Shanghai to spur reforms at state enterprises

Incentives for overseas push will result in new assets treated as profits, but some see risks

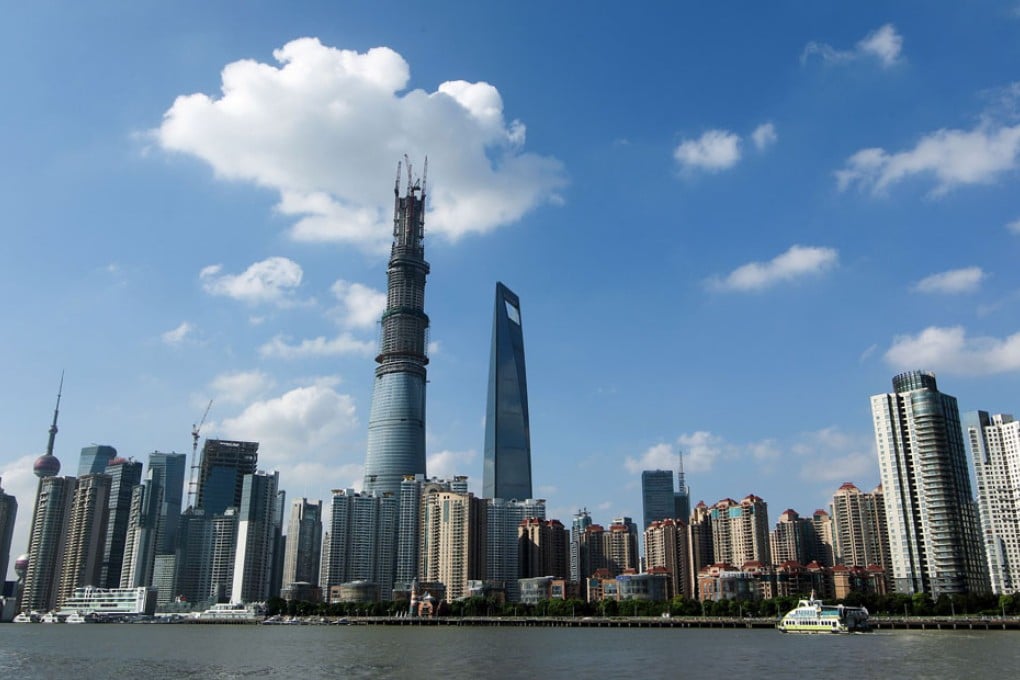

Shanghai has rolled out new incentives to show is resolve to deepen economic reforms and further encourage the city's state-owned enterprises to venture abroad.

But these efforts might expose the industrial giants to risks amid a clutch of reckless overseas acquisitions and the establishment of new production facilities abroad.

Shanghai is striving to lead the reform push for state-owned businesses under the directives of the mainland leadership.

City officials pledged to create five to eight corporate juggernauts that could compete against global conglomerates after a new round of reforms for state-owned businesses.

"An overseas investment should focus on the profitability of the new projects," said Tan Yaling, director of the China Forex Investment Research Institute. "If the motivations are not pure, the investments will be at huge risks."

They envision that purchases of quality foreign assets and expansion of production outside the mainland could offer a fast track for local conglomerates, most of which are either cash-rich or can easily obtain large loans to support their campaigns.