Advertisement

Climate change: is a global ‘carbon currency’ worth trillions of dollars the key to averting global disaster?

- It would encourage investors and businesses to fund projects that fight climate change, according to a policy advocate

- Current policy making, hampered by shifting domestic politics and international relations, is too slow, says Delton Chen, director of Global Carbon Reward

Reading Time:3 minutes

Why you can trust SCMP

Global governments should issue a reward-based “carbon currency” worth trillions of US dollars annually to encourage investors and businesses to fund projects that fight climate change, according to a policy advocate.

The proposed currency – to be issued by a newly created “carbon exchange authority” in each participating jurisdiction – would provide the “carrot” that can co-exist with “sticks” such as carbon taxes and emissions cap-and-trade mechanisms already introduced.

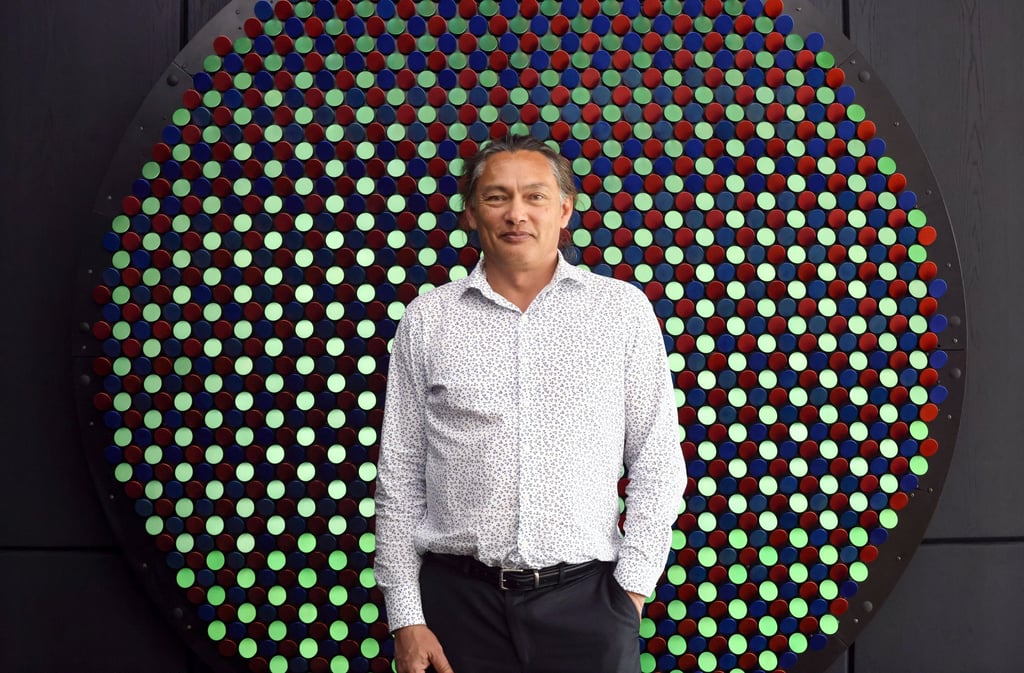

It would help accelerate climate action and increase the chances of containing global warming at below two degrees Celsius to avert the worst impact of climate change, said Delton Chen, founder and project director of Global Carbon Reward, a climate policy advocacy.

Advertisement

Current policy making, hampered by shifting domestic politics and international relations – as seen in last month’s COP27 global climate talks – is too slow, he said.

“The inspiration I had was simply an intuition that a currency instrument could provide climate finance at speed and scale,” the Australian hydrogeologist and climate solutions researcher said in an interview in Hong Kong, where he held seminars attended by government officials, corporate finance leaders and policy researchers.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x