Advertisement

China Aviation Lithium Battery wins Hong Kong bourse approval for US$2 billion IPO

- If successful, the No. 3 battery maker in China could become the second-largest IPO in Hong Kong this year

- Backed by state-owned aerospace giant Aviation Industry Corp of China, CALB plans to raise funds to ramp up production capacity

Reading Time:2 minutes

Why you can trust SCMP

3

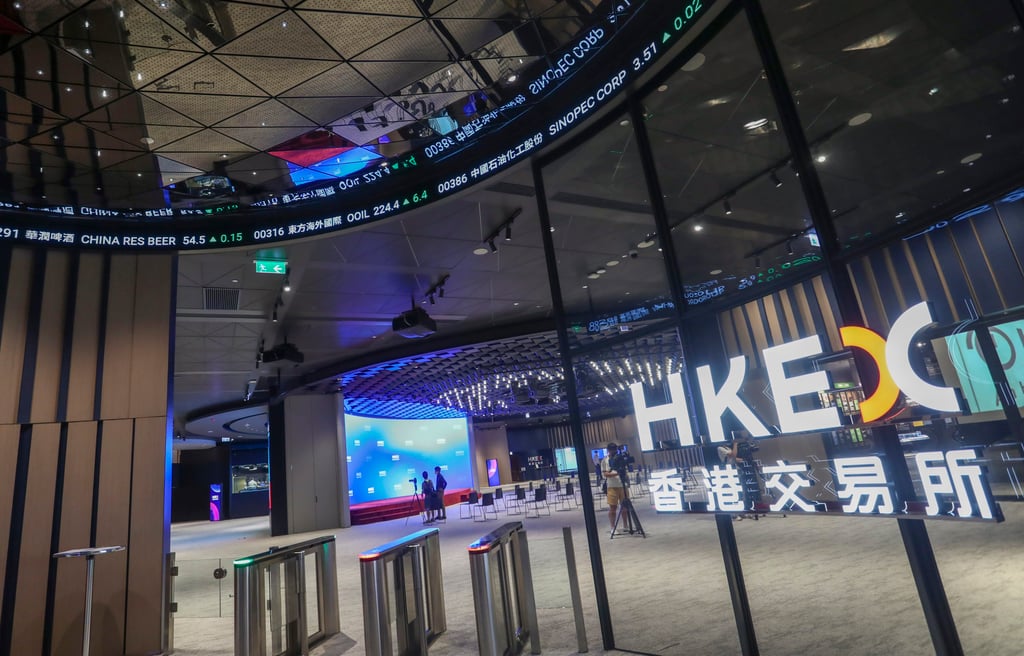

China Aviation Lithium Battery (CALB), the country’s third-largest electric vehicle (EV) battery maker, won approval from the Hong Kong stock exchange’s listing committee on Thursday for a share sale that could raise up to US$2 billion, sources close to the deal said.

CALB’s Hong Kong share sale would follow the initial public offering (IPO) by lithium ore miner and EV battery maker Tianqi Lithium, which raised US$1.7 billion in July. If successful, CALB could become the second-largest IPO in the city this year, after China Tourism Group Duty Free’s US$2.1 billion deal.

CALB declined to comment whether the application was approved.

Advertisement

Unlike Tianqi Lithium, which is also listed in Shanghai, Jiangsu-based CALB has never been listed elsewhere.

“Demand for EV batteries in China will continue to increase amid surging sales of battery-powered vehicles,” said Ivan Li, a fund manager at Loyal Wealth Management in Shanghai. “As the No. 3 player in the domestic EV battery industry, CALB needs fresh capital to propel growth and increase market share.”

Advertisement

The company was co-founded in 2015 by a unit controlled by Aviation Industry Corp of China (AVIC), the state-owned conglomerate that makes fighter jets for the military and owns about 10 per cent of CALB. Other shareholders include the local government of Jinta district in northeastern Jiangsu province.

Advertisement

Select Voice

Select Speed

1.00x