Advertisement

China’s central bank speaks up as data privacy advocate as it curbs unauthorised and excessive data collection by fintech companies

- China’s central bank Governor Yi Gang says it will continue to crack down on fintech companies’ misuse of data, and unfair practices

- PBOC has joined other top regulators in enforcing personal data protection, and data cross-border transfer by Chinese tech firms

Reading Time:3 minutes

Why you can trust SCMP

The People’s Bank of China said it will take the lead to curb the unauthorised and excessive collection of personal data by technology companies that provide financial services, as it steps up to the plate as an advocate of data privacy in the world’s largest fintech market.

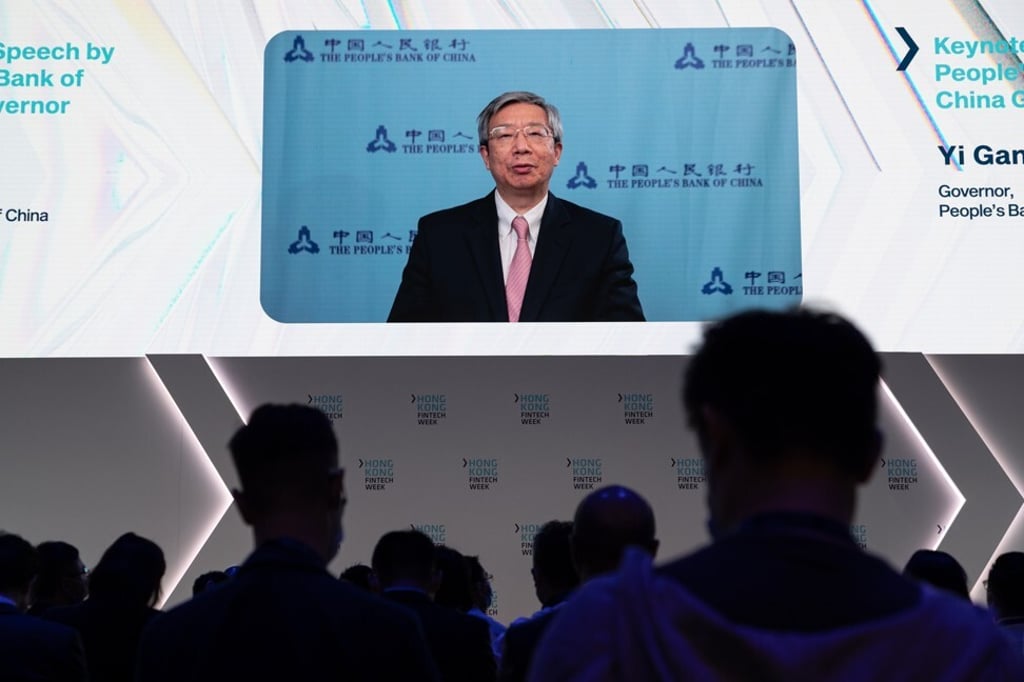

Advancements in artificial intelligence (AI), cloud computing, big data, blockchain and e-commerce have come at the cost of personal data protection, as financial institutions adopt fintech, said the Chinese central bank’s Governor Yi Gang, in an 8-minute keynote speech devoted to data protection during the 2021 Hong Kong Fintech Week.

“Big data is at the heart of technology,” Yi said in his televised remarks from Beijing. “Companies with large traffic could acquire new customers … and enjoy steady data flow. Fintech has increasingly gained the upper hand in using, accessing and storing data.”

Advertisement

Yi’s speech underscores the legal framework for personal data protection that is taking shape in China with the passage of a data security law this year and a personal information protection law, which became effective this month. It also bookmarks the year-long crackdown by Chinese financial and antitrust regulators on fintech giants such as Ant Group, Tencent Holding’s WeChat and JD.com’s JD Digits businesses over the storage, usage and management of personal data collected by technology platforms.

Advertisement

The Chinese central bank is not exactly waking up to data protection, as it had published a set of rules since 2005 to govern the management of data in anti-money-laundering, credit information and consumer protection. What is different now is the central bank shifting its focus to unfair and what it calls excessive collection of data, especially by fintech firms.

“Some [companies] collect data without permission, [and are] leaking customer data, so the strengthening of personal data protection is an urgent matter,” Yi said. “We are cracking down on excessive collection of consumer data, and unfair practices that require customers to hand over data in exchange for financial services.”

Advertisement

Select Voice

Select Speed

1.00x