Advertisement

Greater Bay Area’s Wealth Management Connect scheme to expand eligibility, product range, investment limits

- New measures will further ‘cross-boundary investment … and the development of Hong Kong’s financial industry’, says monetary authority CEO

- Expansion of eligible southbound and northbound products aims to better meet GBA residents’ demands for diversified investments, HKMA says

Reading Time:2 minutes

Why you can trust SCMP

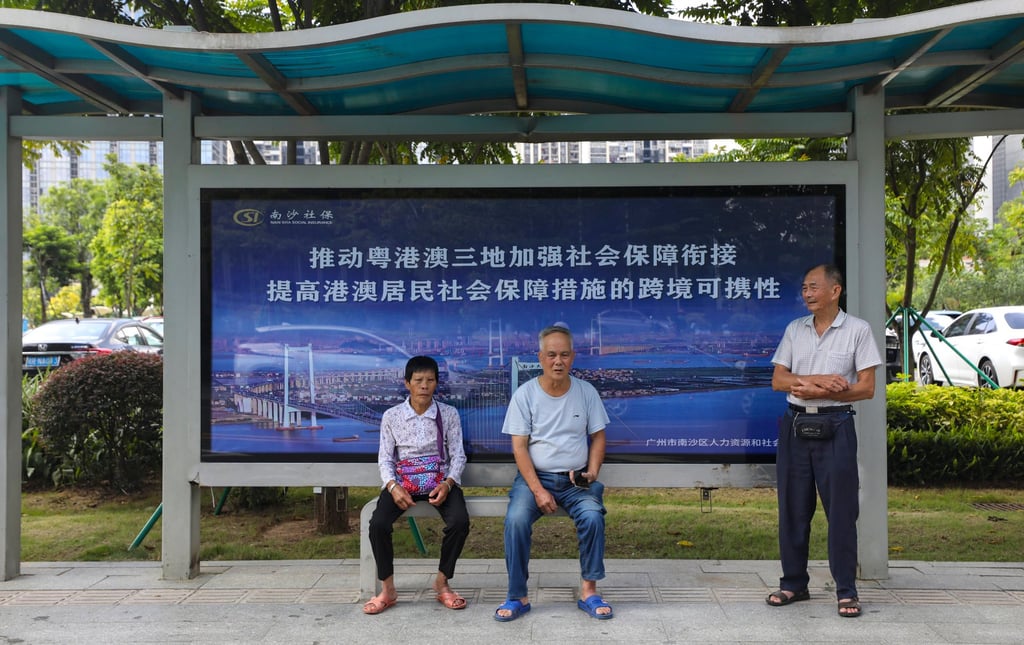

The cross-boundary Wealth Management Connect scheme will expand eligibility to more Greater Bay Area (GBA) residents, expand its range of investment products and raise its investment limits for individuals, among other changes, in a bid to accelerate adoption.

The number of participating institutions will also expand to include eligible securities firms, allowing such lenders to distribute investment products and provide relevant services to southbound and northbound individual investors, the Hong Kong Monetary Authority (HKMA) said in announcing enhancements to the scheme on Thursday.

“We welcome the introduction of the enhancement initiatives and are developing implementation details to put the initiatives into action at full speed,” said Eddie Yue, the CEO of the HKMA.

Advertisement

The new measures will “further facilitate cross-boundary investment of Greater Bay Area residents and the development of Hong Kong’s financial industry”, he added.

The expansion of eligible southbound and northbound products aims to better meet GBA residents’ demands for diversified investments, the HKMA said. The scheme will also get further promotion to acquaint GBA residents with its participating financial institutions and their services.

Advertisement

The scheme, launched in 2021, is Beijing’s first tailor-made plan for the 11 cities of the GBA development zone.

Advertisement

Select Voice

Select Speed

1.00x