Private equity firm PAG seeks US$2 billion from listing as Hong Kong widens IPO market to SPACs, non-traditional firms

- PAG has US$50 billion of assets under various investment strategies including credit, absolute return, real estate and buyout

- Co-founders to hold shares with 10 times more voting power over ordinary shareholders to retain control, set business strategies

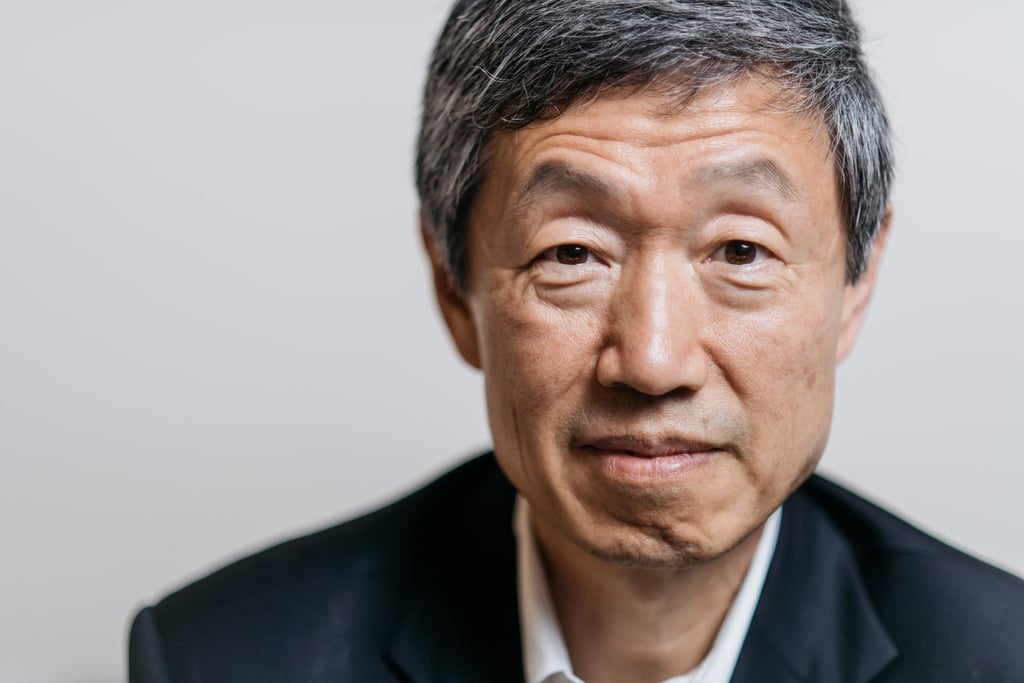

The investment firm, co-founded by Chinese deal maker Shan Weijian, submitted its application on Friday, according to exchange data. While it did not disclose any details, one market source said the initial public offering (IPO) could raise up to US$2 billion to fund new deals.

The Hong Kong-based money manager oversees about US$50 billion of assets across credit and market, absolute return, real estate, private equity and buyout strategies. Its assets have risen sixfold in the past decade, according to its application document.

Hong Kong had seen only six IPOs this year as of February 18, generating a combined US$1.1 billion of proceeds, according to Refinitiv data. That is a sharp decline from the same period a year earlier, when 20 listings contributed to US$8.6 billion in proceeds.

Hong Kong has lost its top ranking to Nasdaq as the largest IPO venue in recent years, a situation made worse by Beijing’s punitive antitrust campaign and other regulatory reforms. New IPOs were reduced to a trickle as the crackdowns triggered a market rout of more than US$1 trillion.