Which job commands 50 per cent salary premium in 2022? The key is to brush up on environmental, social and governance strategies

- ESG jobs command salary premiums of anywhere from 15 per cent to up to 50 per cent, as companies leap over each other to snare suitable candidates, recruiters say

- In mainland China, ESG candidates can command up to 50 per cent increments, according to Hays China

When Keiko Pun graduated in 2017 from City University of Hong Kong, she aspired to use her degree in environmental science and management to create what she called “positive impact.”

She landed a job a year later at China Road and Bridge Corporation, one of the world’s largest civil engineering contractors, where she was in charge of reducing the environmental impact of an infrastructure project in Hong Kong’s Tseung Kwan O district. Opportunities soon came knocking, as companies and consulting firms sought talent to fill their ranks in environmental, social and governance (ESG).

“The whole market is paying attention to [ESG issues],” said Pun, who joined the consultancy BDO in late 2020 as an associate in the Hong Kong ESG services team and got promoted last year. “I thought this field offers more potential for my career growth, so I made the change.”

Pun is one of hundreds of ESG professionals receiving training from Hong Kong’s tertiary institutions, as the city transforms itself into a regional centre for ESG services to sharpen its edge in banking and finance, logistics and supply chain management. The qualification is in hot demand – commanding 25 to 40 per cent salary premiums, recruiters said – as Hong Kong has raised the bar for banks, publicly listed companies, asset managers and insurers to comply with ESG disclosure requirements by 2025.

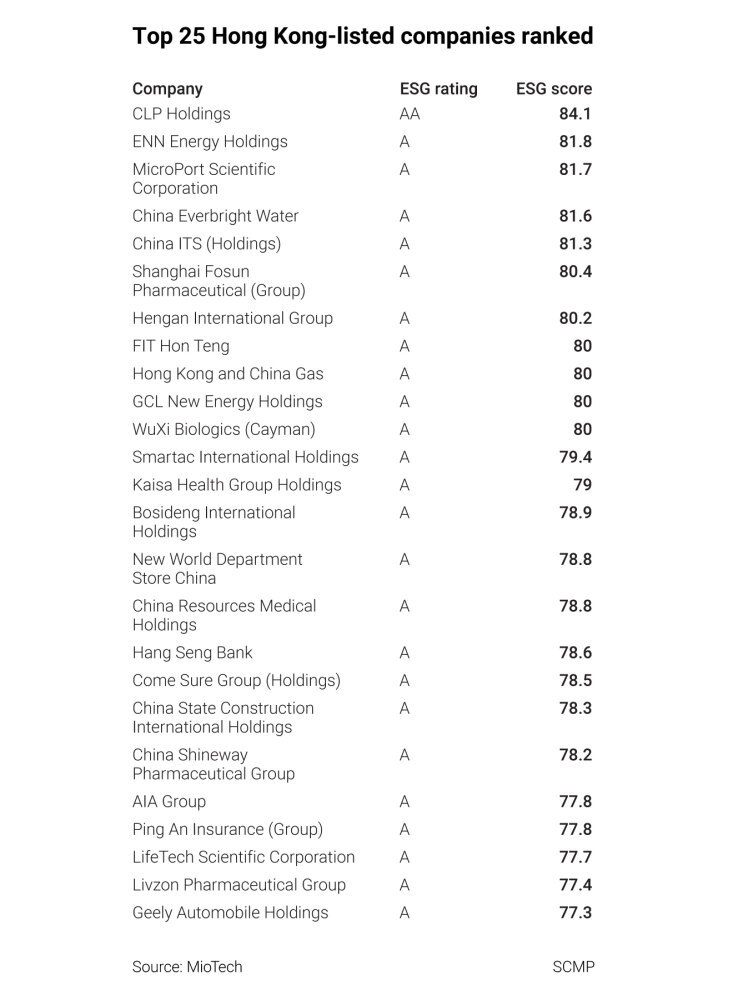

Under ESG rules, companies must add environmental, social and governance factors to the financial metrics of their business operations in regulatory disclosures, and consider both in strategic and capital allocation decisions. As many as 2,586 publicly listed companies, licensed banks and asset managers will have to set up ESG-related positions – or outsource them to consultants – by 2025 in Hong Kong, based on the sum total of institutions under the purviews of various regulators.

