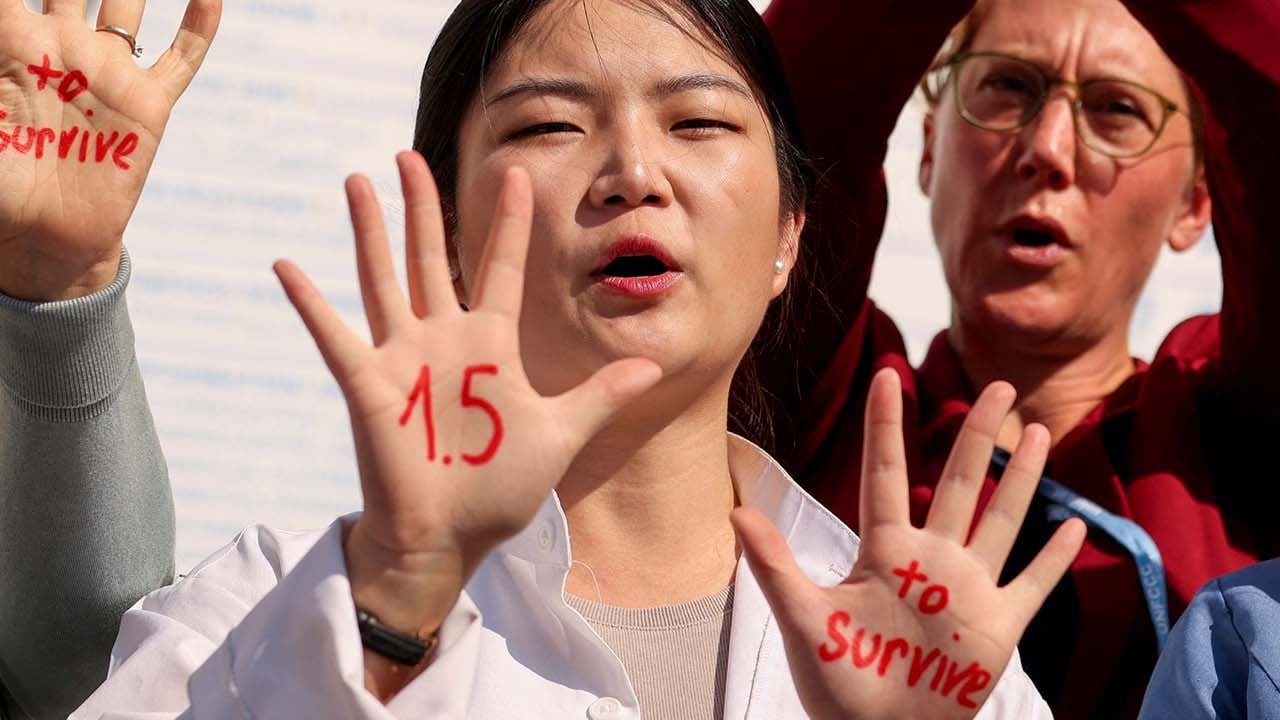

Climate change: is a global ‘carbon currency’ worth trillions of dollars the key to averting global disaster?

- It would encourage investors and businesses to fund projects that fight climate change, according to a policy advocate

