Hang Seng Bank and Qianhai joint-venture mutual fund to launch 2 fixed-income products to tap cross-border opportunities in China

- Hang Seng Qianhai Fund Management is increasing ‘not only the categories of our products, but also the types of strategies’, general manager says

- The scale of the two funds is expected to be more than 600 million yuan (US$84.3 million) in total

The fund is launching two new fixed-income-focused funds on the mainland, according to Liu Yu, its general manager. “We are increasing not only the categories of our products, but also the types of strategies, and continue to expand them,” Liu said in an interview with the South China Morning Post.

The launches come at a time when new product releases have fallen to an eight-year low in China. Only 34 new funds were rolled out in May, a year-on-year and monthly plunge of more than 60 per cent, according to brokerage Shanghai Securities which cited financial data provider Wind Information. The sales of 31.15 billion shares to retail investors last month also slumped to their lowest level in eight years.

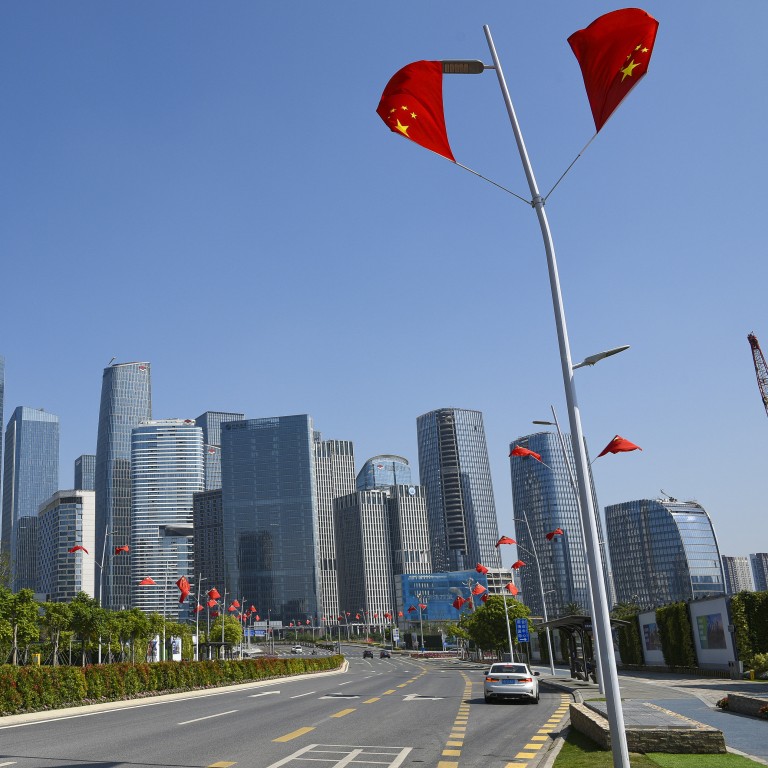

Hang Seng Qianhai is, however, trying to leverage its background as a pilot initiative of Hong Kong and Shenzhen cooperation to tap record-high savings and increasing demand for wealth management products in the world’s second-largest asset-management industry.

The scale of the two funds is altogether expected to be more than 600 million yuan (US$84.3 million), according to the company. It kicked off the sales of a fund with at least 80 per cent of its allocation to bonds on May 12, and expects to wrap up sales earlier than the fund’s August 11 deadline. The other is a “fixed-income plus” product, with 80 per cent of its allocation to bonds and 20 per cent to stocks and other more liquid bonds.

Bay area special zones to speed up tax, legal incentives for offshore funds

“We will focus on fixed-income this year,” Liu said, adding that bond-focused products had performed relatively better than equity funds amid the volatility of the past few years. It is a “natural choice” because this year’s overall sales of equity funds have proven to be difficult, while fixed-income sales have done better, he added.

Chinese retail investors, who are very sensitive to market volatility, have pulled out of mutual funds in recent weeks after equity markets in the country slid amid geopolitical risks and concerns about the sustainability of China’s economic recovery.

The Shanghai Composite Index shed 3.6 per cent in May, after a 15.1 per cent slump last year. In Hong Kong, the Hang Seng Index fell 8.4 per cent last month, following a 15.5 per cent drop in 2022. On the bond market front, the yield of China’s 10-year government bonds fell to 2.748 per cent on Wednesday, the lowest level since November 10 last year, in a bull market for the fixed-income space that started mid-April.

The fund also participates in Hong Kong’s Wealth Management Connect scheme by providing its bond fund products to Hang Seng Bank, through which the lender’s offshore clients can access mainland funds.

Hong Kong, Shenzhen offer perks to lure venture capital firms to Qianhai

“But it also poses more challenges for market participants,” Liu said. “After all, equity funds are more volatile, [therefore] the requirements such as in compliance are higher.”