“The talent pool for ESG professionals everywhere, including Asia and Hong Kong, is not deep,” said John Mullally, Robert Walters’ director of financial services for Southern China and Hong Kong. “A lot of money will need to be invested on new hires and training over the next few years. Finding those individuals with direct experience, knowledge, credibility and qualifications within a short space of time is difficult.”

A dearth of ESG professionals compels companies to build their teams from scratch. Many companies are also turning to consultancies to fill those vacancies.

“If academic and professional institutions are not able to provide a stable supply [of talent], the current shortage could become more severe,” said Tony Wong, founder of the ESG consultancy Alaya Consulting, who said new inquiries in 2021 doubled compared with the previous year.

A search for “sustainability” on LinkedIn returns over 700 jobs waiting to be filled in Hong Kong, while searches for “ESG” and “climate” end up with more than 300 jobs in each case.

Sweltering heat in Hong Kong, extreme weather show need to act now, scientists say

The Big Four global accounting and business consultancies – KPMG, PwC, EY and Deloitte – are among the biggest hirers of ESG professionals, to help clients meet disclosure requirements and formulate their strategies.

People switching jobs within the ESG field can expect salary increments of 25 per cent or more – in some cases up to 35 per cent – depending on the industries and companies, recruiters said. Some ESG specialists in Hong Kong have been headhunted at a 30 to 40 per cent salary premium, noted Amy Lo, chairman of the Private Wealth Management Association’s executive committee.

“They often sit on important committees and are directly responsible for helping to set policies … their relative importance in decision-making differs according to their abilities and the influence they can wield,” Mullaly said.

“Not only are [the firms] looking for support on trusted and verifiable sustainability data, but also help in establishing an ESG governance structure, formulating ESG strategy and policies … to identify and address climate-related risks,” said Judy Li, the Asia-Pacific financial services sustainability leader and partner at EY.

In Hong Kong, the government’s green and sustainable finance cross-agency steering group, which identified talent and data as the top issues to tackle, last month suggested that a common ESG qualifications framework be adopted, and that support be given to people taking up training courses.

