Zero-Covid: reopening playbook turns Chinese stocks into one-way bet for investment banks, value trap for others

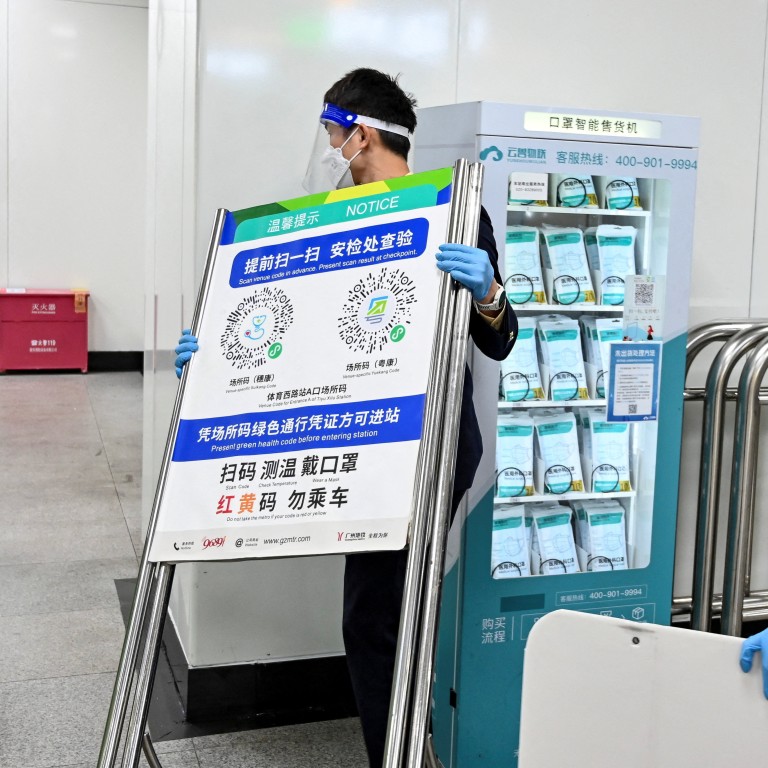

- China unveiled 10 new measures on December 7 to further ease Covid-19 rules, underpinning hopes for an imminent end to its zero-Covid policy

- Morgan Stanley, Bank of America and Goldman Sachs have turned increasingly bullish on Chinese equities in recent weeks

As calls for an end to the zero-Covid policy grow louder, China has stepped up this week and last by delivering the good news, slowly dismantling some of the draconian pandemic-control regime it has had in place since the Wuhan outbreak.

“The economic recovery will be in focus now,” said Wang Chen, a partner at Xufunds Investment Management in Shanghai. “There are concerns the recovery will be slow and bumpy rather than quick and swift, and whether the new Covid measures will spur consumption and production.”

Here are some of the opinions on China’s stock and economic outlook shared by brokers and money managers in recent weeks.

BlackRock

“China’s recent [Communist Party] Congress was a pivotal event, and the country looks set to deemphasise economic growth as it pursues self-sufficiency in energy, food and technology,” strategists including Wei Li wrote in its 2023 global outlook playbook on December 5.

“We are neutral [on Chinese equities]. Activity is restarting, but we see China on the path to lower growth. Tighter state control of the economy makes Chinese assets riskier. We see slower growth compounded by the effects of an ageing population over time.”

In an earlier report in October, BlackRock said the big focus on Covid-related ups and downs in activity ignores another underlying issue: fading demand for Chinese goods from overseas buyers that could shave economic growth in 2022 and 2023.

JPMorgan Chase

Loosening of Covid-19 curbs is the most watched area, as it would lead to cyclical upturn and help weather the impacts from slowing growth, chief Asia equity strategist Wendy Liu said at a briefing on December 7.

China’s consumption sector in 2023, particularly internet companies, is a likely winner under the reopening theme. New infrastructure for utilities, digitalisation and healthcare will continue to be the focus next year. There is also potential upside for old infrastructure such as the underground pipeline system and large-scale transport system.

MSCI China, Hang Seng Index and Hang Seng Tech Index could outperform onshore indices, given their higher internet and consumption mix and implied equity risk premium. JPMorgan expects the Hong Kong-mainland border to reopen in late 2023.

Fidelity International

While it is still early days, China’s easing of Covid-policy measures, supportive central bank policy and the shift in its policy focus towards economic growth will give a favourable backdrop for people to invest.

“Reopening and China’s economic transition is a tailwind not just for China, but also for the broader Asia economy,” money manager Belinda Liao said at a briefing in Hong Kong on December 7.

Self-sufficiency and import substitution are expected to be significant themes over the next five years, she added. Domestic brands, high-end manufacturing and consumer services could benefit from accelerating supply-chain localisation in China.

UBS Securities

Assuming China’s Covid-19 restrictions are eased after the National People’s Congress next March, we expect earnings growth for CSI 300 to accelerate from 4 per cent in 2022 to 15 per cent in 2023, strategist Meng Lei said in a December 5 report.

“We think CSI 300’s current trailing price-earnings of 11.3 times is unjustified given the still-positive earnings growth as well as rising onshore excess liquidity and credit impulse. The elevated equity risk premium should also subside with more policy support for the private sector.

“We think easing Covid policies would be the most important catalyst. Stronger macro-policy easing and more regulatory-policy clarity may also lift sentiment.”

DWS

“Once zero-Covid policy restrictions are significantly rolled back in China, Chinese equities should get a significant boost,” Sean Taylor, chief investment officer for Asia-Pacific, said in a report dated November 28.

There are still some medium-term risk factors in China, such as further development of China’s common prosperity policies, the real estate sector and geopolitical risks. Also, the global export weakness needs to be overcome and the Chinese economy needs to regain momentum before DWS turns overweight on emerging markets, he added.

Additional reporting by Zhang Shidong