Hong Kong’s world-beating stock market is in ‘tortuous’ recovery mode as pullback clouds China bets, hedge fund strategist says

- The rally in the Hang Seng Index over the past three months reflects a trend reversal heralding an eventual economic recovery, hedge fund strategist Hong Hao says

- The benchmark slipped further on Monday, following last week’s 4.5 per cent loss that ended its six-week winning run

The Hang Seng Index retreated 4.5 per cent last week, the most in three months. Funds from mainland China took their money off the table, while investors also withdrew from the Tracker Fund, the biggest fund tracking the benchmark index. The market struggled even as fresh data showed Chinese manufacturing expanded for the first time in four months.

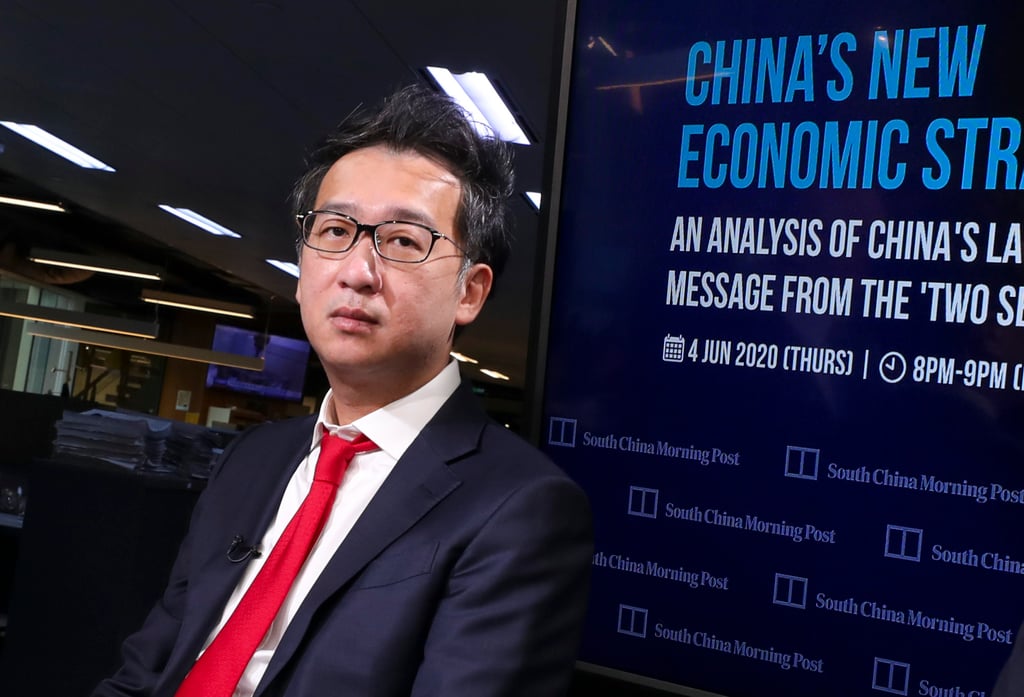

“A call here will have to determine whether the rally is just another dead-cat bear market rebound, or a genuine trend reversal heralding an eventual economic recovery,” said Hong Hao, a partner and chief strategist at Chinese hedge fund Grow Investment. “We are in the recovery camp, but believe that the journey will be tortuous.”

Hong based his optimism on the 850-cycle line, a technical indicator that has accurately predicted global boom-bust cycles in the past 60 years, except during the 1970s stagflation, the 2008 global financial crisis and during the coronavirus pandemic in 2022.

The Hang Seng Index surged more than 10 per cent in January, its best start to a year since 2012, before its setback last week. That ranked as the best performance among major global stock indices, according to Bloomberg data.

Still, the market is facing a critical juncture at this point. Despite a recovery in sentiment, mainland funds have turned net sellers of Hong Kong stocks. Investors also withdrew their money from the Tracker Fund, the city’s largest investment vehicle tracking the Hang Seng Index.