China’s carbon neutrality goal

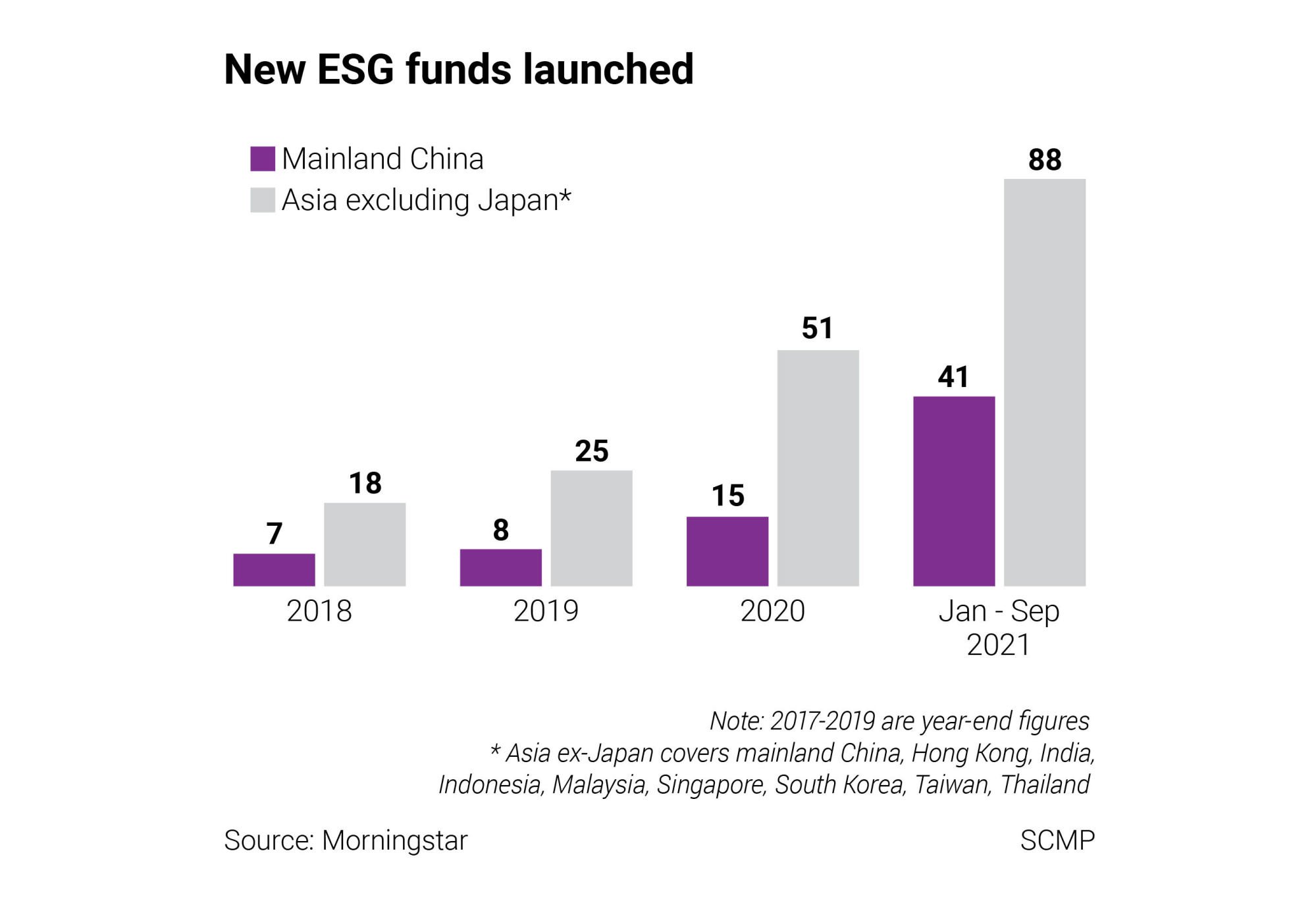

The demand in mainland China for ESG talent will rise in the next five years, as the Chinese securities regulator ordered listed companies to expand their mandatory disclosures to include environmental violation penalties. They are also encouraged to make voluntary disclosures on measures to cut carbon emissions, alleviate poverty and revitalise rural areas.

As ESG jobs are in high demand, suitable candidates can demand salary increments of between 30 to 50 per cent based on the annual package, according to recruitment agency Hays China.

“There is a critical shortage of [ESG professionals] who are well versed and experienced in the ESG and sustainability areas, so positions like the chief sustainability officer (CSO) will become increasingly important,” said Linda Zhang, the partner in charge for the executive search firm Heidrick & Struggles in Shanghai, noting that CSO roles command salary increments of between 15 and 30 per cent.

The chief sustainability officer role was created in response to trends that require businesses to invest more in sustainability and environmental improvements, she added.

Hong Kong’s tertiary institutions are expanding their ESG programmes to meet the rising demand.

The University of Hong Kong’s masters programme for sustainability leadership and governance saw its 2021 applications increase by 10 per cent from the previous year. Pun of BDO has also enrolled herself into the programme part time.

It’s “not just a response to demand, but a way of shaping and helping financially or accounting-oriented disciplines to think more broadly about the sustainability context [in which] capital needs to be invested,” said the programme’s director Margaret Burnett.

Enrolments in the programme’s sustainable and responsible investment course more than doubled after it was turned into a core module, said Sammy Fung, the principal lecturer of the university’s business school who teaches the course.

“We need people who are familiar with the disclosure regimes, who can systematically disclose climate-related risks, and [ensure] the market understands what they are talking about,” he said.

