Liquidity stricken Shimao seeks buyers for some 40 projects valued at over US$12 billion

- The assets include hotels, shopping malls and serviced apartments estimated to be worth 77.1 billion yuan (US$12.1 billion)

- One of the prized assets on the list is a landmark hotel built in an abandoned quarry in Shanghai valued at 2.25 billion yuan

The package of 37 assets includes hotels, shopping malls and serviced apartments estimated to be worth 77.1 billion yuan, according to a document obtained by the Post.

Two sources with knowledge of the asset sales said that Shimao had approached potential buyers including state-owned rivals and financial firms, but the response was lukewarm.

“The sale of the quarry hotel could make headlines,” said Yin Ran, an angel and property investor in Shanghai. “Nearly all families in Shanghai would be interested in staying at the hotel for at least a night.”

Shimao was not available for comment on Monday.

The Shanghai-based developer said in a statement on Sunday evening that the group was looking to offload part of its projects to strike a balance between assets and debts. But the company added that the 2.25 billion yuan valuation of the quarry hotel, known as InterContinental Shanghai Wonderland, was incorrect.

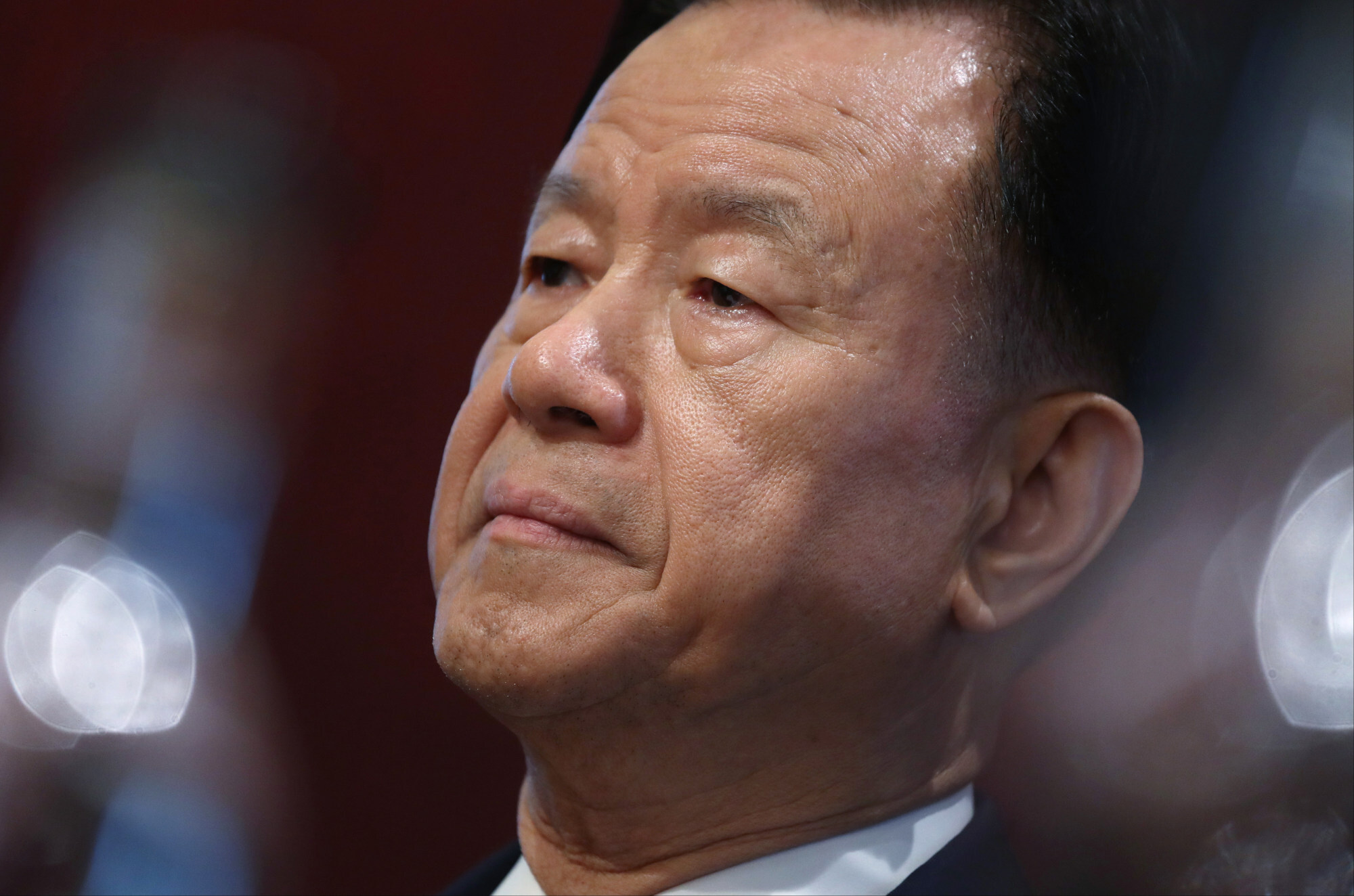

Shimao, founded by Hui Wing Mau, or Xu Rongmao, in 1989, was regarded as a sound and restrained developer until it fell victim to Beijing’s draconian tightening measures to curb the real estate industry in late 2021.

It faces 20 billion yuan of payments this year from onshore bonds and offshore notes, according to Fitch Ratings. The company also faces debt obligations such as trust financing and around 10 billion yuan of asset-backed securities, of which 5.6 billion yuan is due this year.

Sources said that several potential buyers had reviewed Shimao’s hotel and assessed its value, before they balked at the price.

The 338-room hotel, located at Sheshan, in Shanghai’s southwestern Songjiang district, officially opened in November 2018 after 12 years of development. It cost Shimao 2 billion yuan.

The structure rises 88 metres from the floor of the abandoned quarry. Only two of its 18 floors are above ground level, while the lowest two are submerged in a lake that occupies the vast quarry pit.

Basic rooms are listed at more than 3,000 yuan per night, or a third of the average local monthly income.

China’s hotel sector is among the industries worst affected by the outbreak of the Covid-19 pandemic since early 2020.

The mainland’s big hotels posted a record loss of 41.4 billion yuan in 2020, according to data compiled by Shenzhen Huamei Restaurant Management Consulting.

The country’s zero-tolerance policy towards Covid-19 continued to wreak havoc on the hospitality sector last year.