Exchange Fund’s gains slump 28 per cent to US$21.9 billion in 2021 as Hong Kong market rout hits investment returns

- The Exchange Fund’s rate of return of 3.6 per cent in 2021 was the worst since it made 0.3 per cent in 2018

- The outlook is rosier this year as the lower valuation of Hong Kong stocks makes them attractive, says broker

Hong Kong’s Exchange Fund, the war chest used to defend the local currency, saw its earnings drop 28 per cent in 2021, as its performance was hit by a slump in the city’s stock market.

The Exchange Fund made a gain of HK$30.8 billion in the second half of last year, far lower than HK$139.7 billion earned during the first half. The fund’s rate of investment return of 3.6 per cent in 2021 was the worst since it made 0.3 per cent in 2018. It was also lower than the 5.3 per cent in 2020 and 6.6 per cent in 2019.

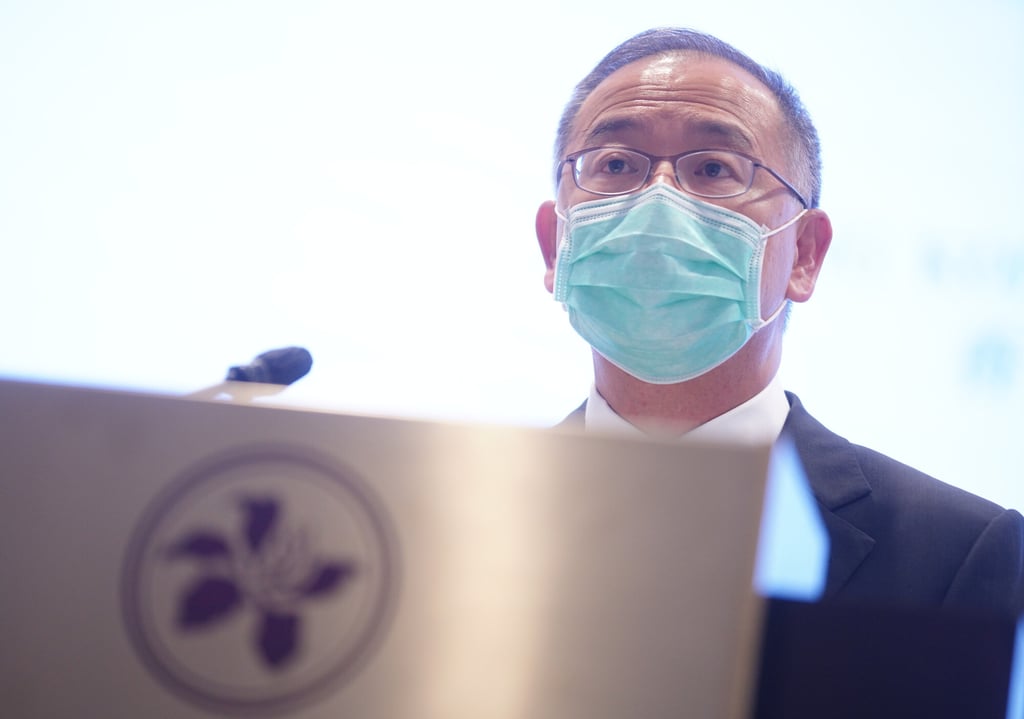

“The global investment markets were very volatile in 2021, a trend that is likely to continue this year,” said Eddie Yue Wai-man, chief executive of the HKMA, in a media briefing to announce the results on Thursday. “The US is likely to increase interest rates amid rising inflation pressure, which is likely to lead to adjustments in stock and bond markets worldwide.”

The fund’s performance was affected by the stock market slump in Hong Kong in the second half of last year after Beijing launched a regulatory crackdown to rein in the technology and private education sectors.

The Hang Seng Index fell 14 per cent in 2021, making Hong Kong the worst-performing market out of 92 major indices tracked by Bloomberg. The Hang Seng China Enterprises Index, which tracks the performance of Chinese companies, fared far worse, declining 23.3 per cent last year.