GogoX slumps in trading debut as Hong Kong’s first unicorn marks the return of IPO ceremonial gong since pandemic

- GogoX shares began trading at HK$21.60, compared with their IPO price of HK$21.50, before crashing 22 per cent at the close

- The logistics company raised about HK$671 million in gross proceeds, before an overallotment of 4.68 million shares

The logistics group fetched HK$21.60 in the first transaction, compared with its initial public offering (IPO) price of HK$21.50. The stock slid 22 per cent to HK$16.72 at the close of Friday trading, giving it a HK$10.4 billion (US$1.32 billion) market value.

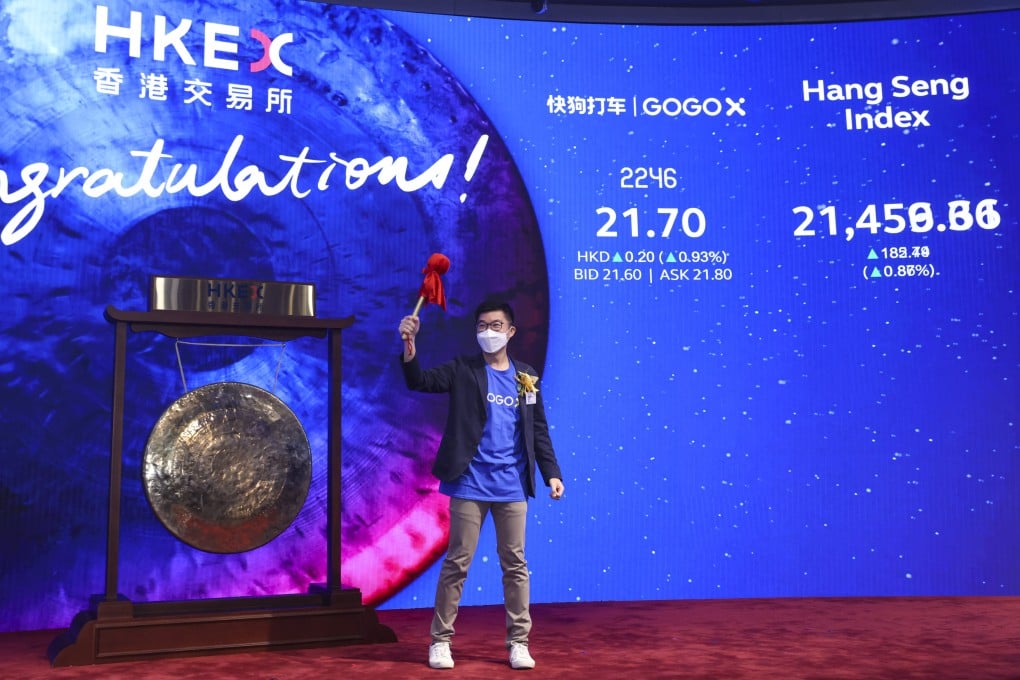

GogoX’s co-founder and co-chief executive Steven Lam struck the exchange’s ceremonial gong with a mallet wrapped in red cloth at 9.30am to mark the commencement of trading. The last time such a ceremony was held was in March 2020 to mark the listing of SG Group Holdings, when an attendee tested positive for Covid-19.

Hong Kong Exchanges and Clearing or HKEX as the bourse operator is known, moved all listing ceremonies online since then.

The two-year silence in Hong Kong’s listing hall matched the slump in the city’s IPO fundraising, which fell to ninth place in the first six months of 2022 according to Deloitte, after topping the world in seven times in the past 13 years.

Before GogoX, 24 companies had sold shares in the city, raising a combined HK$17.8 billion, 92 per cent less than a year ago.