Vision Deal, SPAC backed by former Alibaba.com CEO, moves closer to listing as Hong Kong’s second blank-cheque offering

- Backed by former Alibaba.com head, the Vision Deal special-purpose acquisition company was fully subscribed by Monday, people familiar said

- Vision Deal was aiming to raise US$130 million and said it plans to buy and merge with companies in smart-car technologies and e-commerce

Vision Deal HK Acquisition Corp, backed by a former Alibaba Group executive, took a step towards a listing in Hong Kong after its share sale was fully subscribed by investors on Monday, people familiar with the transaction said.

The special-purpose acquisition company (SPAC) won approval from the Hong Kong stock exchange’s listing committee last week and began marketing its shares to institutional investors this week. The sale was fully covered by Monday evening, and a listing is slated for June, according to these people, who were not authorised to speak publicly on the deal.

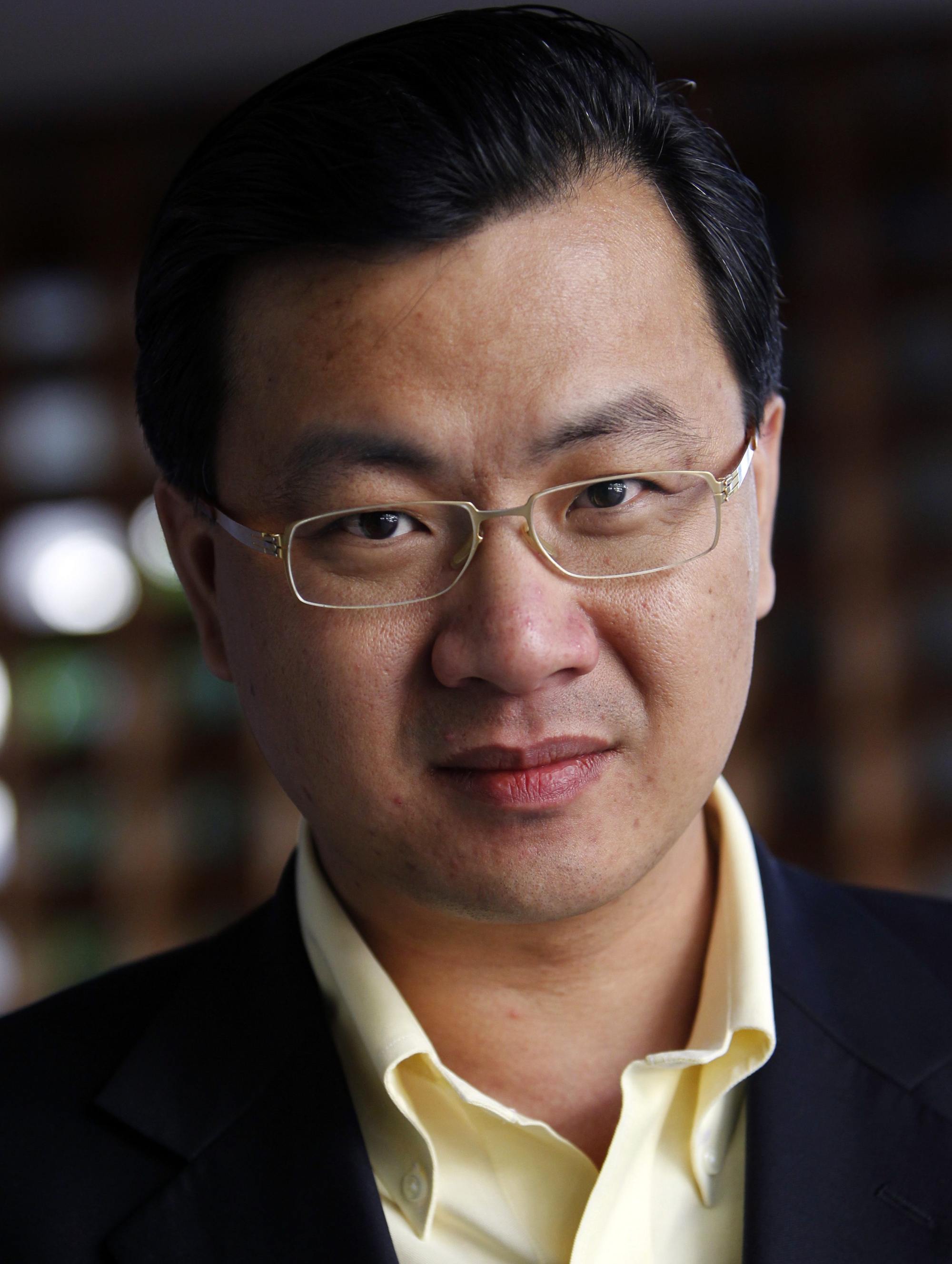

The firm, which aims to raise about US$130 million, is 45 per cent-owned by Zhe Wei, the former chief executive officer of Alibaba.com before its privatisation in June 2012. The other 55 per cent is co-owned by boutique investment bank DealGlobal and financial advisory firm Opus Capital.

Vision Deal aims to buy businesses in China that focuses on smart-car technologies, supply chain and cross-border e-commerce capabilities, according to its draft prospectus filed to stock exchange.

“The growth of [China’s] smart-car technologies market is being propelled by favourable government policies and technological advancements,” Vision Deal said in the filing. “Supported by strong domestic supply-chain capabilities, China’s consumer companies are gaining traction overseas.”

The terms and timetable of Vision Deal’s share offering were redacted in its draft prospectus.

The Vision Deal offering has come as the global IPO market has cooled amid interest-rate hikes in the US, concerns about global recession and inflation exacerbated by Russia’s invasion of Ukraine, and Covid-19 lockdowns in China.

Only 16 companies have completed IPOs in Hong Kong this year, raising US$2.1 billion in total, a 92 per cent slump in value from the same period a year ago when 38 deals raised US$24.4 billion, according to Refinitiv data.

Hong Kong’s first SPAC falls in IPO debut as retailers barred from trading

Citigroup and Haitong International are the joint sponsors of Vision Deal. They were not immediately available for comment.

Enoch Yiu contributed to this story.