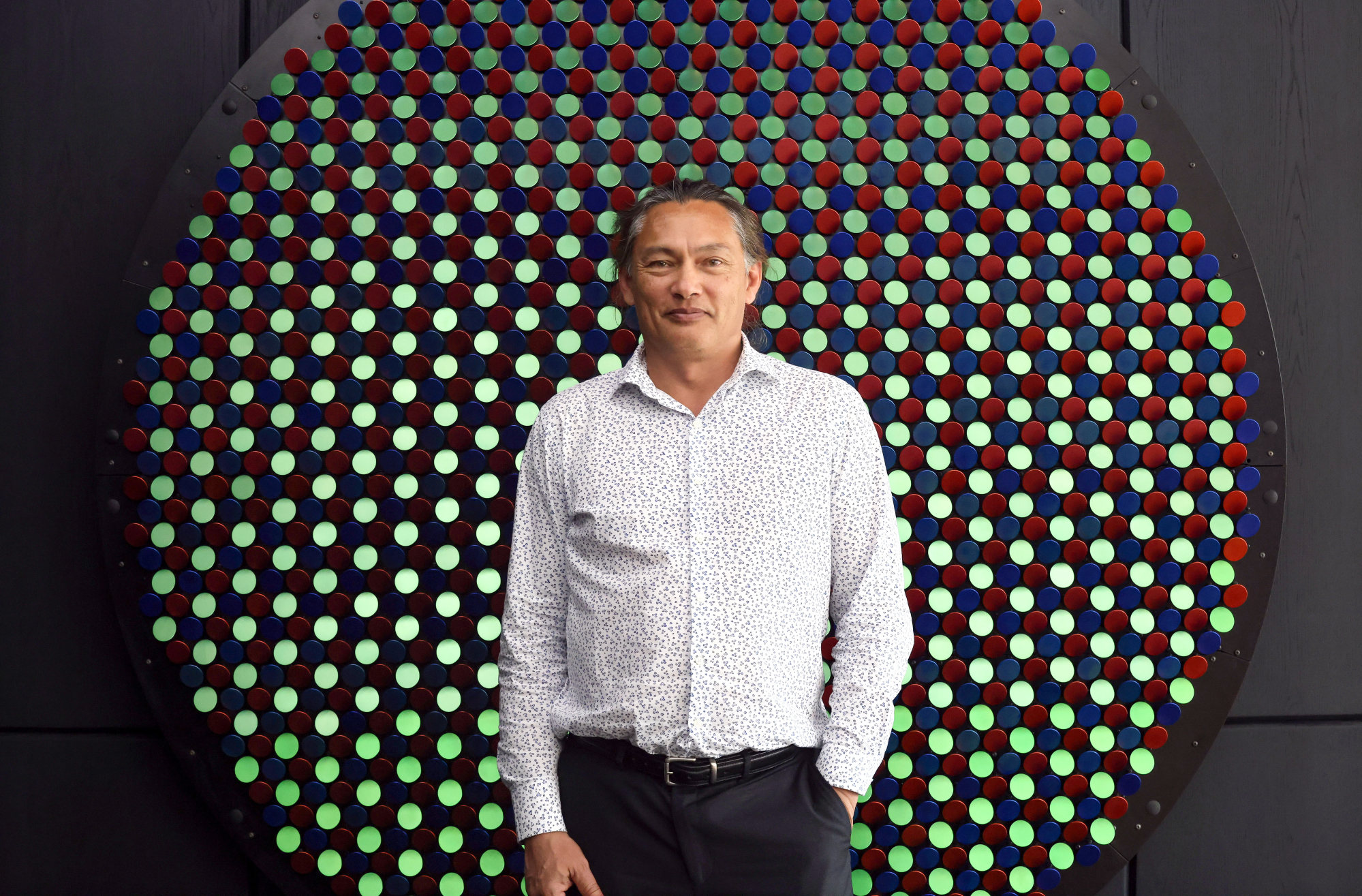

- Current policy making, hampered by shifting domestic politics and international relations, is too slow, says Delton Chen, director of Global Carbon Reward

The proposed currency – to be issued by a newly created “carbon exchange authority” in each participating jurisdiction – would provide the “carrot” that can co-exist with “sticks” such as carbon taxes and emissions cap-and-trade mechanisms already introduced.

Current policy making, hampered by shifting domestic politics and international relations – as seen in last month’s COP27 global climate talks – is too slow, he said.

He plans to publish a working paper on his proposals early next year. His carbon currency idea was portrayed in Kim Stanley Robinson’s climate novel The Ministry for the Future, published in 2020.

Chen has called for an international agreement under which central banks guarantee to buy the carbon currency at set “floor prices”, similar to the way the Hong Kong dollar is linked to the US dollar under the city’s currency board system, except there would be no upper limit on its price.

The price floor would rise steadily until the middle of the century, when global net zero emission goals are supposed to be reached to satisfy the Paris Agreement of 2015.

“The beauty of this approach is that ... the currency can convert the cost of climate mitigation into an investment,” Chen said.

Under pressure on climate policies, HSBC to stop funding new oil, gas projects

Project developers would be able to swap the carbon currency for participating countries’ hard currencies at low transaction costs, when they need to pay for equipment and staff costs.

Several trillion US dollars worth of the currency could be issued annually, Chen said.

To reach net zero emissions by 2050, annual clean energy investment worldwide will need to more than triple by 2030 to around US$4 trillion, according to the International Energy Agency.

Economists said central banks have already been taking measures in their monetary policies to encourage climate action, and getting governments to commit to another climate finance regime would be no mean feat.

Lithium, copper miners under pressure to improve ESG performance, ISS says

“There are already other ways to create rewards, such as giving preference to green collateral as well as green corporate bonds in the European Central Bank’s quantitative easing policies,” said Alicia Garcia-Herrero, chief economist for Asia-Pacific at French bank Natixis.

“The ECB, as regulator, is also pushing banks to have green solvency ratios and there are many more things they can do that look safer.”

China’s central bank has also conducted “targeted” easing measures to help certain climate-friendly activities, said Dong Jinyue, senior China economist at BBVA Research.

“Carbon currency can only be implemented – if legally not problematic – during the easing monetary cycle but not in the tightening cycle, like what we are experiencing currently,” she said.

“Established monetary discipline might [also] be broken if the central bank could easily print money to fund environmental-friendly projects.”