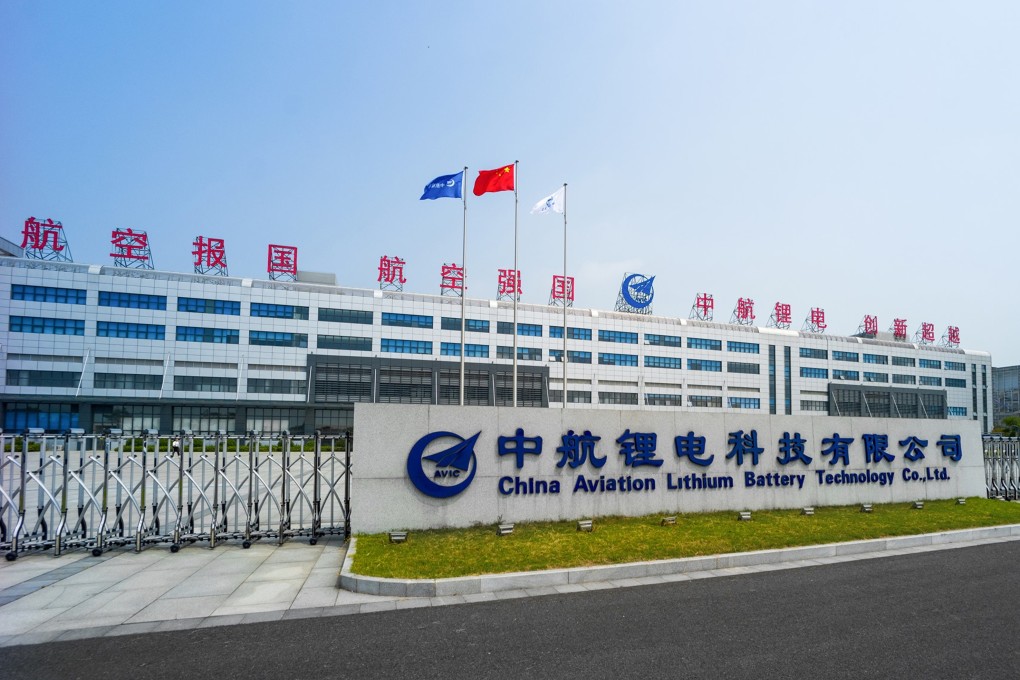

Chinese EV battery maker CALB raises US$1.26 billion in Hong Kong’s third-largest IPO this year as local investors shun 79 per cent of allocation

- China Aviation Lithium Battery (CALB), the country’s third-largest EV battery maker, priced the shares at the bottom of its marketed range

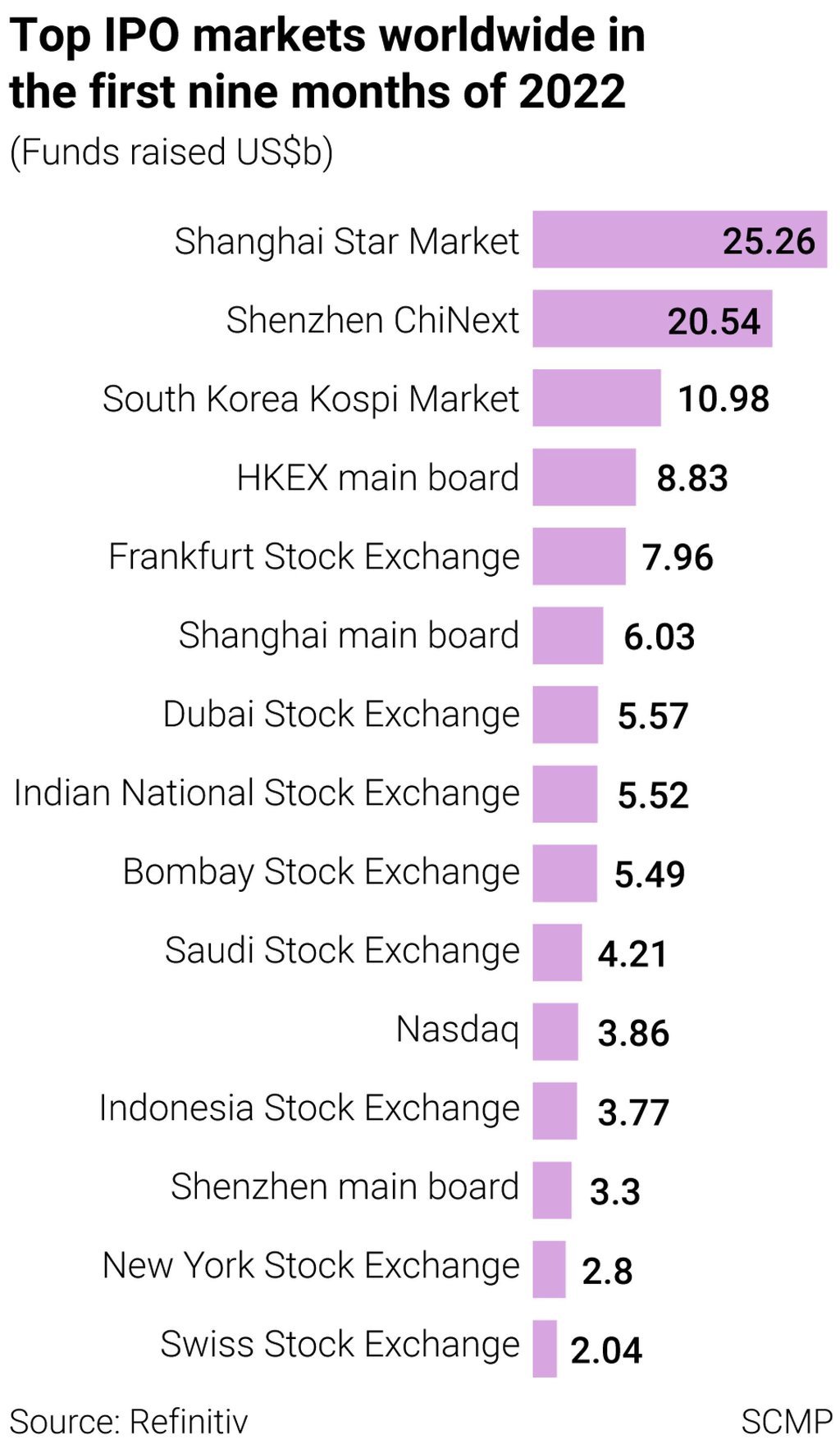

- The Hong Kong tranche, which was undersubscribed 0.21 times, has been offered to international investors, pulling its share down to 1 per cent of the overall offer

China Aviation Lithium Battery (CALB), the country’s third-largest electric vehicle (EV) battery maker, has raised HK$9.9 billion (US$1.26 billion) from its initial public offering, after pricing the shares at the bottom of the marketed range.

Trading in CALB will begin on Thursday.

The battery manufacturer reported year-on-year sales growth of more than 100 per cent for three consecutive years from 2019 to 2021 amid a boom in battery-powered car sales in China, the world’s largest automotive and EV market.

CALB, which received approval for its IPO on September 8, posted a net profit of 111.5 million yuan (US$15.6 million) in 2021, turning around from a loss of 18.3 million yuan the previous year.

The company was co-founded in 2015 by a unit controlled by Aviation Industry Corp of China, the state-owned conglomerate that makes fighter jets for the military and owns about 10 per cent of CALB.