Advertisement

China banking crisis: savers at risk as small lenders face ‘perfect storm’ of soured property loans, slowing economy

- A debt crisis in the property sector and an economy hobbled by a zero-Covid policy have left small lenders struggling

- Crisis has been compounded by recent mortgage boycott and protests over frozen accounts in Henan

Reading Time:6 minutes

Why you can trust SCMP

43

It’s been a tumultuous year for mainland China’s economy.

A debt crisis of seismic proportions has brought some of the country’s biggest property developers to their knees, while a spate of Covid-19 lockdowns spanning manufacturing hubs and commercial centres in the summer has hobbled output.

No one in the financial sector is feeling the pinch more than the small lenders, which account for about a quarter of the country’s total banking assets. This could spell trouble for millions of individual savers, analysts warned.

Advertisement

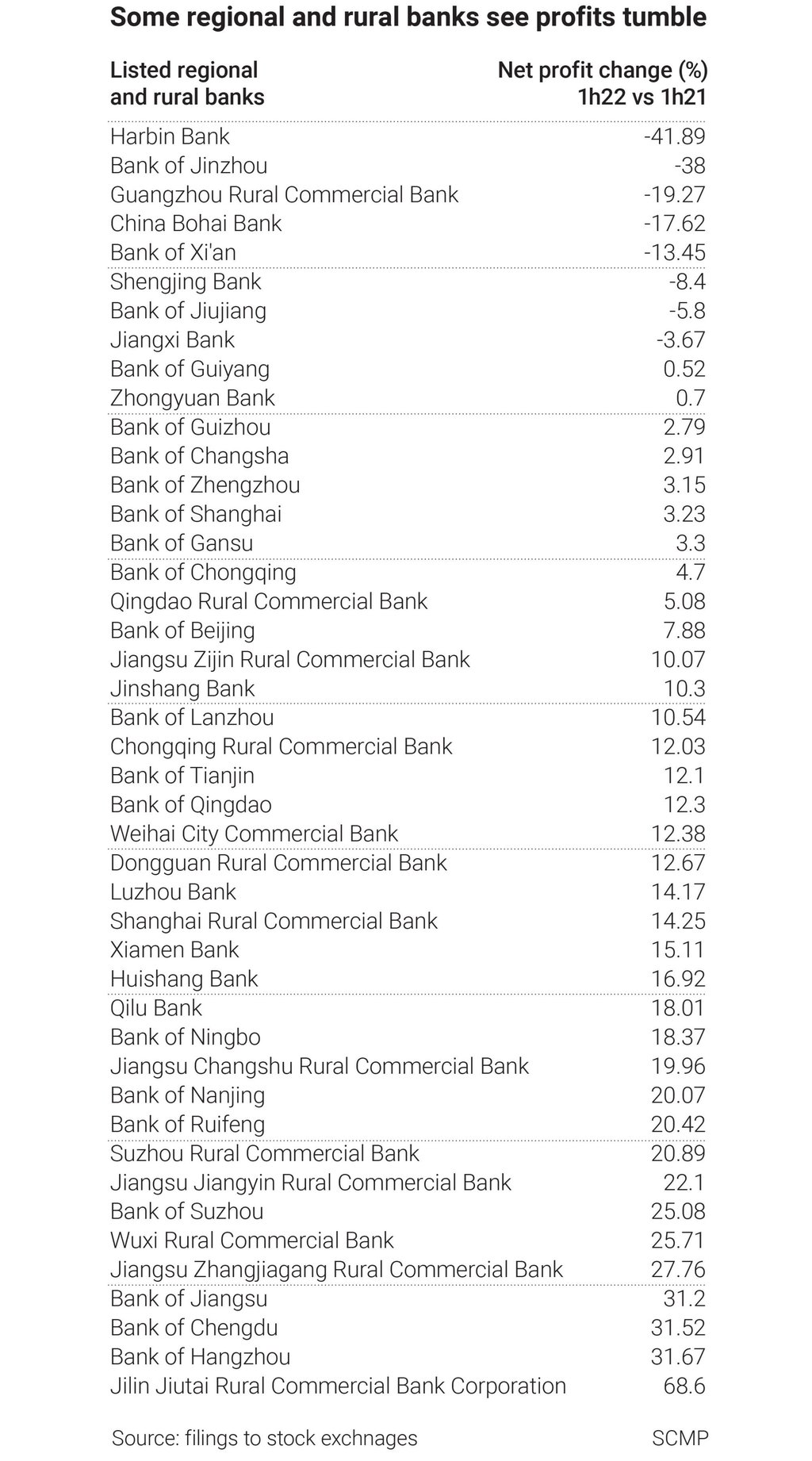

Some 20 per cent of the 45 regional and rural banks listed on stock exchanges suffered a plunge in profits in the first half of 2022, while some saw their non-performing loan ratios deteriorate. It was the poorest half-year performance in years.

The wounds of non-listed small lenders – 128 city commercial banks, 1,596 rural commercial banks and 1,651 village and township banks, to be precise – could be even deeper, a worrying prospect that prompted the banking regulator to promise speedy action.

Advertisement

Two rural banks, Liaoyang Rural Commercial Bank and Liaoning Taizihe Village Bank, in the northern province of Liaoning, entered bankruptcy proceedings, in a rare move announced by the China Banking and Insurance Regulatory Commission last Friday.

Advertisement

Select Voice

Select Speed

1.00x