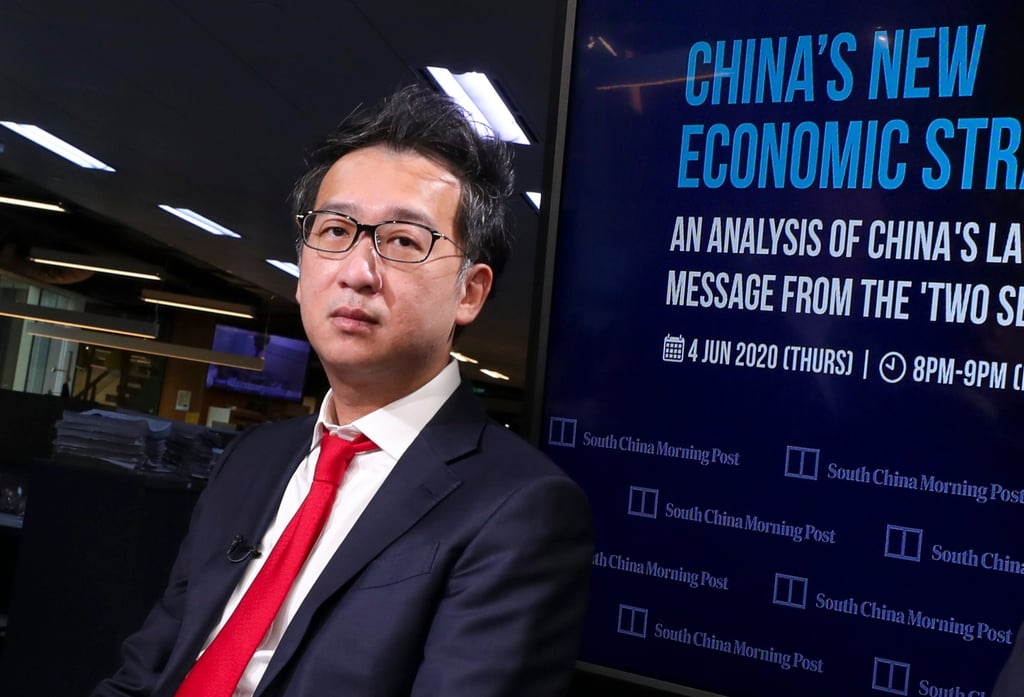

Hong Kong and China stocks have bottomed out, strategist whose tweet kick-started current rally in markets says

- Hong Kong’s benchmark Hang Seng Index will consolidate and then extend a rally in the next three to six months, says Grow Investment Group’s Hong Hao

- Index could reach levels of as high as 23,000 within the next 12 months from its current level

“At this stage, [the Hang Seng Index] will certainly consolidate, as China’s economic cycle has already reached a very low point and is very likely to enter a turning point,” Hong said. “After the consolidation … the rally will extend in the next three to six months.”

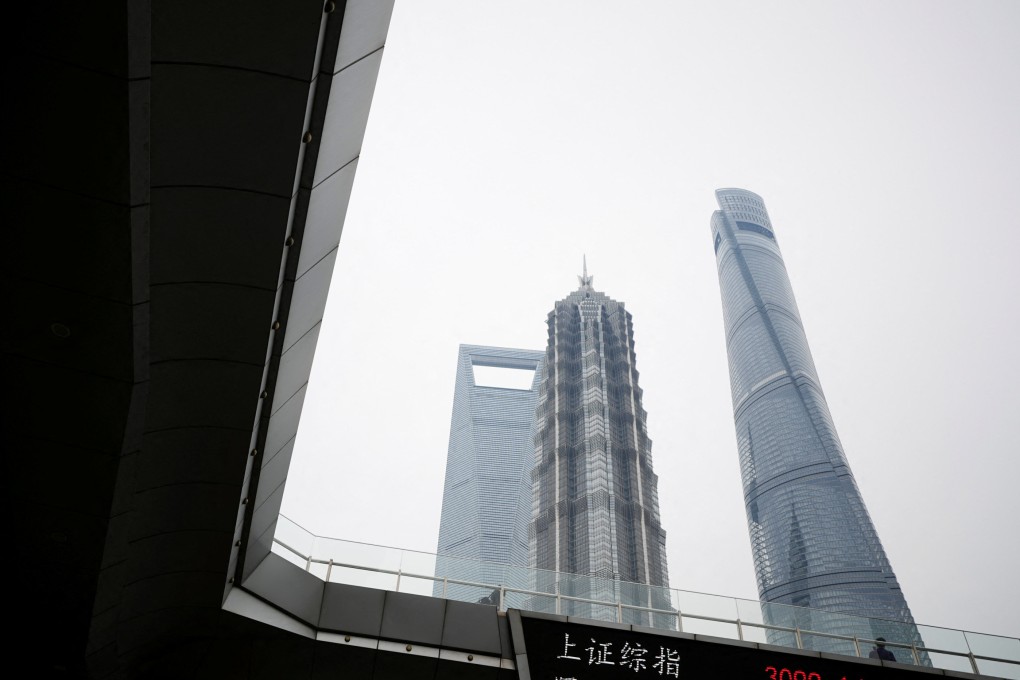

Hong’s forecast is significant because of his track record. He has accurately predicted trends in the Chinese stock market, including the stock bust of 2015. He also forecast in March that the Shanghai Composite Index will drop below 3,000 points, which occurred on April 25. He currently leads the research team and is in charge of overseas investments at Shanghai-based Grow Investment, which focuses on high-net-worth individuals in China and has assets worth about 10 billion (US$1.4 billion) yuan under management.

The HSI could reach levels of as high as 23,000 within the next 12 months, from its current “still oversold” level, representing a 30.3 per cent upside, Hong said. The benchmark fell 1.9 per cent to 17,655.91 on Monday for its fourth consecutive day of loses. The gauge has, however, rebounded 20.2 per cent this month.