Advertisement

Gold within sight of US$2,035 record amid looming war in Ukraine while market’s ‘fear gauge’ jumps

- Spot gold approaches an all-time high of US$2,000 per ounce on haven bids as Russia sends troops into breakaway regions in Ukraine

- Aggressive Fed rate hikes could raise real yields on various assets, dimming the allure of gold that does not earn interest, according to ING strategist

2-MIN READ2-MIN

1

Gold prices are likely to test the record set in 2020 as heightened geopolitical tensions over a Ukraine invasion, runaway global inflation and stock market volatility fanned demand for safe haven assets, according to State Street Global Advisors (SSGA).

The yellow metal climbed to an eight-month high of US$1,940 per ounce on Thursday after President Vladimir Putin ordered Russian troops into two breakaway regions in Ukraine. Spot gold soared to US$2,035 in August 2020 as the pandemic sparked global recession fears and a rush into the safety of US government bonds.

The US, which described Russia’s move as a prelude to an invasion of Ukraine, has responded with several sanctions with its allies. US stocks entered a correction phase this week, as the S&P 500 Index slipped more than 10 per cent from its peak in January while a measure of market volatility rose to near a record.

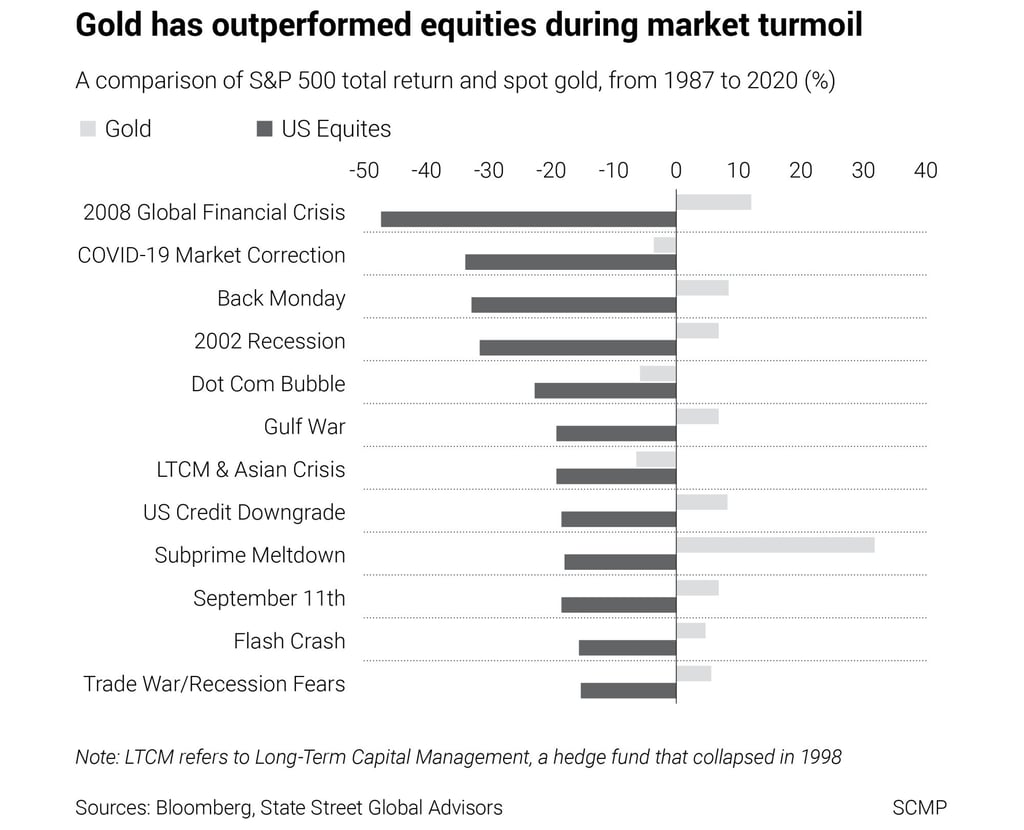

Higher volatility and geopolitical risks “could trigger more demand for safe haven assets and benefit gold,” said Robin Tsui, Hong Kong-based Asia-Pacific gold strategist for SPDR ETF at SSGA. “Historically, where there has been a slump in equities, it would often coincide with an outflow from equities into gold.”

Advertisement

The S&P 500 lost 33.8 per cent during the depth of the Covid-19 pandemic in February-March 2020, while gold weakened 3.6 per cent, according to data from SSGA and Bloomberg.

The VIX Index, which measures S&P500’s expected volatility and is also known as the “fear gauge”, stood at 31.02 on Wednesday, near the record 32 in late January. The five-year average is about 19.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x