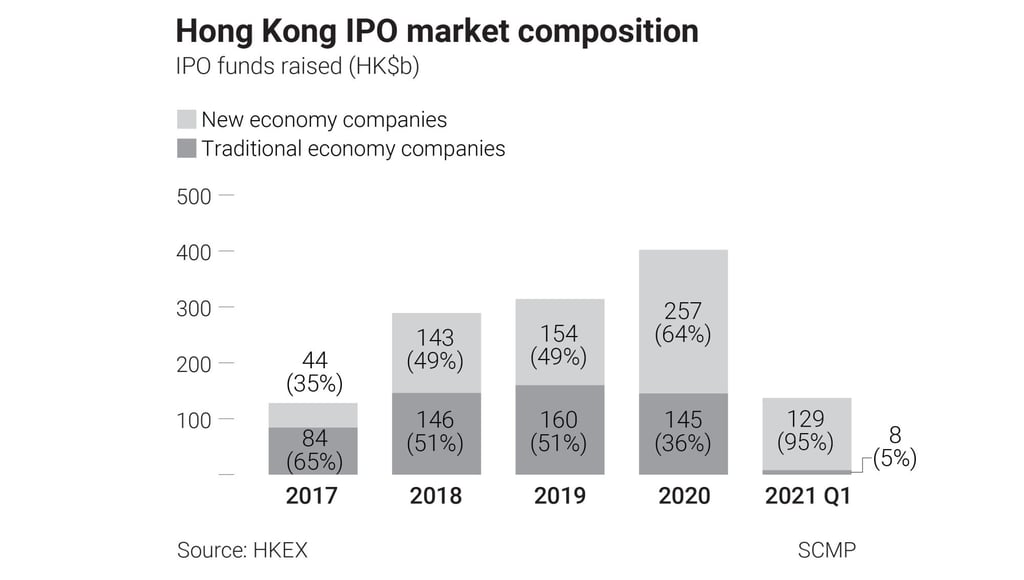

Hong Kong’s IPO ranking set to slip as Nasdaq, New York and Shanghai claim top spots in 2021, KPMG reports

- IPO proceeds seen shrinking 23 per cent this year to HK$356 billion (US$39 billion), the first decline since 2017, KPMG says

- Recovery in 2022 should take hold in the third quarter as foreign-traded VIE-structured Chinese tech companies seek new home in Hong Kong

Hong Kong is set to end the year as the fourth-ranked venue for global initial public offerings (IPOs) as proceeds shrink amid regulatory clampdown by Chinese authorities, according to KPMG. A rebound may gain momentum in late 2022.

The city’s stock exchange is likely to count 110 IPOs this year, generating HK$356 billion (US$39 billion) in proceeds, according to forecasts published by KPMG on Thursday. That represents a 23 per cent slide from 2020 when it ranked second behind Nasdaq, and the first drop since 2017.

KPMG estimated that Nasdaq, New York and Shanghai bourses will claim the top three busiest markets in a year when global IPO proceeds are expected to surge 55 per cent to US$433 billion.

“Companies have either shifted their IPO timetable beyond this year or scaled down their fundraising since the third quarter on the back of market and regulatory uncertainties,” said Louis Lau, a Hong Kong-based partner in the capital markets advisory group at KPMG China.

IPO activities in Hong Kong would be more steady around the third quarter of 2022, Lau added, as tech companies drive new listings, including US-listed variable interest entities or VIEs. Seven US-listed Chinese tech and electric-vehicle makers have made secondary or dual -primary offerings in Hong Kong this year, contributing 27 per cent of the total IPO proceeds.