Currency anxiety: Chinese, Hong Kong businesses sweat fallout from the diminished UK pound

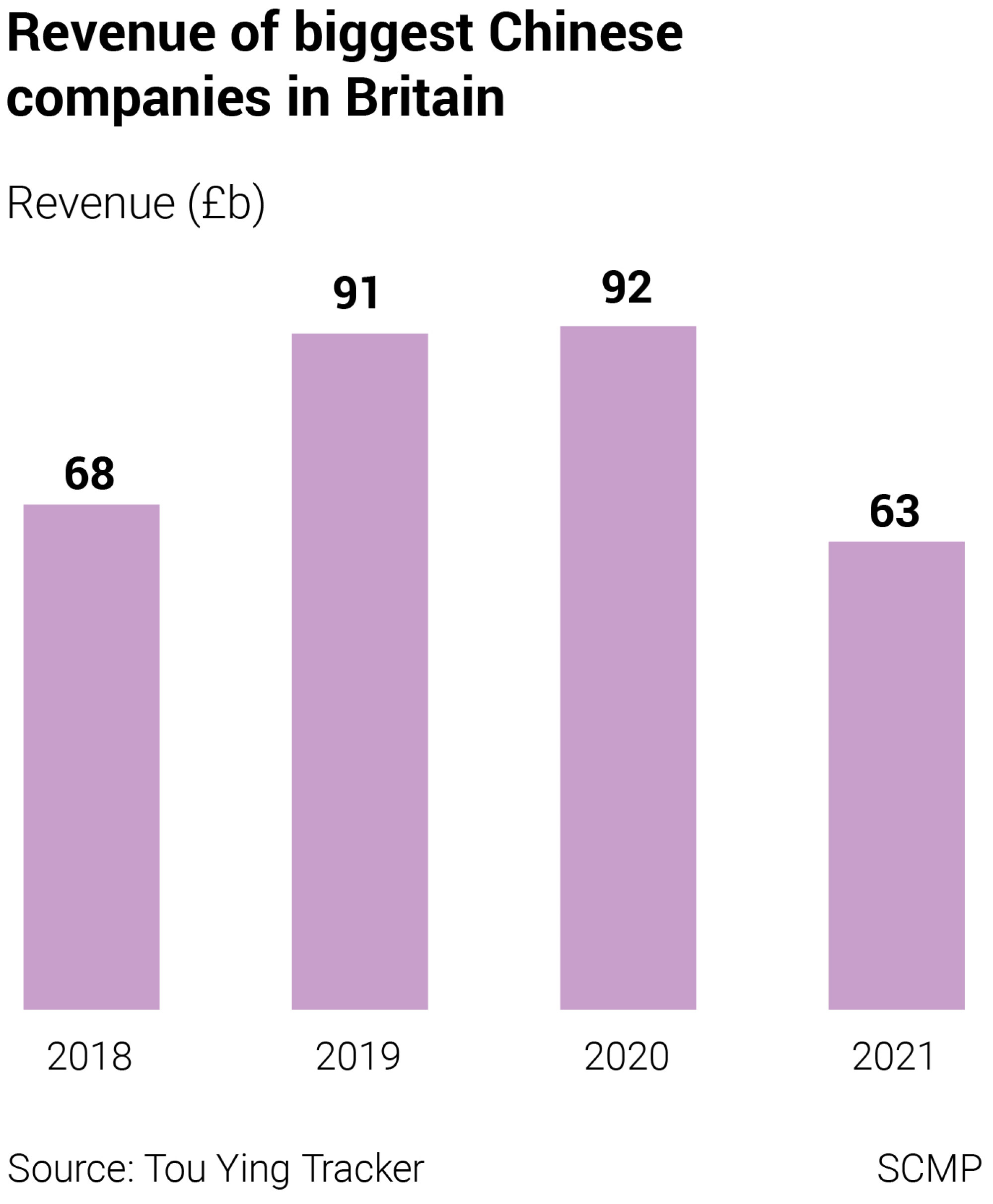

- Biggest Chinese, Hong Kong businesses in Britain generated more than £63 billion (US$71 billion) in revenue last year

- Wild swings in currency could lessen buying power, erase investment value and make financing more expensive as Bank of England eyes more rate increases

The pound’s wild swings – it fell to a 50-year low against the US dollar at one point in recent weeks before recovering somewhat this week– threaten more than £63 billion (US$71 billion) in revenue and tens of billions of dollars in investments for these companies, according to analysts.

