HSBC, JPMorgan lead global banks into metaverse with gaming, immersive experiences as consumer preferences shift

- HSBC, JPMorgan Chase among financial companies setting out stalls in virtual playgrounds as metaverse gains traction

- Banks, other financial institutions sticking to marketing, rather than transactions in virtual worlds

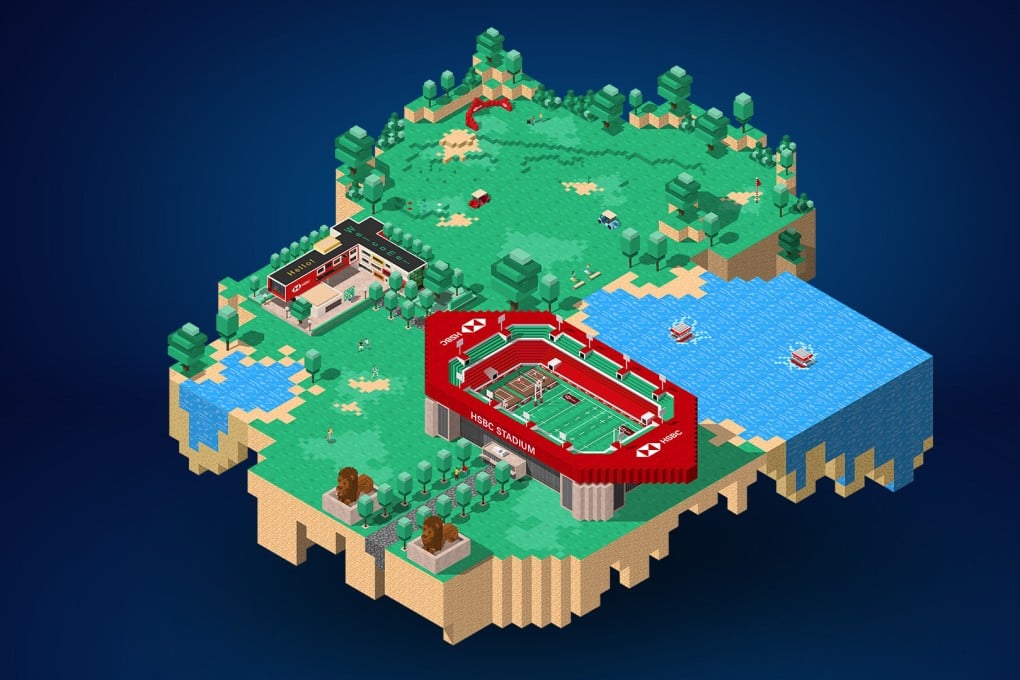

HSBC, Europe’s biggest lender by assets, last month acquired a plot of real estate within The Sandbox’s metaverse, the first global bank to do so. JPMorgan Chase led its Wall Street peers by opening its Onyx lounge in Decentraland in February, allowing consumers to buy virtual land using digital assets.

“Companies and brands, even financial institutions, need to compete to give more value to their customers,” said Erich Wong, head of growth (Hong Kong) for The Sandbox, a blockchain gaming platform owned by Hong Kong’s Animoca Brands. “Providing experiences that offer a better sense of community is a powerful tool for doing so.”

Lenders and insurers are shifting more of their offerings towards digital portals as customers increasingly prefer the convenience of online transactions, but are not yet planning to offer those transactional services in the metaverse.

While HSBC has not revealed its plans for its virtual space in The Sandbox, the lender would focus on “immersive brand experiences” and “gamification,” or adding game mechanics to non-gaming experiences, to explore complex subjects.

“We truly see that virtual reality, augmented reality technology, and all of these new three-dimensional interfaces will gain mass adoption at some point,” said Suresh Balaji, chief marketing officer for Asia-Pacific. “HSBC has always been invested in communities. Gaming creates huge communities.”