Hong Kong pushes Seoul aside to cling to third place in Refinitiv’s 2022 list of the world’s biggest IPO markets, behind Shanghai and Shenzhen

- A strong second half lifted the city from 10th place in June, according to Refinitiv data

- The city fared better than its two traditional rivals in the United States, as Nasdaq and the NYSE both dropped out of the top 10

The city’s stock market edged past Seoul to claim third place, but lagged behind Shanghai’s Star Market and the ChiNext market in southern China’s technology hub of Shenzhen, according to Refinitiv.

Hong Kong’s standing was helped by the five companies that rushed to list on the final trading day of 2022, which raised HK$394 million (US$50.51 million) between them. Companies raised a combined US$12.69 billion this year in Hong Kong through 75 IPOs, according to Refinitiv’s data.

Hong Kong was the third biggest IPO market in 2021.

That is 70.5 per cent less than the US$42.96 billion raised in 2021, and is the lowest annual figure since 2012, the Refinitiv data showed.

The Shanghai-based Star Market ranked top with 118 companies raising US$29.63 billion in 2022, while the Shenzhen-based ChiNext in second place saw 144 companies raising a total of US$24.71 billion.

Hong Kong did fare better than its two traditional rivals in the United States. Nasdaq and the New York Stock Exchange (NYSE) are both out of the top 10 after a 95 per cent year-on-year decline in funds raised, the data shows.

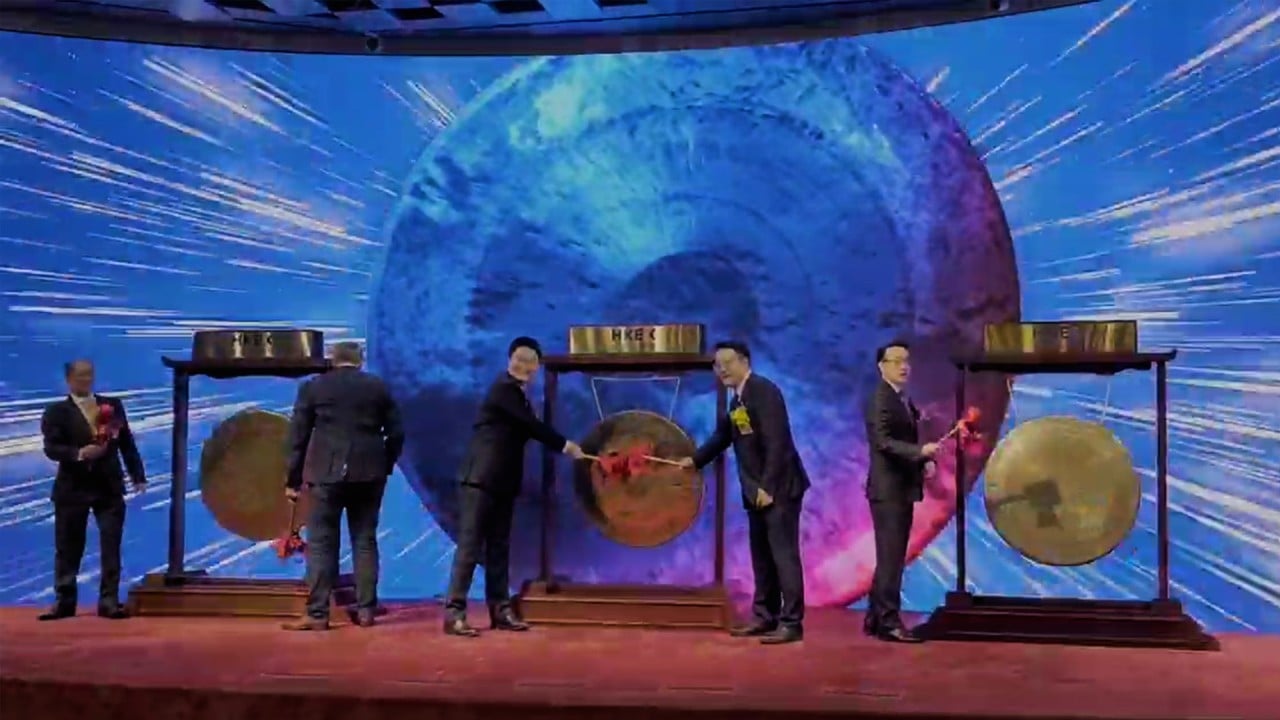

HKEX ends 2022 with its busiest listing day in 30 months as IPOs return

Nasdaq, the top IPO market in 2021, ranked 11th with 88 companies raising US$5.29 billion, while NYSE dropped to 15th with only four new listings raising U$2.798 billion.

Singapore, which pipped Hong Kong for third place in the Z/Yen Global Financial Centre Index, did not host a single IPO on its main board in 2022. Catalist, established by the Singapore Exchange for fast-growing companies, hosted eight IPOs for a total of US$38.2 million, ranking 66 out of the 118 global markets tracked by Refinitiv.

South Korea’s Kospi market ranked fourth with US$11.21 billion raised. LG Energy Solution raised US$10.75 billion in January, the biggest listing globally this year.

Germany’s stock market ranked sixth, following Porsche’s Frankfurt listing in September which raised US$8.84 billion in the second-largest IPO worldwide in 2022.

During a dry spell in the first half of 2022 the number of new IPOs in the city dropped by more than 90 per cent year on year. New listings, however, resumed in the third and fourth quarters after market sentiment improved.

In the three months to December, 28 IPOs raised a total of US$3.78 billion, after 24 IPOs raised a total of US$6.47 billion in the third quarter, the Refinitiv data showed. That was almost five times as much as the US$2.37 billion raised during the first six-month period.

Deloitte expects Hong Kong to see 110 new listings raising about HK$230 billion.

“We are optimistic about the IPO markets in Hong Kong in 2023,” said Edward Au, southern region managing partner of Deloitte China. “This is backed by various positive factors and developments including a slowdown in US interest rate hikes and reopening of the Hong Kong and mainland boundary.”

He also predicted more mainland Chinese companies listed in the US will opt for a secondary listing in Hong Kong.

“As valuations pick up eventually, more spin-off listings are anticipated,” said Au.

“We expect Hong Kong to have a slow start, given it will take time for these new positive developments to develop,” he said.

“We believe the overall performance of the Hong Kong market will be positive in 2023 and Hong Kong will continue to be featured as a ‘super-connector’ supporting the Chinese mainland’s connectivity with the rest of the world and vice versa.”

China reopening fails to save mutual funds as stock losses unnerved investors

Robert Lee, a lawmaker representing the financial sector in the city, also expects the amount of funds raised via Hong Kong IPOs to increase next year as market sentiment improves and borders reopen.

China has said it will reopen its border on January 8, while Hong Kong’s government has now dropped almost all its Covid-19 restrictions.

“We believe Hong Kong IPOs are likely to kick off with a slow start in 2023 with many global economies facing recession,” said Victoria Lloyd, partner in Baker McKenzie’s capital markets practices in Hong Kong. “Hong Kong securities market is likely to pick up pace in the latter half of next year.”

.jpg?itok=zSWXqQCw)