Fluctuations in the pound could also endanger the value of at least £93 billion in foreign direct investment pumped into the British economy by Hong Kong and Chinese companies in recent years and more than £1.14 billion in properties bought this year.

Companies without currency hedges will have to work harder to pay off loans while making a smaller profit if the pound remains challenged, said Ian Zhu, managing director of the start-up consultancy Tou Ying Limited.

“The weaker pound will lead to reduced buying power of importing from China, which leads to higher inflation as well,” Zhu said. “It will not just impact Chinese companies in the UK, but also impact all British companies importing from overseas where the US dollar is the trading currency.”

Zhu previously served as an editor of the influential Tou Ying Tracker, which measures the role of the biggest Chinese-controlled firms in the British economy. The tracker is published annually by accounting firm Grant Thornton and the Chinese Chamber of Commerce in the UK.

Surging energy prices, driven by Russia’s invasion of Ukraine and the subsequent sanctions on Russia, sent inflation in Britain to its highest level in 40 years in July, igniting fears millions could be forced into poverty without government intervention. The Bank of England has warned that the nation’s economy could already be in a technical recession.

To tackle the crisis, Britain’s Chancellor of the Exchequer, Kwasi Kwarteng – who was sacked last night after just 38 days in office – announced a £60 billion package of support for households and businesses last month, along with a plan to cut taxes by £45 billion per year by financial year 2026-27 in hopes of spurring growth.

In one of several recent U-turns designed to restore market confidence, Truss’s government backtracked on eliminating a 45 per cent tax rate for the nation’s highest earners.

Then in a press conference last night, shortly after giving Kwarteng his marching orders, Truss bowed to mounting pressure from her own MPs and the markets by reversing her plan to cut corporation tax.

The pound had strengthened somewhat in recent days on hopes Truss and Kwarteng were considering ditching the tax cuts, but its oscillations have cast a shadow over the outlook for the British holdings of companies owned by Hong Kong tycoons and Chinese billionaires, including those founded by Li Ka-shing, Hong Kong’s richest man. Holdings by the CK Group of companies include the pub chain Greene King, the Three UK mobile network and drug and beauty chain Superdrug.

The pound’s decline means that the property investments of Hongkongers in the UK have declined by about a fifth this year, according to consultancy Colliers.

“For example, acquiring a £100 million office building in London would have cost HK$1.054 billion,” said Shaman Chellaram, senior director of valuation and advisory services for Asia at Colliers in Hong Kong. “Today that investment would be worth HK$850 million if sold at the same acquisition price and converted back to Hong Kong dollars.”

Those who need to exit their investments in the UK should be prepared to accept “a price reduction, especially as borrowing costs increase and yields start to push out”, Chellaram said. But those who have holding power are likely to wait out the current market conditions.

On the other hand, the weaker pound could make property investments in the UK more attractive as investors hunt for opportunity. The pound has weakened by more than a quarter (27 per cent) this year against the Hong Kong dollar – pegged to the US dollar since 1983 – which makes UK assets cheaper in Hong Kong dollar terms.

“There is ample capital looking for deals amid the downward pressure on pricing, although investors will be initially cautious,” Chellaram said. “We expect family offices to perhaps be more active during this time as they look to deploy capital opportunistically. Investors will be more cautious and selective on which assets to acquire, with the increasing cost of debt a major factor.”

In the longer term, UK property investment will continue to be attractive, according to Oliver Watt, director of cross-border investment at Savills.

