China debt restructuring is at impasse, World Bank chief says

- China is trying to pull together all creditors of developing nations in distress into a coordinated position, but there is a stalemate

- China yet to indicate it’s willingness to take losses on loans, and technical aspects of net present value such as long-term rescheduling of debt

China is at an impasse in terms of restructuring debts owed to it by developing nations in distress even after the World Bank made additional efforts to provide ultra-low interest loans and grants to those countries, the anti-poverty lender’s chief said Monday.

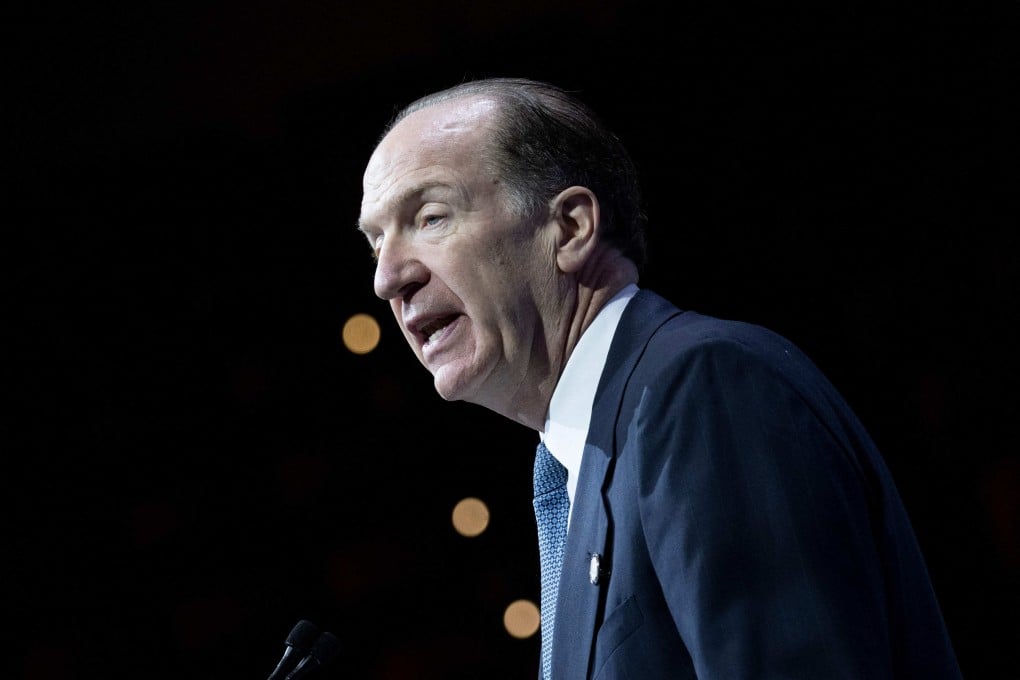

“From China’s side, they are working to try to pull all their creditors together into a coordinated position, but it’s still a stalemate as far as progress being made,” David Malpass, who is set to step down at the end of this month, said in an interview on Bloomberg Television. “It’s been frustrating because of lack of progress.”

The World Bank was a co-chair – along with the International Monetary Fund and Group of 20 host India – of the Global Sovereign Debt Roundtable at the Spring Meetings of the IMF and World Bank last month. That forum brought sovereign and private lenders together with borrowing countries to try to work out some of the biggest challenges in the current debt restructuring process.

Malpass said that the roundtable participants are planning to hold a seminar to resolve persistent problems. China, the biggest sovereign lender to poor countries, still hasn’t indicated that it’s willing to take losses on loans, and technical aspects of net present value need to be discussed with the nation, such as long-term rescheduling of debt payments, Malpass said.

“There has to be that on the table from China in order to get to restructuring agreements,” Malpass said.