State-backed developer China South City averts default on July 2024 bond with consent from creditors, fails to restructure four other bonds

- China South City received requisite approval from bondholders to restructure a US$235 million note

- Developer failed to win enough consents from creditors to restructure four other dollar bonds, all due in 2024

China South City Holdings averted a default on an offshore debt after winning consent from creditors on deadline day, a narrow escape for the state-backed developer struggling with a liquidity squeeze after months of sliding home sales. It failed to restructure four other bonds.

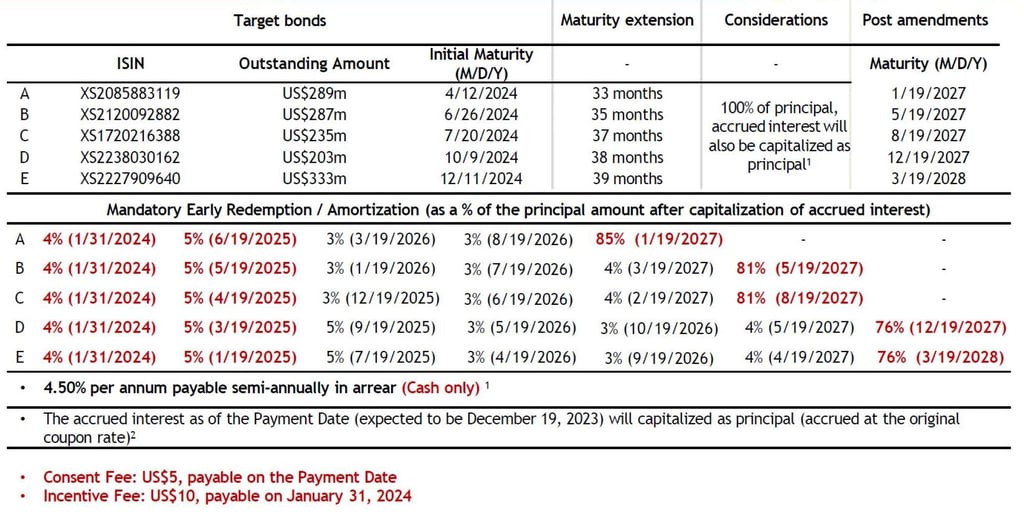

Bondholders agreed to extend the maturity of its US$235 million July 2024 note by 37 months to August 2027, as well as lower the annual coupon by half to 4.5 per cent, according to a statement issued by its information agent D.F. King late on Tuesday. The consent solicitation exercise ended on Monday.

“Requisite consents in respect of July 2024 notes have been received” by the closing date, it added in an email. “Upon the satisfaction of other relevant consent conditions, the proposed amendments and waivers in respect of July 2024 notes will take effect on December 19.”

The developer had said earlier it had no money to pay the interest on the July 2024 bond on December 19. That semi-annual coupon, estimated at US$10.6 million, will now be paid in cash on July 19 next year under the amendments approved by the bondholders.

Chinese developers have muddled through the past three years under financial distress, triggering more than US$100 billion of debt defaults. Home sales slumped amid the Covid-19 pandemic, while Beijing tightened lending to over-geared home builders at the same time.

Even so, China South City failed to garner enough support to restructure four other dollar-denominated bonds, each maturing in April, June, October and December 2024 with a combined face value of US$1.11 billion, the company said in a stock exchange filing on Wednesday.