In September, the Hong Kong University of Science and Technology (HKUST) announced an undergraduate sustainable and green finance programme with its first intake of 30 students in 2022.

The programme will be jointly offered by its business and management school and its division of environment and sustainability.

“In the past three years, a number of companies from consultancies to [financial firms], have told me they want people with a basic grounding in sustainability,” said Christine Loh Kung-wai, chief development strategist of the division. “They are looking for young people … [and] mid-level executives.”

The Hong Kong Management Association, which provides education and training programmes, last year launched two ESG executive diploma and certificate courses.

To meet demand, at least 11 courses will be launched in 2022 to help students prepare for new roles in ESG and sustainability, said Artie Ng, director of the association’s Global Centre for ESG Education and Research.

Hong Kong’s regional leadership in catching up to the international ESG movement can also be seen from the number of registrations in the European Federation of Financial Analysts Societies’ Certified ESG Analyst (CESGA) exam in December.

Which regions have the most number of certified ESG consultants?

| Germany | 347 |

| Spain | 302 |

| Switzerland | 240 |

| France | 208 |

| Hong Kong | 140 |

Source: European Federation of Financial Analysts Societies

Surging 61 per cent compared to the previous intake in September, it was also more than doubled from the year-earlier level, according to environmental organisation Friends of the Earth (HK), which administers the programme in the Asia-Pacific.

Hong Kong has the fifth largest number of CESGA holders after Germany, Spain, France and Switzerland in September, among over 2,000 holders globally.

Since November, over 130 people in the city have received the designation, according to Anthony Cheung, the convenor of green finance at the Friends of the Earth (HK).

“We expect the number to triple in the next six months,” he said. “Competition for ESG talent is intensifying across the region.”

To address the talent gap, Hong Kong’s government added ESG financial professionals to the 13 categories that qualify for immigration visas in October.

