Singapore’s Seraya Partners closes US$800 million fund backed by BlackRock and AIIB to build Asia-Pacific infrastructure

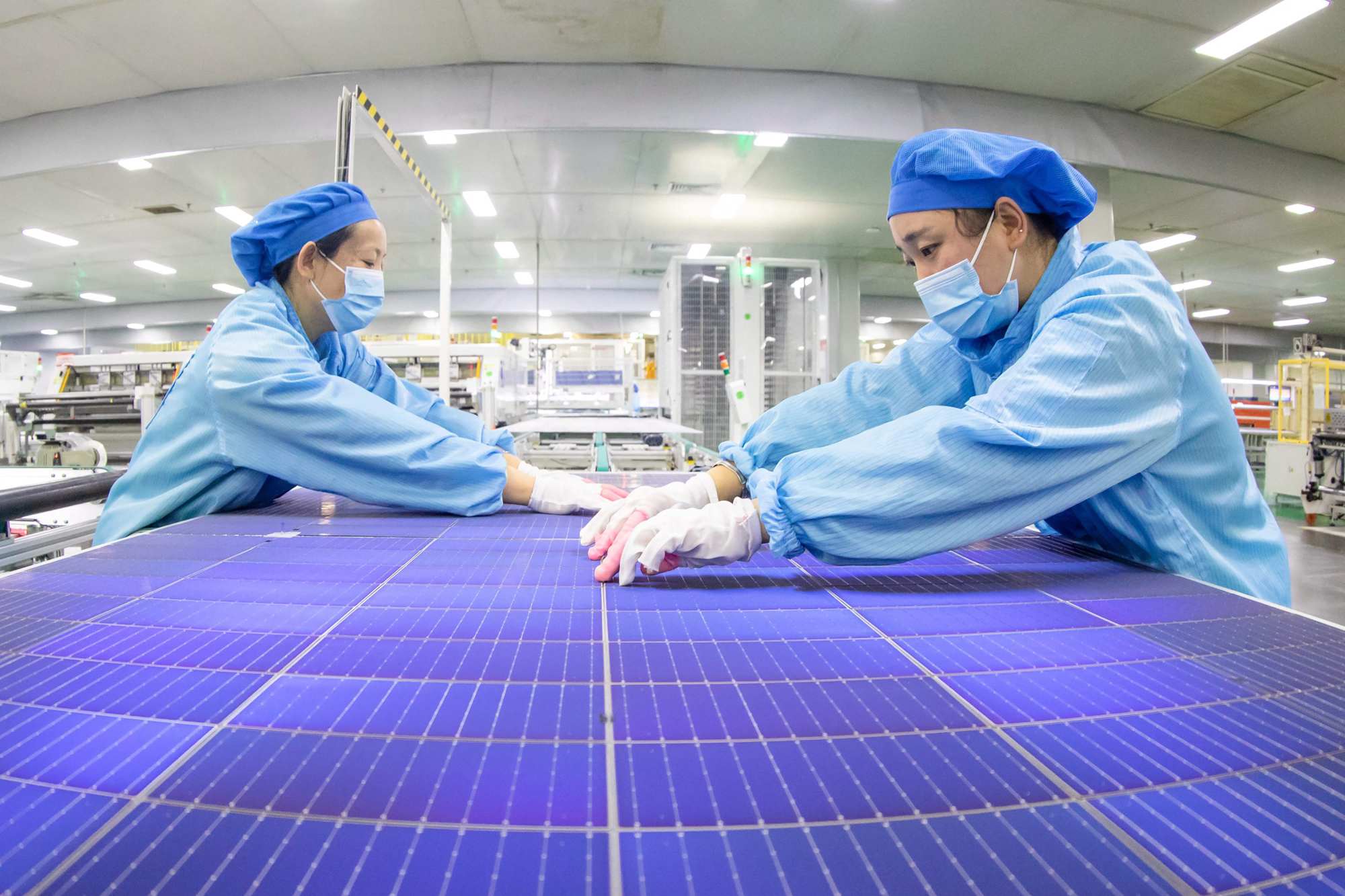

- The oversubscribed fund will focus on bolstering Asia’s digital infrastructure and energy transition

- Fund has already allocated around half of its capital to companies including a green data centre operator and an offshore wind farm vessel operator

Singapore-based private-equity firm Seraya Partners has closed a US$800 million fund focusing on bolstering Asia’s digital infrastructure and energy transition, backed by investors including BlackRock and the Asian Infrastructure Investment Bank (AIIB).

The fund, which invests in next-generation infrastructure in Asia, focusing on energy transition and digital infrastructure platforms enabled by technology, surpassed its target of US$750 million, according to a statement by Seraya on Tuesday.

Investing in mid-market opportunities in infrastructure assets with an average check size of US$100 million, the fund is committed to bolstering the region’s transition to net zero and accelerating the adoption of clean, sustainable energy, according to the firm.

“Energy transition and digital infrastructure will be the twin engines to bridge this gap and lead us toward net-zero ambitions. We are deeply grateful for the support and confidence our investors have placed in us to address the infrastructure gap. We are committed to creating value for our investors while building a more sustainable future for Asia.”

Seraya said it has identified supply-and-demand gaps within the energy transition and digital infrastructure sectors, and has made a solid start on deployment of the fund. Around half of its funds have already been allocated to three companies in Asia: green data centre operator Empyrion DC, offshore wind farm vessel operator Cyan Renewables and energy storage solution provider Astrid Renew.

Hong Kong has role to play as China’s offshore hub for green finance: UN envoy

The firm believes its approach “will drive attractive returns in the mid to high teens”.

The fund has commitments from global institutional investors, including sovereign wealth funds, pension funds, insurers, and family offices across North America, Europe and Asia-Pacific. Limited partners include Beijing-headquartered AIIB, Alberta Investment Management and funds and accounts managed by BlackRock.

“AIIB’s investment in Seraya Partners shows its commitment to support Asian infrastructure asset managers,” said Dong-ik Lee, AIIB’s director-general for the banking department. “It is well-aligned with AIIB’s mission of financing infrastructure for tomorrow.”

The investment will help reduce bottlenecks in the infrastructure supply chain through innovative technologies such as offshore wind farm vessels, Lee said. “AIIB looks forward to working with Seraya Partners to unlock new technologies and new ways to address climate change and to better connect Asia and the world digitally.”