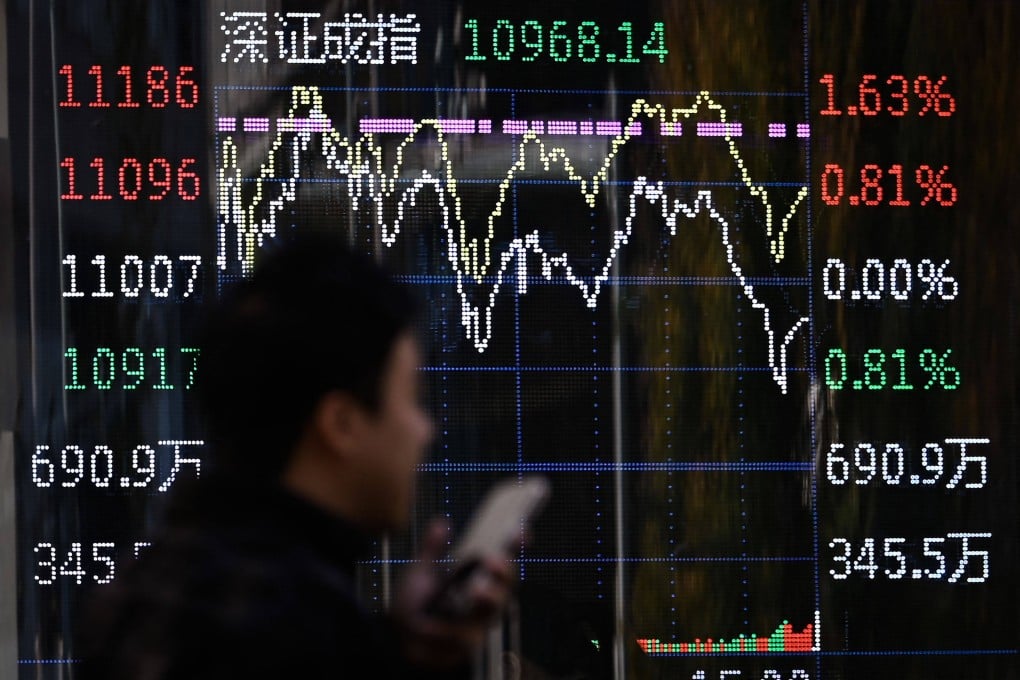

China’s securities regulator clamps down on speculation to prevent sharp market swings

CSRC signals it wants a slower but longer stock market rally after trading volumes and margin financing hit record highs

The stance, reiterated at a securities watchdog meeting last week, drew renewed attention after regulators moved to cool pockets of overheating in the A-share market following a strong start to 2026.

Mainland China equities rallied in early January, with trading volumes surging and margin financing balances repeatedly hitting record highs. The CSI 300 Index has risen 2.2 per cent so far this year, extending gains after a strong rally in 2025, while the Shanghai Composite Index ended 17 consecutive sessions of positive daily returns on January 12. Both benchmarks have recorded double-digit gains for two straight years.

Regulators responded last week by raising margin financing requirements to 100 per cent from 80 per cent across mainland exchanges, effective on Monday, in a move widely seen as a targeted effort to rein in leverage and avoid excessive speculation.