Tiger Brokers set to expand in Hong Kong to catch online rival Futu as city’s market breaks trading records

- Tiger Brokers is looking to close the gap with Futu Holdings after the Hong Kong market broke trading records in 2022

- Firm pledges to deliver online trading services with cheaper transaction costs and tech-driven support to attract new clients

Tiger Brokers, an online Chinese brokerage backed by Xiaomi Corp, will bring “cheap and user-friendly” services to catch up with main rival Futu Holdings as the firm expands in Hong Kong while Beijing tightens rules to stem capital outflows.

The brokerage offers zero-commission and zero-fee for clients using its platform to trade Hong Kong stocks, while fees have also been waived for transactions in US stocks and options. The firm earlier this month unveiled TigerGPT, a text-generating chatbot that can support traders in finding data and functions on its online trading platform.

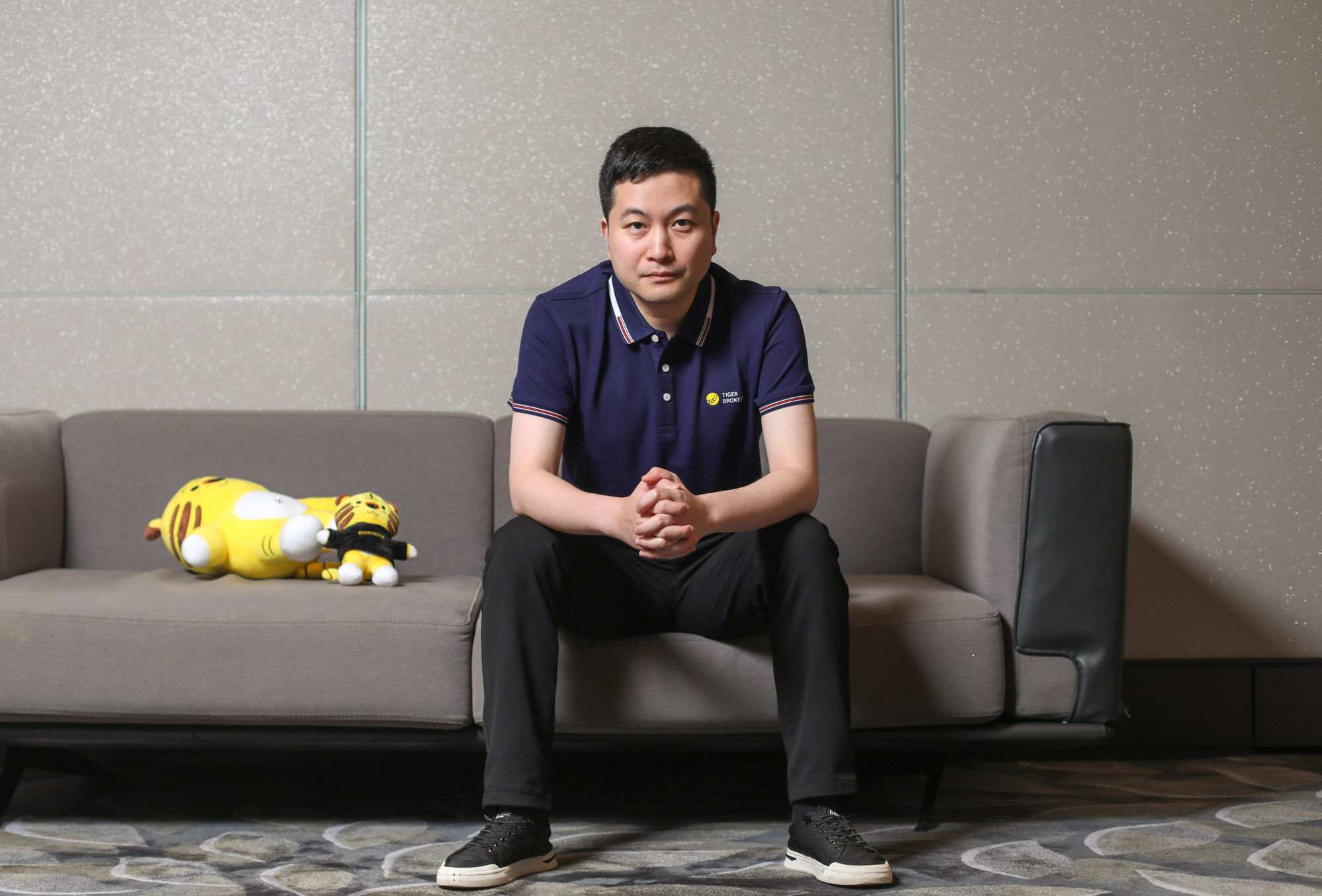

“We see Hong Kong as a promising market,” Wu Tianhua, founder and CEO, said in an interview with the Post. “To differentiate, we are pricing much lower than our competitors as our clients are quite active in terms of trading and are also quite sensitive to transaction fees.”

Wu has a rival in its own backyard in Futu Holdings, an online brokerage backed by Tencent Holdings, which has bulked up its business in Hong Kong since at least 2014. While Tiger Brokers obtained its licence in 2018, Wu said it has only started expanding in earnest in the city from earlier this year.

Investors eye Hong Kong stocks without currency angst as June countdown begins

“In the past couple years, the main reason we lagged behind our competitor is the gap we have in Hong Kong,” the 39-year-old founder said. “Although we have advantages in other markets, for example in Singapore, where we are the biggest online broker, we have to say that we are a bit late stepping into Hong Kong.”

Tiger Brokers is owned and operated by Nasdaq-listed Up Fintech Holdings. Its revenue shrank 15 per cent to US$225.4 million in 2022, with the firm turning in a net loss of US$2.2 million versus a US$14.7 million profit in 2021.

Wu said cheaper transaction costs and continuous investment in innovative functions and products like TigerGPT can help Tiger Brokers build its niche and acquire new clients in Hong Kong, a market with more than 600 active stock brokers.

“We are confident we can seize a certain market share in Hong Kong shortly with real benefit,” Wu said in the interview.

Founded in June 2014, Tiger Brokers has grown from a couple employees working in a 200 square-metre residential unit to over 1,000 employees with operations in Singapore, New Zealand, US, Hong Kong, Australia and mainland China.

Client acquisition, though, is one area that has come under deeper scrutiny by market regulators in Beijing. Late last year, the China Securities Regulatory Commission (CSRC) blocked Chinese online brokerages from giving new onshore traders access to global equity markets. The measure did not affect existing customers.

In late February, CSRC tightened the rules by banning foreign securities firms without mainland licences from signing up new onshore clients. However, existing mainland account holders are allowed to trade stocks in offshore markets as long as they comply with China’s currency and capital-control regulations.

Tiger Brokers and Futu do not have operating licences to facilitate stock trading in mainland China, but both have signed up a lot of mainland customers on their online platforms.

“Clear and detailed regulations and definitions are much better than rumours which panic users,” Wu said, noting that assets held by clients from mainland China have since increased with better transparency. “Now we know what to do and how to follow the rules. It will facilitate industry growth in an orderly manner, and protect investor interests.”

Tiger Brokers has approvals in markets including the US, Hong Kong, Singapore, Australia and New Zealand. It had 2 million account holders worldwide as of last year. It also took part as underwriters in 48 initial public offerings in the US and Hong Kong in 2022, the third largest player by deal count, according to its US exchange filing.