Advertisement

Hong Kong leans on new digital IPO platform to help recovery after listing volumes plunge to a 20-year low

- The new digital platform – Fast Interface for New Issuance (FINI) – is expected to reduce the settlement cycle to two days from five

- A smaller window for offering, pricing and listing will result in lower risks for issuers and investors, and facilitate an IPO even in volatile markets

Reading Time:3 minutes

Why you can trust SCMP

Hong Kong authorities and bankers are betting a new digital platform will boost investor confidence through a shortened settlement cycle for initial public offerings (IPO) and a quicker listing process.

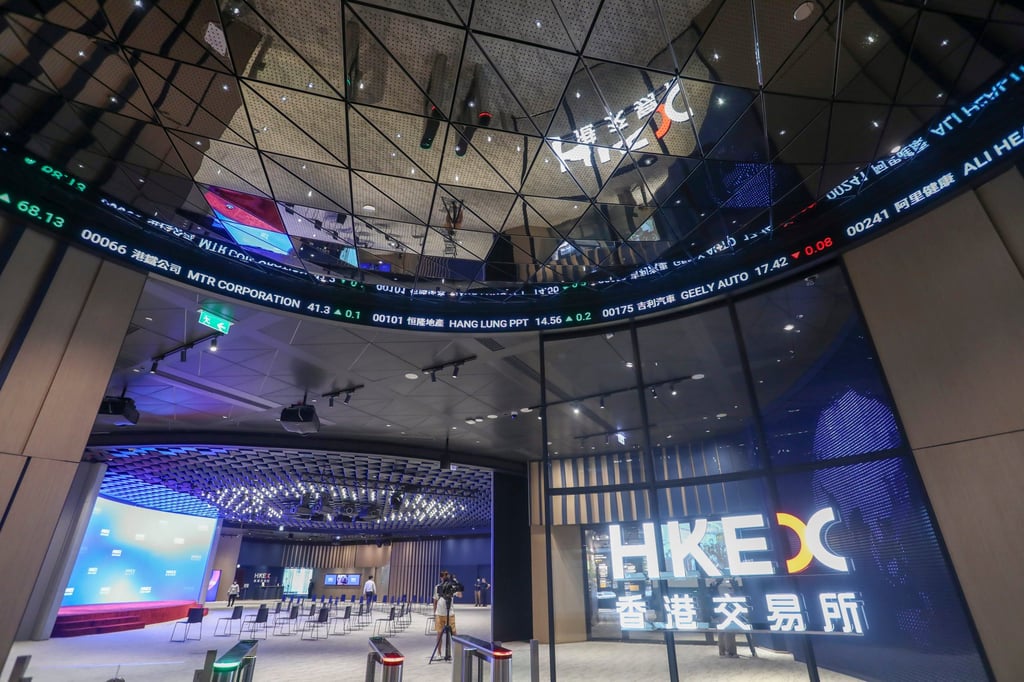

This comes at a time when Hong Kong Exchanges and Clearing (HKEX), the operator of the world’s third largest stock market, grapples with a business slowdown which saw share listing volumes plunge to a 20-year low in the first nine months of the year.

HKEX, which has been ranked the world’s largest IPO market seven times in the past 12 years, saw its position slip to ninth place in the world for IPO venues, in the nine months ended September, according to data provider Refinitiv.

Advertisement

But all that could change as the city awaits the launch of a new digital platform – Fast Interface for New Issuance (FINI) – set for November 22.

It is one of the initiatives taken by the HKEX to help rejuvenate the sluggish market and which is expected to reduce the settlement cycle to two days from five by replacing the current time-consuming paper subscriptions process.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x