“It is key to appreciate that the negativity around the broader performance of the UK, which has caused the pound to fall, doesn’t translate to property investment,” he said. “Investors can look back to how UK property bounced back after the uncertainty of the global financial crisis and Brexit vote and see opportunities long-term as a result.”

For now, economists are warning that more economic pain is likely.

“The [UK] economy is headed for a serious, perhaps sustained recessionary period,” said Clifford Bennett, chief economist at ACY Securities. “The hangover effect from the Covid stimulus remains in full force too. There is very little to see on the horizon that could in any way be viewed as supportive of either the economy or the currency.”

Credit rating agency Fitch Ratings is forecasting a 1 per cent contraction in the UK economy in 2023. It also cut Britain’s long-term foreign-currency issuer default rating to negative from stable on October 5, saying that the economic package “could lead to a significant increase in fiscal deficits over the medium term”.

Meanwhile, Moody’s Investors Service said “large unfunded tax cuts are credit negative”.

“A sustained confidence shock arising from market conditions over the credibility of the government’s fiscal strategy that resulted in structurally higher funding costs could more permanently weaken the UK’s debt affordability,” said Evan Wohlmann, a Moody’s senior credit officer, in a report.

Former Bank of England Governor Mark Carney also accused the government of “undercutting” key economic institutions in Britain.

“Unfortunately having a partial budget, in these circumstances – tough global economy, tough financial market position, working at cross purposes with the Bank [of England] – has led to quite dramatic moves in financial markets,” Carney said on Radio 4’s Today programme on September 29.

However, the role of Chinese firms in the British economy – and the potential effect of an unstable pound – is likely to be much higher.

The tracker only gives a snapshot of about 845 companies, with Grant Thornton estimating that about 30,000 companies in Britain are part of a China-owned corporate group or are majority held by a Chinese national company.

At the same time, Chinese and Hong Kong companies poured at least £93 billion in foreign direct investment into the UK economy between 2017 and 2020, according to the most recently available British government data.

For example, sovereign wealth fund China Investment Corporation has acquired stakes in Heathrow Airport Holdings, Neptune Energy, Thames Water and pan-European logistics company Logicor since 2012.

Those investments are already facing pressure, as shown by the decline in the domestically focused FTSE 250 Index, which lost more than 5 per cent of its value after Truss was confirmed as Britain’s new prime minister on September 5.

Why CK Asset’s buy-backs do not guarantee a smooth ride for the stock

European asset manager Amundi believes the British economy has already entered a recession, one that is likely to be mild.

“While the fiscal package will stimulate demand in a supply-constrained economy, it will likely put a floor on growth but at the same time support inflationary pressures coming from demand, leading to higher inflation likely for longer in the medium term,” Amundi Institute research strategists Sergio Bertoncini and Federico Cesarini said in a note.

Falling market values in Britain could represent a buying opportunity for Chinese and other overseas companies, particularly if the pound weakens again.

The coronavirus pandemic has made it difficult for Chinese investors to travel to Britain in recent years for deals, but there is hope quarantine requirements could be eased following the coming 20th party congress, Zhu said.

