Exclusive | Thailand’s Chearavanont clan considers a Hong Kong family office, answering city’s ‘Wealth for Good’ call to set up Asia hub to manage fortunes

- The CP Group’s senior chairman Dhanin Chearavanont and his eldest son Soopakij will join a Friday gala dinner at the Palace Museum after the Wealth for Good summit

- A family office in Hong Kong is a good opportunity to consolidate the sprawling investments by one of Asia’s wealthiest clans, said a family member

The Chearavanonts, whose members have dominated Thailand’s billionaires list for decades, plan to set up an outfit in Hong Kong to invest the clan’s fortunes, becoming one of the biggest names in the rarefied world of family offices to heed the city’s ambition of becoming Asia’s wealth management hub.

The two executives will be in Hong Kong to see for themselves and “get a better picture” of Hong Kong’s prospects as a hub for the ultrawealthy to invest and do good, said CT Bright’s vice-president Alex Jiaravanont, a nephew of Dhanin and cousin of Soopakij.

“We see Hong Kong as a good intersection of many things” said Jiaravanont, who also goes by the Thai name Ekachai. “It is part of China, the second-largest economy in the world, with links to the rest of the world, along with low taxes and a vivid lifestyle”.

“We believe the wide range of new policies will help attract the world’s biggest family offices to come to Hong Kong to manage their wealth, conduct their charity programmes and collect artworks to pass on to the next generation,” said Secretary for Financial Services and the Treasury Christopher Hui.

The summit will discuss various initiatives for family offices, divided into philanthropy, the arts, technology and a Wealth for Green session focusing on the environment, sustainability and governance (ESG), according to its programme.

Richard Li, chairman of the PCCW Group and the younger son of Hong Kong’s wealthiest man Li Ka-shing, is scheduled to speak in a panel on technology with Yahoo!’s co-founder Jerry Yang and Sequoia China’s founding managing partner Neil Shen.

The two top CP Group executives - Dhanin and Soopakij - will skip the discussions at the summit on Friday due to their packed schedule, and will leave Hong Kong via private jet after the gala dinner, said Jiaravanont, whose family name is an alternative spelling of the clan name. But representatives of the group will attend the summit.

The Chearavanont clan, whose wealth was estimated at US$33.7 billion in 2017 by Forbes, does not operate a family office yet in Hong Kong, even though it has been among the biggest and earliest investors in China. The CP Group, whose businesses on the mainland span poultry, feedstock and retailing, was one of the country’s first foreign investors, getting Shenzhen’s business licence number 0001 when China picked the city as the test bed for its market reforms and forays into capitalism.

Different units in the CP Group invest from their offices in Hong Kong, said Jiaravanont, an architect by training, who reports to his cousin Soopakij at CT Bright, an investment arm of the CP Group.

During his four-day trip with a delegation of 20 business executives, Lee met the Thai prime minister as well as many of Thailand’s largest businesses, including the CP Group.

Lee “had a good conversation” at CP Group with Dhanin, Jiaravanont said. “My uncle is very keen on doing something in Hong Kong”, so the family office is a good opportunity to make use of the local government’s incentives to consolidate the clan’s sprawling investments, he said.

Jiaravanont’s father is Apichart, based in Hong Kong. Apichart is the son of Chia Siew Whooy, the youngest of the two brothers who founded the CP Group in 1921. Dhanin is the youngest son of the clan patriarch Chia Ek Chor.

The CP Group is Thailand’s largest conglomerate, with businesses that range from feedstock to shopping centres, telecommunications and the 7-Eleven convenience stores across the country.

