How the debt bubble burst for China’s Huishan Dairy

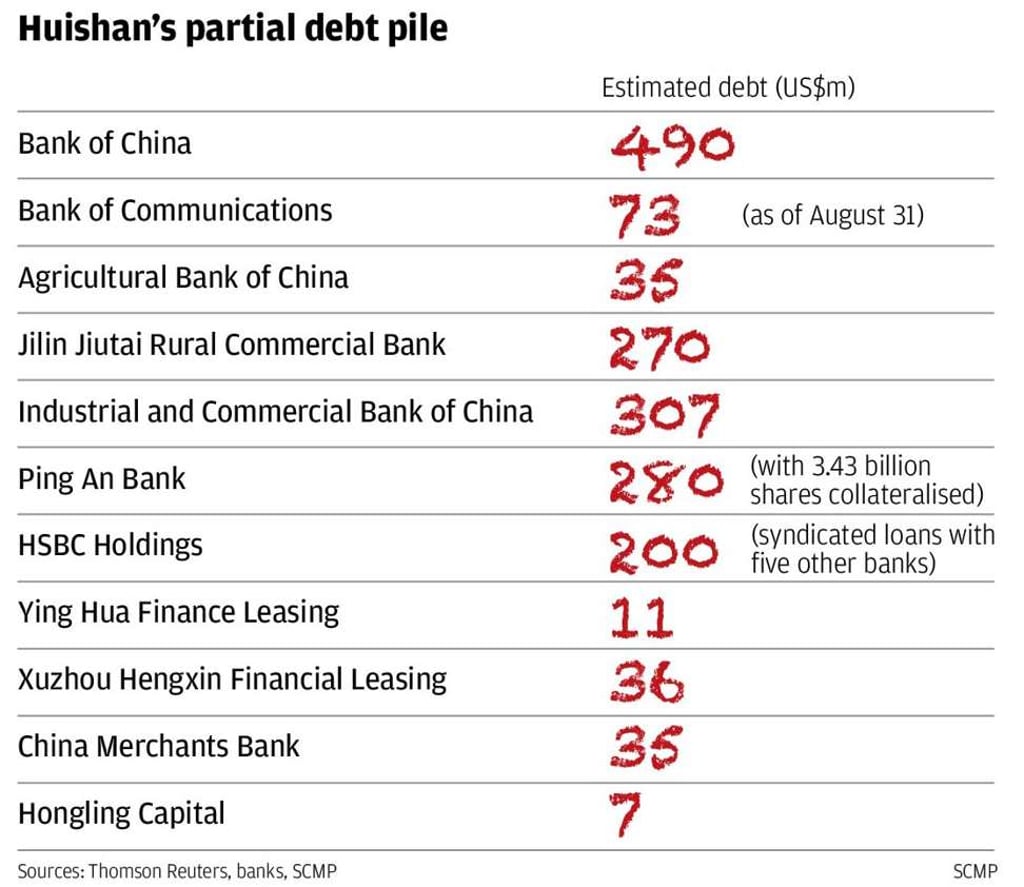

Troubled operation, estimated to be US$5.8 billion in debt, is pinning its hopes of survival on a ‘White Knight’ and/or a government bailout – although many industry insiders consider neither will be enough

A missing treasury head, a mysterious 85 per cent stock plunge, resignations of half of its board members and a billionaire tycoon chairman most of whose wealth evaporated in 1.5 hours.

All of these have combined to create what has become an unfolding drama engulfing China’s largest dairy farm operator, China Huishan Dairy Holdings, whose crisis has exposed a gigantic debt overhang looming over corporate China.

Before its remarkable March 24 share price crash, by a record 85 per cent in 90 minutes, Huishan had been one of the most “stable” stocks in Hong Kong, hovering around a narrow range between HK$2.75 (US 25 cents) and HK$3.17 for nine months.

Now it find itself firmly stuck in a debt quagmire.