Advertisement

Chinese cryptocurrency-mining rig maker Nano Labs eyes US$50 million Nasdaq IPO defying clampdown at home

- Hangzhou mining-chip designer Nano Labs seeks to raise US$50 million from sale of American depositary shares

- With Beijing’s blanket ban on cryptocurrency mining activities, Nano Labs aims to pivot towards the metaverse instead

Reading Time:2 minutes

Why you can trust SCMP

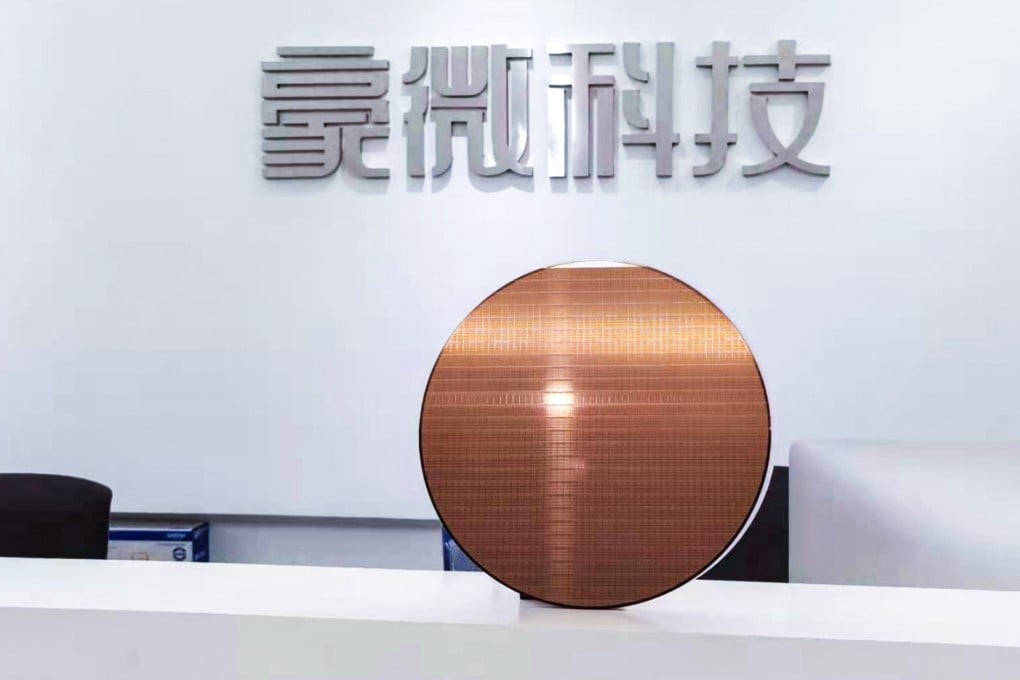

Nano Labs, a cryptocurrency-mining chip designer based in Hangzhou, Zhejiang province, has filed for an initial public offering in the US to raise US$50 million.

The application for American depositary shares comes amid a slew of regulatory risks in China and the US, leading to a drought in Chinese issuers’ overseas fundraising. Only two IPOs have been completed in New York so far this year, which raised a combined US$49.5 million, compared with 28 that raised US$5.8 billion in the year earlier period, according to Refinitiv.

Still, Nano Labs is pushing ahead with a listing on Nasdaq, with a pitch to investors that it is evolving into a metaverse firm, providing computing power for gaming and entertainment, from a cryptocurrency-mining rig maker.

Advertisement

“I am earnestly confident that the metaverse will open a new era for humankind,” chief executive and chairman Kong Jianping said in the draft prospectus filed last Friday. “It is my intention that Nano Labs will be committed to developing the power of the metaverse and [be] among the key players to help the world explore it.”

The metaverse is a new frontier of the internet, which features an immersive, three dimensional online universe created by the convergence of physical, augmented and virtual reality.

Advertisement

Nano Labs co-founders Kong and Sun Qifeng are the two largest single shareholders currently, with stakes of 32.8 per cent and 22.3 per cent, respectively. Kong was previously the co-chairman, and Sun a director, at competitor Canaan, the first cryptocurrency-mining rig maker to list in the US in November 2019. They left Canaan in August 2020 following a power struggle involving Canaan CEO Zhang Nangeng, Chinese media reported at the time.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x