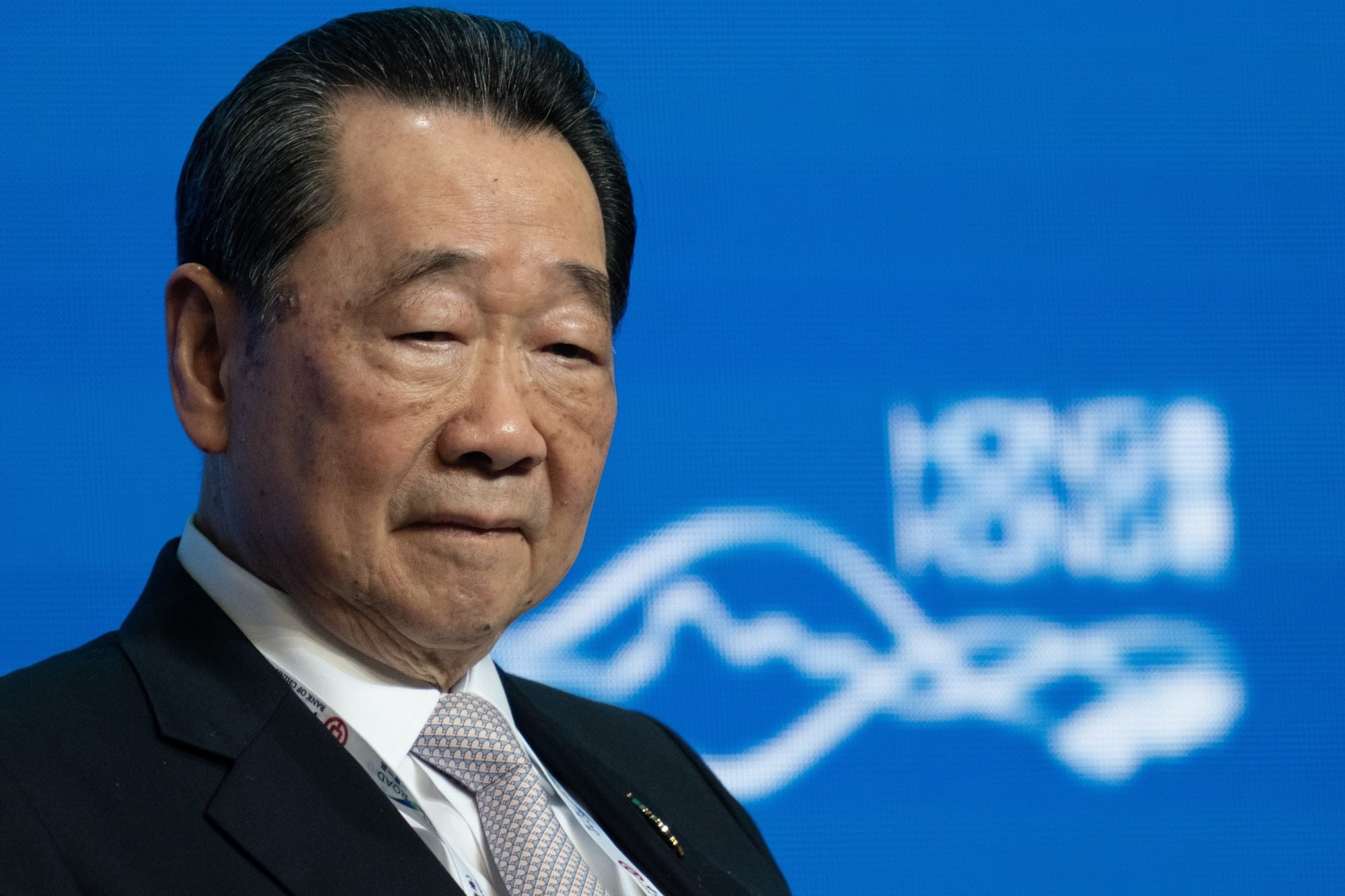

Dhanin, who turns 84 next month, is Thailand’s richest man, with a fortune estimated by Forbes at US$15 billion. He stepped down as CP Group’s chairman in 2017 after running the group for 48 years, naming his eldest son Soopakij as chairman, and the youngest Suphachai as CEO.

China is great with many things such as technology, said Jiaravanont, citing computerisation and EV batteries as the areas they are interested in, while they are also eyeing opportunities globally.

At the group level, 70 per cent of its investments is related to food production business, with 30 per cent into other areas such as technology. The group could see some restructuring in its businesses from the Hong Kong offices with the establishment of the family office in the city, but the plan is still in process, Jiaravanont said.