Ziroom may raise US$1 billion in Hong Kong as the SoftBank-backed home rental platform mulls IPO

- The SoftBank Group-backed startup is working with Citic Securities, Goldman Sachs Group and Morgan Stanley on the listing preparations, sources say

- The company could file a preliminary prospectus with the Hong Kong stock exchange as soon as April

Chinese home rental platform Ziroom is considering a Hong Kong initial public offering that could raise about US$1 billion as soon as this year, according to people familiar with the matter.

The SoftBank Group-backed startup is working with Citic Securities, Goldman Sachs Group and Morgan Stanley on the listing preparations, the people said. The company could file a preliminary prospectus with the Hong Kong stock exchange as soon as April, said the people, who asked not to be identified as the information is private.

At US$1 billion, Ziroom’s IPO could be Hong Kong’s largest since EV battery maker CALB’s US$1.3 billion listing in October, according to data compiled by Bloomberg. Bankers and analysts are expecting a recovery in first-time share sales in the city now that China has reopened its borders, capping the worst year for IPOs since the financial crisis.

Deliberations are at an early stage and details of the IPO including size and timeline could still change, the people said. Representatives for Citic, Goldman Sachs and Ziroom declined to comment, while a representative for Morgan Stanley didn’t immediately respond to requests for comment.

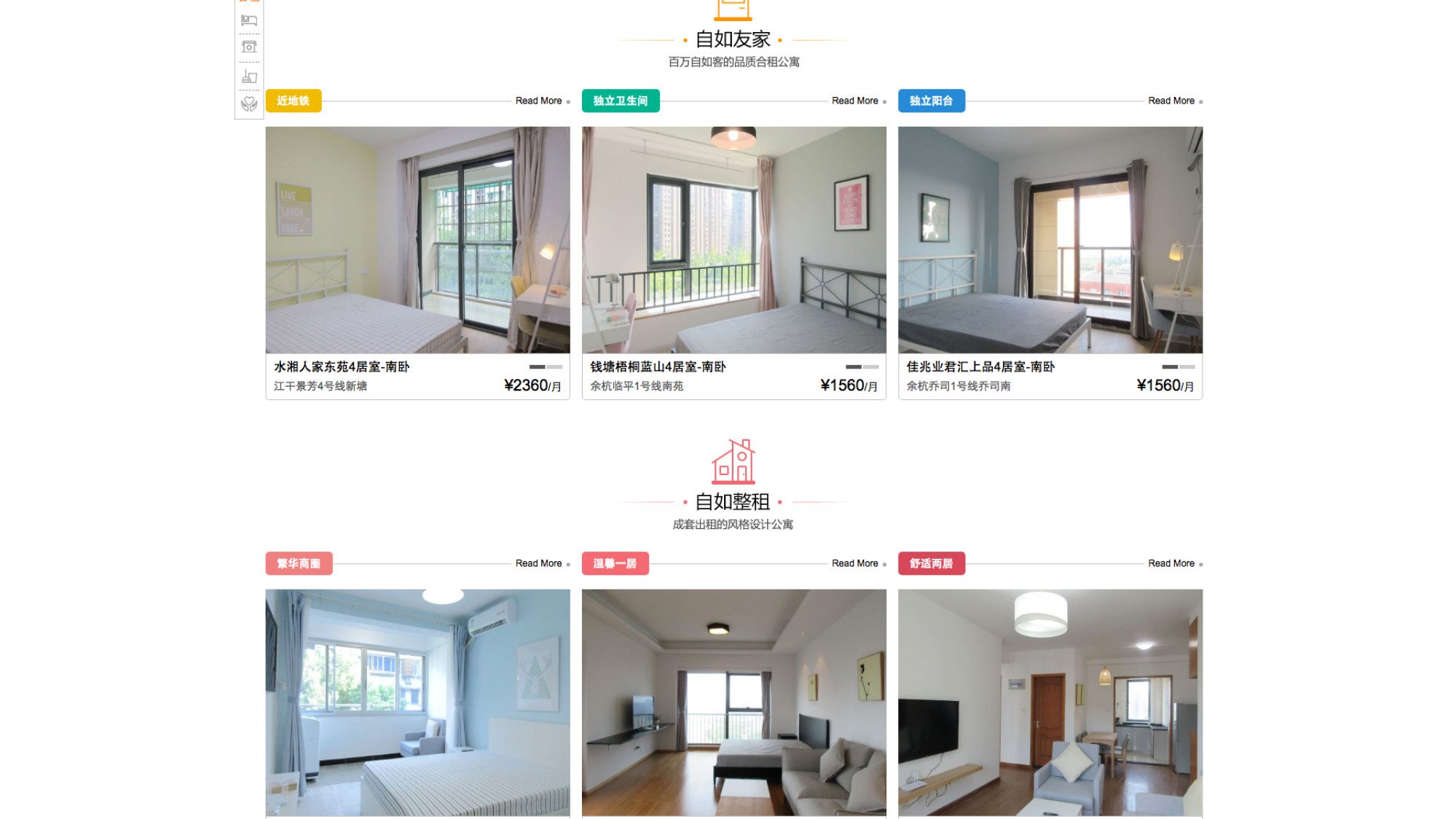

Ziroom was founded in 2011 by late Zuo Hui, who also established US-listed Chinese online property platform KE Holdings. Ziroom, whose Chinese name “zi ru” means carefree, signs up homeowners who want to rent their properties out, refurbishes the homes according to standardized templates and sub-leases them to tenants. It also offers services such as cleaning and maintenance for the tenants. SoftBank Vision Fund invested in the startup in 2019.