Top PE firms Apollo, Partners Group, TPG, with solid core business, target alternative assets in Asia to ‘generate alpha’

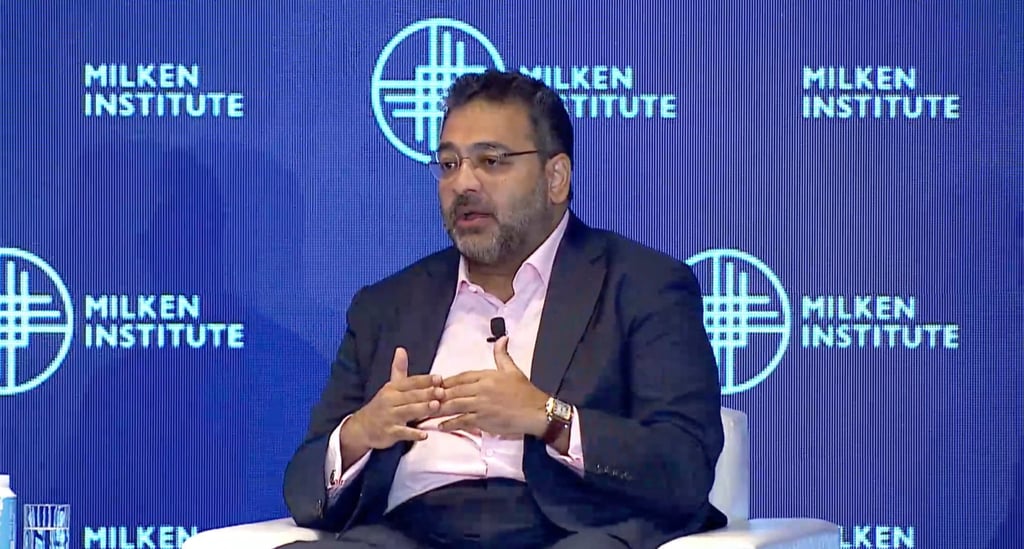

- ‘The [private equity] industry will adjust itself to push and outperform returns to the baseline that’s now been reset,’ TPG Capital’s Ganen Sarvananthan says

- Private equity firms with an Asia focus are increasingly tapping into alternative asset classes such as private credit and infrastructure

Private equity giants operating in Asia are confident in their core business, but they are eyeing alternative assets such as private credit and infrastructure to generate better returns.

As total deal value and fundraising in the Asia-Pacific private equity market slumped to the lowest in a decade in 2023, Apollo Global Management, Partners Group and TPG Capital were being selective in their allocations, according to senior executives.

“This is a time where quality is probably going to trump quantity,” Ganen Sarvananthan, managing partner and head of Asia and the Middle East at TPG, said at the Milken Institute Global Investors’ Symposium in Hong Kong on Tuesday.

“I wouldn’t be betting against private equity. The industry will adjust itself to push and outperform returns to the baseline that’s now been reset.”

The private equity market worldwide plunged last year, including in Asia-Pacific, where deal value and fundraising dropped to US$147 billion and US$100 billion, respectively, according to a report by Bain & Co.