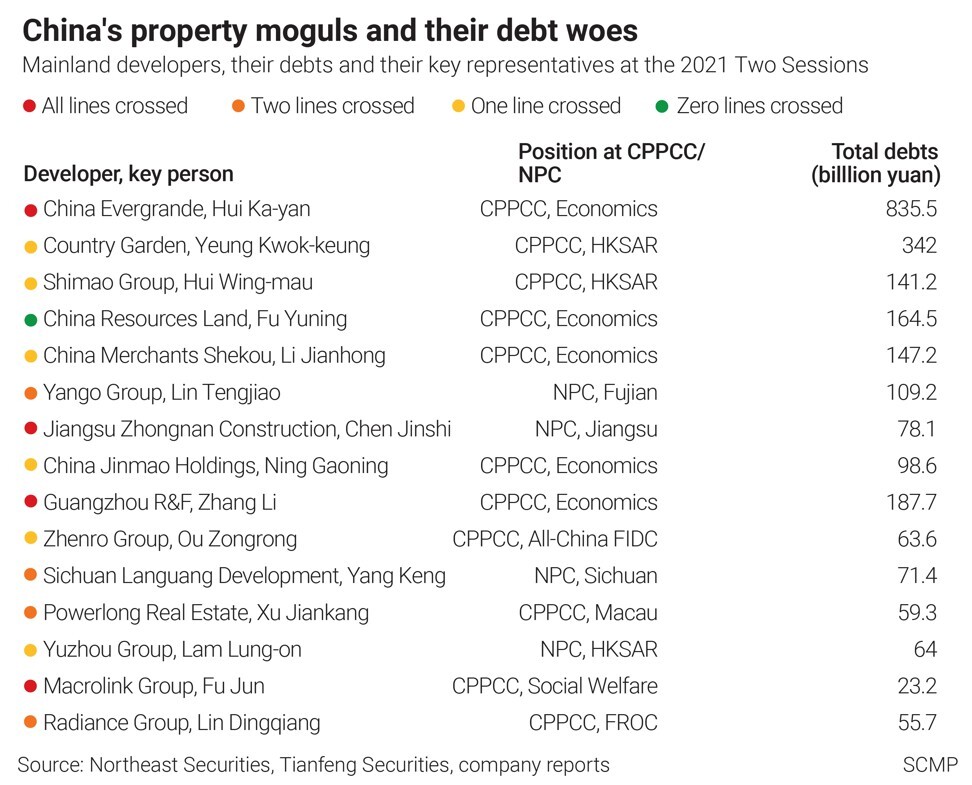

“The three red lines and other measures to control developer leverage may also be tempered, even while they retain rhetorical value as part of government campaigns to improve housing affordability and rein in financial risks,” they added.