‘Door to Europe’: Monaco targets Greater Bay Area’s wealthy as it pitches low taxes to attract family offices, investments

- Frederic Genta, a high-ranking official from the principality, holds a flurry of meetings with government officials and investors in Macau and Hong Kong

- Genta hopes to attract some family offices to set up a second base in the European microstate

With the Mediterranean country approaching 30 years of diplomatic relations with China in 2025, it is pitching itself to Hong Kong and Macau, including making a push for family offices, offering greater networking opportunities for investors, and exploring cultural exchanges, said Frederic Genta, Monaco’s secretary for attractiveness, development and digital transformation.

“We hope we can be a small door to Europe for the Greater Bay Area,” said Genta, a former Google executive, who is now charged with making Monaco more appealing to prospective investors and residents.

Genta and Monaco’s ambassador to China, Marie-Pascale Boisson, arrived in Macau on Tuesday for a two-day visit to meet senior Macanese government officials and investors.

Genta followed it up with a visit to Hong Kong on Thursday for another round of meetings with family offices and prospective investors.

“In a multilateral world, you need several bases,” said Genta.

“I don’t expect tons of people to come and live in Monaco from Hong Kong or Macau, but I hope some people who have family offices will establish a second base for Europe in Monaco,” he said, adding that he would be equally supportive of Monegasque banks and residents investing in the Greater Bay Area.

Monaco currently has “more than 40 big family offices”, according to Genta.

The world’s second-smallest country by land area after Vatican City, Monaco is famed for its glitzy tourism sector, home to the Formula One Monaco Grand Prix, an annual yacht show and the Monte Carlo Casino.

It is also a haven for the ultra-rich, with no income tax, capital gains tax or inheritance tax, and a robust private banking sector. Just under half of its 37,000 population are millionaires, according to a 2023 Henley & Partners report on the world’s wealthiest cities.

Monaco is rushing to shore up its anti-money-laundering laws, under fears of being downgraded to the Financial Action Task Force’s (FATF) greylist of moderate-risk countries. It has been on the back foot since late 2022, when a report by Europe’s anti-money-laundering agency found significant gaps in its measures to tackle financial crime.

Wealth for Good: Hong Kong launches project linking charities with donors

FATF, an international watchdog dedicated to combating money laundering and terrorist financing, is expected to visit Monaco this summer for further inspection.

“I don’t know what’s going to be the outcome [of the FATF visit],” said Genta, adding that the principality has done a lot so far to comply with the regulations.

Being on the greylist restricts a country’s ability to participate in global trade and finance, with a 2021 International Monetary Fund study finding that this could cause gross domestic product to plunge by 7.6 per cent.

Looking eastward is a shift away from Monaco’s traditionally western European investor base into regions where it is not well understood or known, said Genta. The Greater Bay Area is one of three locations it is looking to build ties with, along with Singapore and the Middle East.

Among the sweeteners on offer is potential membership of Monaco Private Label, an invitation-only network launched for leading investors in the principality. Created in 2009 to attract a super global elite to the principality, it currently has around 2,000 members from 60 countries.

Genta said he hoped to grow the club’s membership from Hong Kong and Macau, and potentially hold some of its events in the Chinese cities next year.

Monaco has had “very strong relations” with China over their nearly three decades of formal ties, he said.

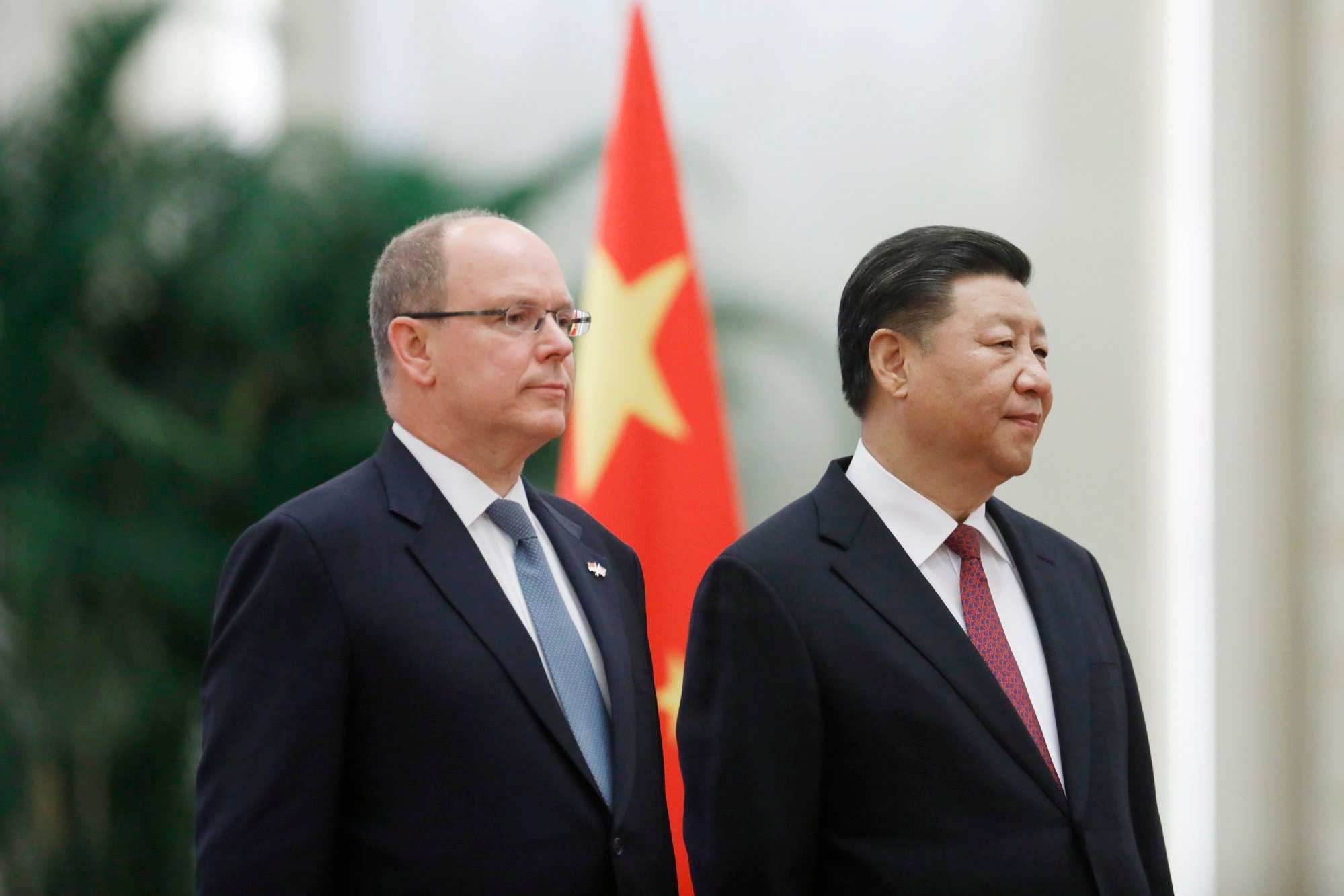

Prince Albert II, its head of state, and Chinese President Xi Jinping, have made reciprocal state visits in recent years. In 2019, Monaco became the first European country to roll out a 5G mobile network built by Chinese telecommunications giant Huawei, just as the firm was fighting a US government ban.