Ukraine crisis: Russian rouble plunges 30 per cent against US dollar as Moscow markets freeze on sanctions stress

- The Russian currency lost a third of its value in offshore trading at one point and hit an all-time low of 109.185 per dollar in Moscow

- Quotes were infrequent and volatile at the start of the session, and traders warned that low liquidity was making it difficult to match buyers and sellers

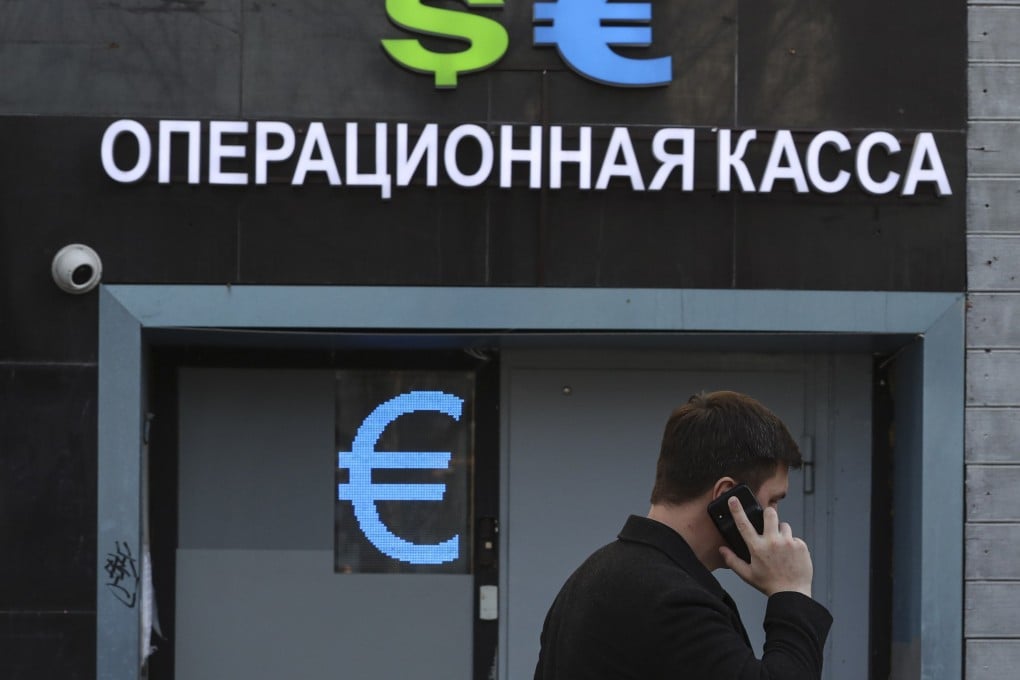

Russian markets were paralysed on Monday and traders struggled to price the rouble as international sanctions shook the country’s financial system.

The Russian currency lost a third of its value in offshore trading at one point and hit an all-time low of 109.185 per dollar in Moscow. Quotes were infrequent and volatile at the start of the session, and traders warned that low liquidity was making it difficult to match buyers and sellers. The central bank cancelled local trading altogether in stocks and bonds as the price of Russian-linked shares and debt tumbled overseas.

Normal volumes picked up later in the session after the central bank allowed the currency to weaken in steps to a level approaching the offshore rate. The rouble then erased some of its losses to trade 13 per cent weaker at 95.4825 roubles per dollar as of 2:41pm in Moscow.

“There’s so little liquidity that pricing data we can see at the moment doesn’t really mean anything,” said Paul McNamara, a fund manager at GAM Investments. “People are struggling to get out of forwards because no one can tell what will happen in the next month. We think most foreigners have reduced but not eliminated their exposure.”