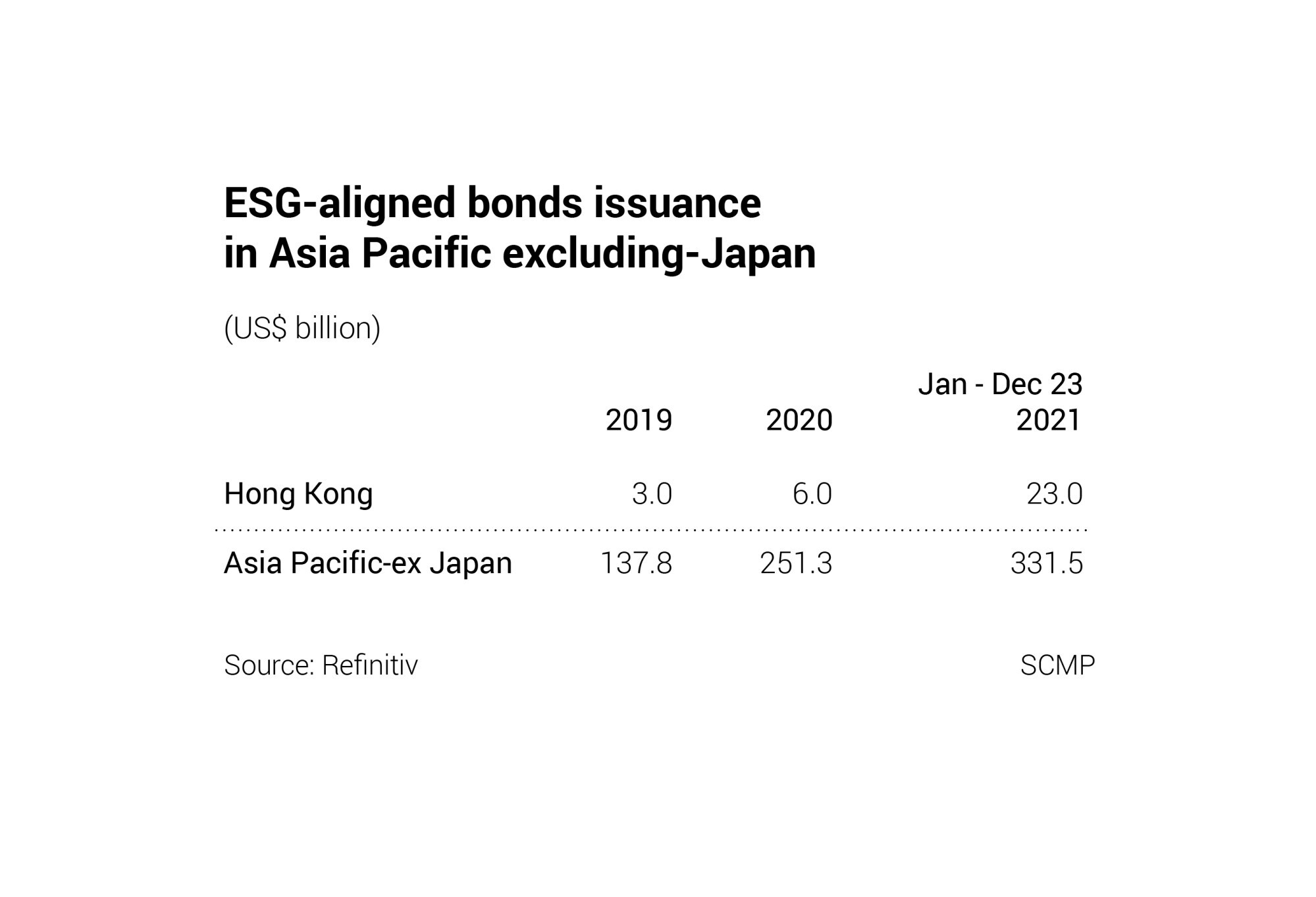

Hong Kong and Singapore are vying for sustainable finance business and talents, said Nneka Chike-Obi, a director of Sustainable Fitch, the sustainable finance research unit of credit ratings agency Fitch Ratings.

Singapore launched its Green Finance Centre in mid-October, its first research institute dedicated to green finance and talent development. Backed by the Monetary Authority of Singapore (MAS) and nine financial companies, it draws on climate science, financial economics and sustainable investing teaching and research resources of Singapore Management University (SMU).

“Because so much policymaking around sustainable finance is happening in Europe, that is where people who have the skills and experience can be found,” Chike-Obi said. “Hong Kong and Singapore are trying to bring them over here.”

Still, what businesses look for in ESG skills has evolved quickly over the past few years, another reason why finding the right people is not easy, headhunters said.

The breadth and depth of ESG information application has expanded within organisations, said Tan Jenn-Hui, the Singapore-based global head of stewardship and sustainable investing at Fidelity International, with US$700 billion of client assets under management.

“If you were hiring ESG professionals five to 10 years ago, the skills that you were looking for were mostly around data analysis,” he said. “Now, you want people who also understand how to integrate ESG considerations into the business strategies.”

ESG professionals are increasingly required to have multidisciplinary skills – spanning finance, climate science, investment products development, regulations and communications, Tan said, adding that Fidelity has doubled his team to 30 people across five Asian and two Europe locations in 18 months.

Proven interpersonal skills are also highly valued, as are previous success in devising and implementing organisational change.

“To us, integration of ESG factors in investing is as much about persuading, influencing, guiding and educating … as creating policies and procedures,” said Tan, who spent half his working life as a lawyer before switching to investment management.

“We look for people who are adaptable, flexible, creative, [good at handling] ambiguity and connecting the dots together … [we] look for people who are able to think differently from the ways things have been done in the past.”

A year into her promotion, Pun said she has found her calling. She aspires to go in-house to lead an ESG team at a large company, she said.

“Many people asked why I studied environmental science as there wasn’t much going on [in vacancies] in Hong Kong,” she said. “But now it has gained importance. The government has even released a carbon neutrality plan. Society is changing for the better.”