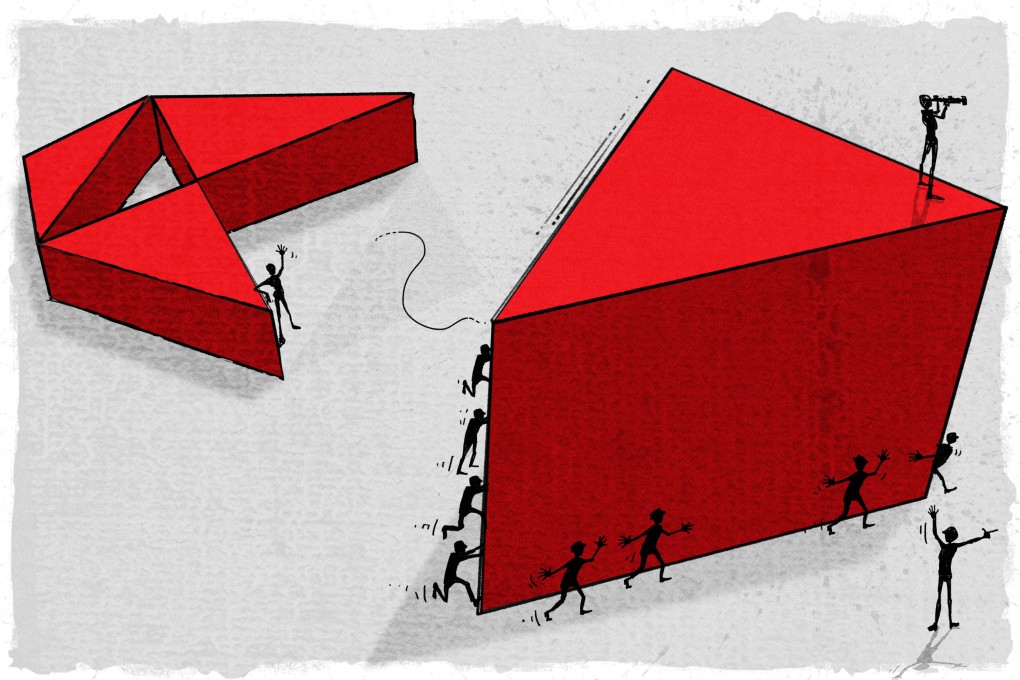

Breaking up HSBC: Ping An’s call to debate the future of Hong Kong’s largest bank raises vexing question if its value is greater than the sum of its parts

- Ping An, HSBC’s biggest shareholder, making push for change at the lender in latest example of investor strife

- Asia is the bank’s biggest profit centre, but insiders say much of its revenue in parts of its Asian business originates outside the region

HSBC’s decision in 2020 to scrap dividends infuriated the bank’s legion of Hong Kong shareholders from retirees to pension funds who depend on regular payouts by the city’s largest currency-issuing bank for income.

One such retiree was Lo Chi-man, 71, a shareholder for 12 years who counted on the 6 per cent average dividend on his 50,000 shares to supplement his pension. He sold his stake when HSBC acceded to a call by the UK banking regulator to suspend payouts and conserve capital for the unfolding Covid-19 pandemic.

“We want shareholders to participate in the debate and to propose solutions for HSBC,” a Ping An spokesperson said this week, days after the bank reported a 28 per cent plunge in first-quarter profit. “Ping An supports all reforms and proposals from investors that can help HSBC’s operations and long-term growth.”