Advertisement

Singapore-based firm behind Uplive and Lamour to list on NYSE via SPAC merger with Magnum Opus

- The special-purpose acquisition deal for Asia Innovations Group, expected to close in the first quarter, values the merged entity at US$2.5 billion

- Magnum Opus in June ended an agreement to buy the American publisher of Forbes magazine

Reading Time:2 minutes

Why you can trust SCMP

1

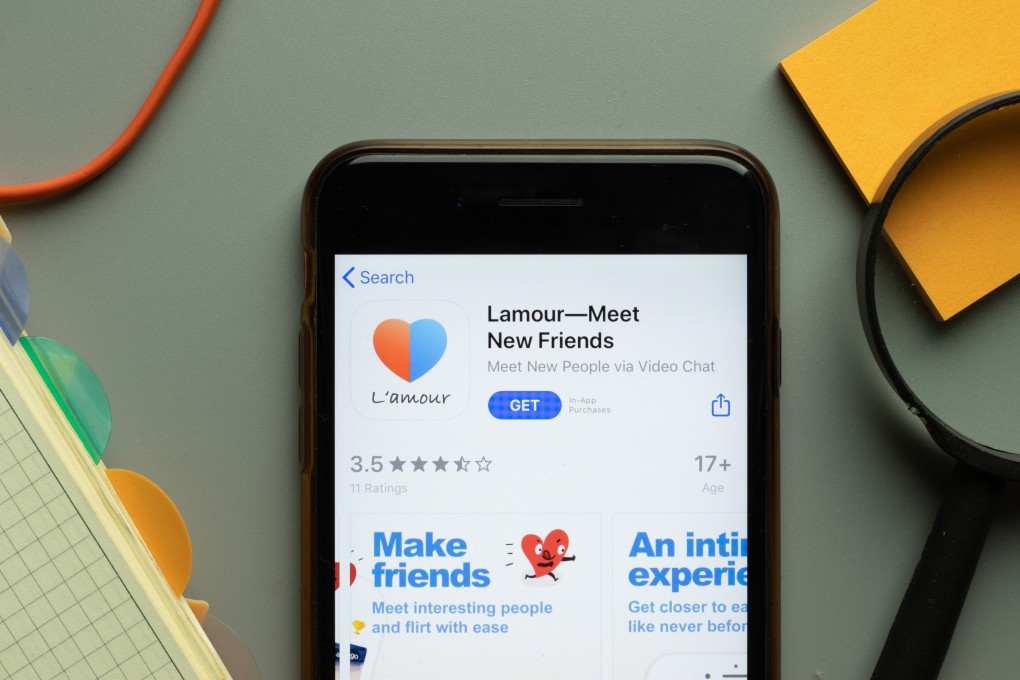

Asia Innovations Group (ASIG), the tech start-up behind live streaming service Uplive and dating app Lamour, is set to become a publicly listed company on the New York Stock Exchange through a merger with Magnum Opus Acquisition.

The special-purpose acquisition company (SPAC) deal is expected to close in the first quarter of 2023. The estimated value of the company once merged is US$2.5 billion. Existing shareholders of ASIG will own 84 per cent of the combined company.

“The proposed merger will combine the best of macro growth in emerging markets, and the benefits of being a publicly listed company in the US to transform ASIG into a global mobile powerhouse,” said Andy Tian, chief executive officer of ASIG.

Advertisement

Magnum Opus in June ended an agreement to buy the American publisher of Forbes magazine in a deal in a deal valued at US$630 million.

SPACs, also known as blank-cheque companies, are created to raise finances and buy assets within a limited period of time, usually 18 to 24 months. Both the SPAC market and the initial public offering (IPO) market have cooled off this year amid rising interest rates, geopolitical uncertainties and inflation.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x