SHKP's Shanghai project signals new China strategy

Developer seen expanding on mainland with plans for investment that could top HK$50b

Faced with limited development opportunities and increased policy risk in Hong Kong because of the government's adoption of market-cooling measures, analysts expect SHKP will become more active on the mainland.

"Considering its company size, it has lagged behind rivals in terms of revenue coming from across the border," said Kenny Tang Sing-hing, a general manager at AMTD Financial Planning. "It is time for the giant to catch up with its peers."

For the year ended June, SHKP's mainland property sales were about HK$10 billion, with rental receipts totalling about HK$2.07 billion. That compares with Wharf's 15 billion yuan (HK$19 billion) in mainland property sales and HK$1 billion in rental income and Cheung Kong's HK$13 billion in property sales last year.

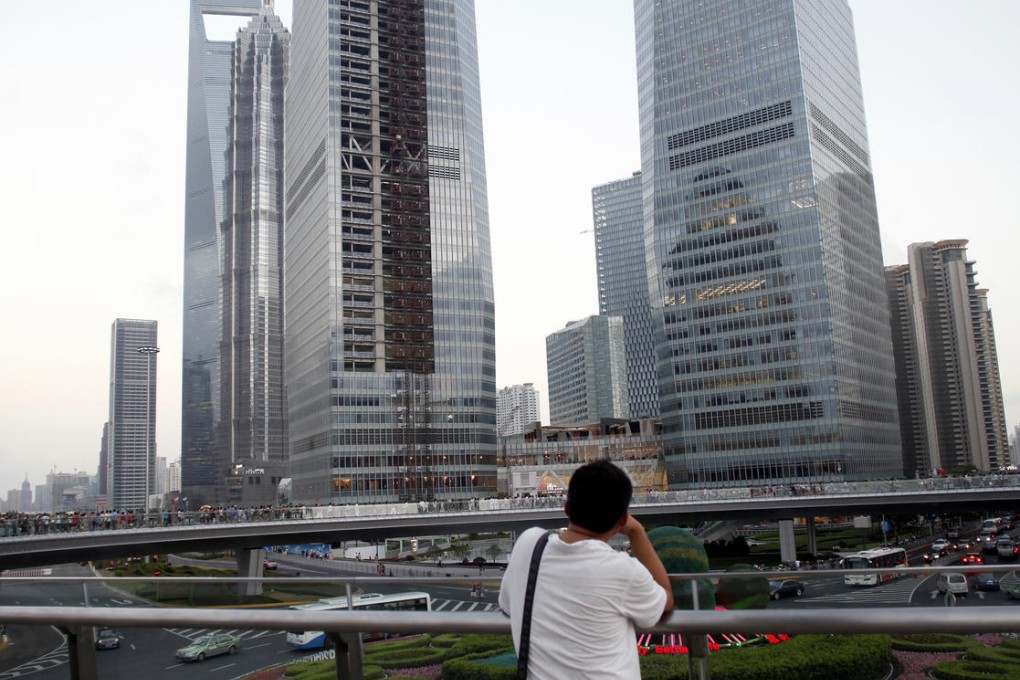

Tang was speaking after SHKP secured a 1.06 million square foot office-retail-hotel site in Xujiahui, a shopping and entertainment district in Shanghai, for 21.77 billion yuan on September 5. It was the second-highest price paid for a block of land on the mainland, trailing only the former Asian Games city site in Guangzhou, which sold for 25.5 billion yuan in 2010.

Taking construction and interest expenses into account, analysts estimate SHKP's total investment in the project could exceed HK$50 billion.