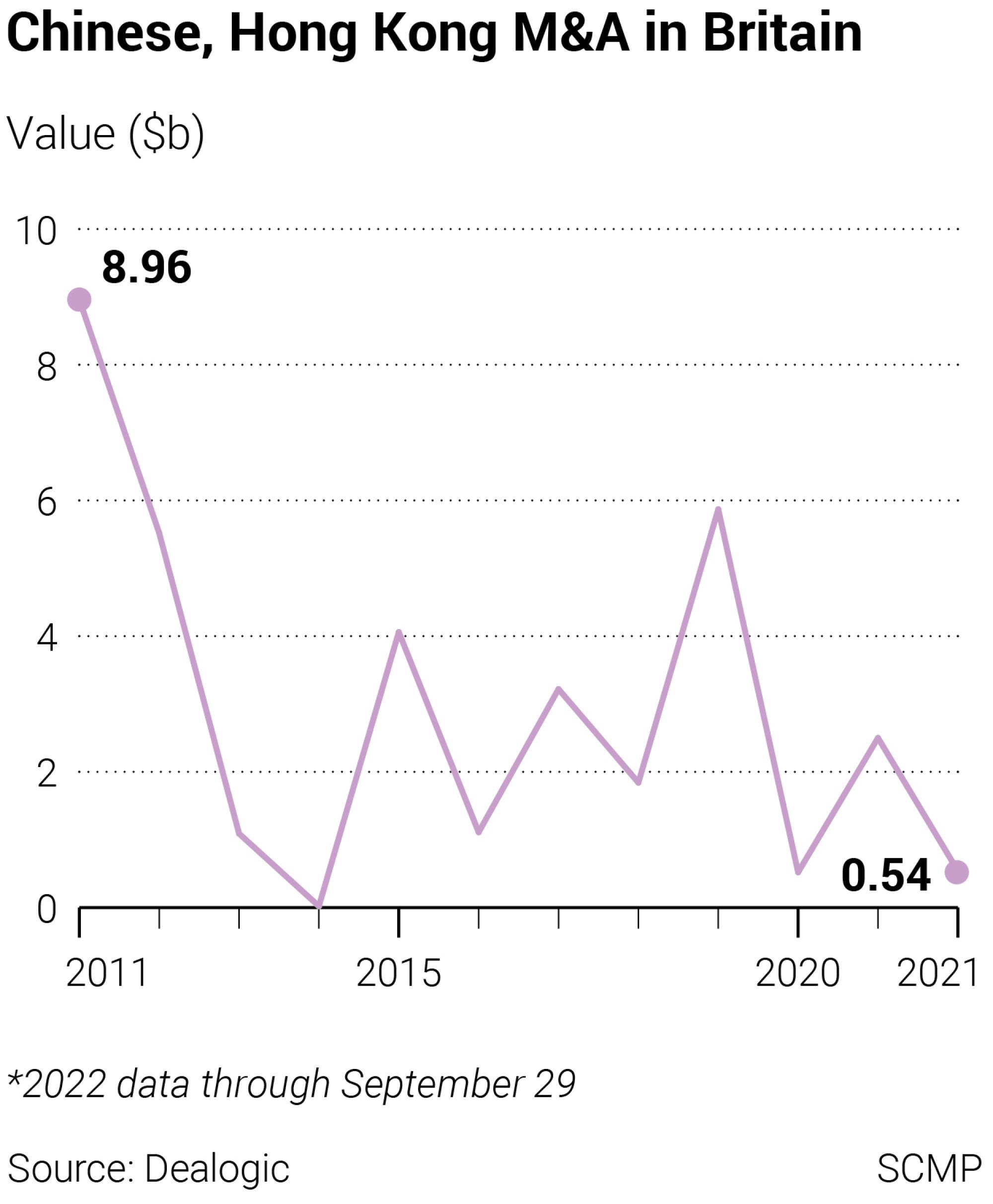

Deal making by Chinese and Hong Kong companies in Britain has fallen sharply since 2020, with a combined US$3.9 billion in transactions between January 2020 and September 29 of this year. That compared with US$6.2 billion worth of deals in 2019 alone.

Economic uncertainty could make investing in Britain less attractive despite declining share and bond values as a result of the pound’s decline, analysts said.

“A drastic rate rise, a widely rumoured move, would only make [Britain’s] fiscal balance worse,” said Ryan Lam, head of research at Shanghai Commercial Bank in Hong Kong. “The UK is set to let the currency take some of the strain. Just because something is on sale doesn’t mean that it’s valuable.”

The instability in the pound could present both opportunities and difficulties for some of the more than 140,000 Hongkongers holding British National (Overseas) passports and their families who have applied to emigrate to the UK since a new route to British citizenship was introduced in January 2021.

The currency’s weakness means any wealth they have converted from Hong Kong dollars to pounds will not go as far.

The Organisation for Economic Co-operation and Development has predicted that headline inflation in Britain will be about 10 per cent in late 2022, before gradually slowing next year. Growth is expected to be flat next year in Britain.

Additional reporting by Cheryl Arcibal